2 Big Deals in the Coming Low-Yield World

|

| By Gavin Magor |

“I'm goin' down

I'm goin' down

Cause you ain't around baby

whole world's upside down”

—Bruce Springsteen

I am quite certain “the Boss” Bruce Springsteen wasn’t talking about interest rates in his famous song but rather a troubled relationship … but it seems that interest rates are finally going to start coming down later this year.

So, in that context, we’ll agree with the Boss.

We here at Weiss Ratings want all investors to be prepared for what’s on the financial horizon just as a musician wants to know the next note.

The main reasons for the Federal Reserve anticipating a rate cut later this year? New slightly lower inflation reports and a cooling labor market are at the top of the list.

At this point, I’m not sure if I would exactly call it a “soft landing.” But it’s a lot better than expected considering how high inflation was last year.

It is very encouraging to see inflation finally start to come down. And in general, I am still optimistic about the market … while staying cautious.

I do have two ways for investors to take advantage of this likely economic path.

First, by using stocks that Weiss Ratings considers to be “buys.”

Second, with new creative yield-seeking strategies in a world where rates are falling.

I’ll start with the former, because just upgraded a few new names into our elusive “A”-rated territory.

2 New Elusive "A" Rated Names

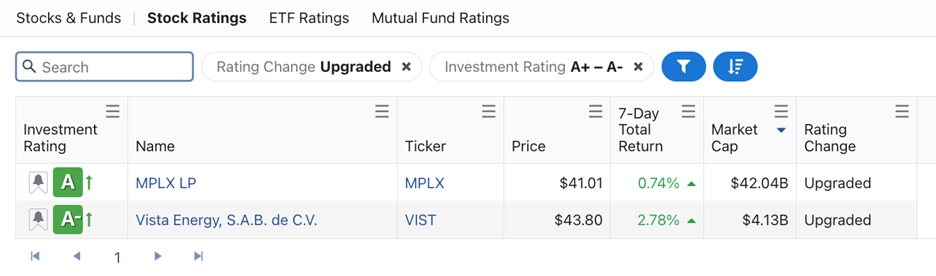

After a few simple clicks to the Weiss Ratings stock screener, I was able to find two stocks that were recently upgraded into “buy”-rated territory.

I filtered for “Upgraded” and “Investment Rating” “A” through “A-.”

Here’s what populated:

MPLX (MPXL) and Vista Energy (VIST) are both names I encourage you to explore … and all of our “A”-rated names for that matter.

MPLX pays out a very juicy 8% dividend yield. And VIST is a rocketing energy name that is up a staggering 1,000% over the past three years. Check out both as they meet your portfolio needs.

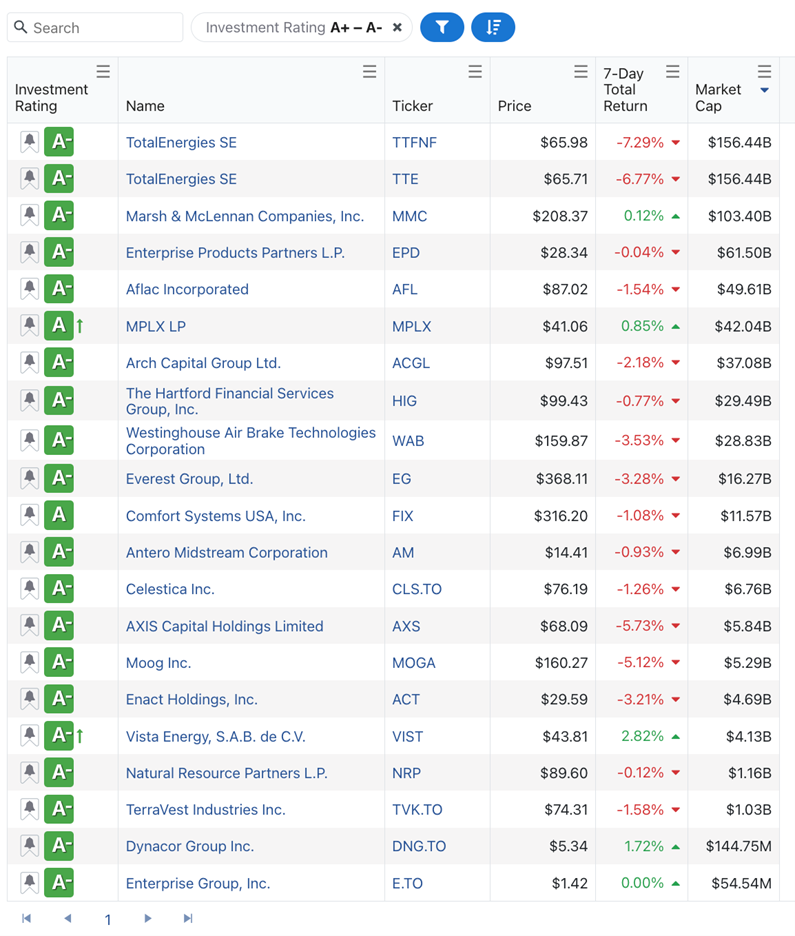

Here’s an updated look at all of our current “A”-rated names:

As the year progresses, I eagerly encourage you to keep looking at all of our financial ratings as we’re always updating what we view as very stable stocks to your portfolio.

Another great strategy is taking a look at Dr. Martin Weiss’ new Crypto Yield Hunter strategy that’s blowing away the average yields we’re seeing in the markets.

A Big Deal in the World of Yields

At the same time as inflation burns holes through consumers’ wallets, we’re also seeing puny yields by banks even during times of high interest rates.

I’m here to tell you that you can and should fight back with the Weiss Ratings. The tiny yields we currently have are only going to get even lower.

The largest bank in the U.S. by total assets, JPMorgan Chase (JPM), (currently rated a “B” within our bank ratings) pays out a miniscule 0.01% on savings accounts.

Other banks are not much better. On average, they pay 0.65% interest on savings accounts.

Savvy investors are finding newer, far greater and respectable yields in the range of 26x better than what the banks pay.

Dr. Martin Weiss has already put $100,000 of his own money towards this yield-seeking strategy. In fact, I may even put some cash on the table as well.

If you have cash in a bank account that is earning small yields, I strongly urge you to check out his presentation here immediately.

Cheers!

Gavin Magor

with

PJ Amirata