How We Aim for Astronomical AI Profits

|

| By Gavin Magor |

It may not be the consensus thought anymore, but here at Weiss Ratings, we know the AI hype is just getting started.

Not only because of what we’re seeing in the market but because of the technology we’ve developed over several decades that is now just being released.

Regardless of interest rates, the economy and geopolitical issues, the impact of AI on our lives is just getting started ... and Big Tech knows it, too.

That was further emphasized in the latest round of earnings reports released in the past few weeks.

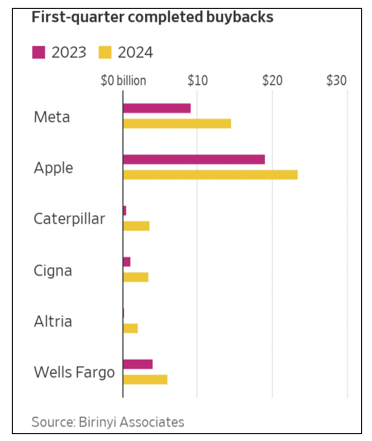

Many S&P companies, in general, are buying back their stock in hefty magnitudes, especially tech stocks.

S&P 500 companies that have reported their latest quarter earnings have disclosed $181.2 billion in buybacks, up 16% from the year-ago period. It shows that large companies have optimism, otherwise they’d be holding onto that cash.

Meta Platforms (META) repurchased $14.5 billion of its stock, up from $5 billion a year earlier, and Apple (AAPL) has made history yet again by announcing that it will now buy back $110 billion of its own stock.

However you look at it, these buybacks, especially for tech companies, are bullish. Five of the magnificent seven stocks now even pay a dividend.

There’s no better place to aim for tech and AI profits than with the Weiss ratings, so let’s see what it’s saying about the tech sector.

Step 1: Check in with Our Updated Ratings

The Weiss Ratings are updated daily, and recently, we’ve seen some key ratings changes in the tech space.

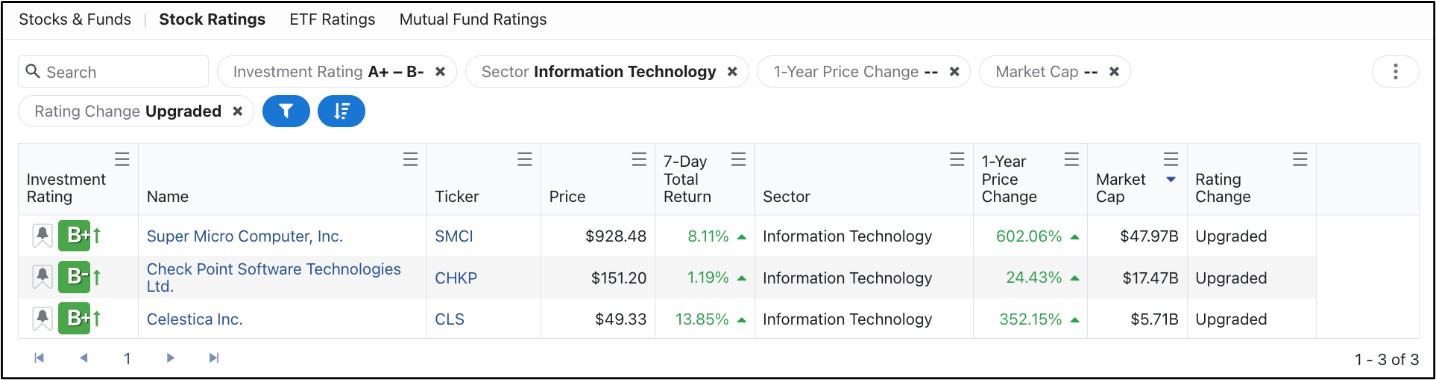

After heading over to the Weiss Stock Ratings, I filtered for tech stocks in our “Buy” range and then selected “Ratings Change” and “Upgraded.”

Here’s what populated:

The three recently upgraded tech names are Super Micro Computer (SMCI), Check Point Software Technologies (CHKP) and Celestica (CLS).

Explore all three, but I am especially familiar with SMCI as my premium readers have been able to grab 70% gains on it in the past.

As you can see in the image above, shares are up an eye-popping 602% over the past year. It’s certainly a name that has benefitted greatly from the AI market craze.

In our ratings upgrade, we cite that it “was upgraded to B+ from B on 5/7/2024 due to a noticeable increase in the valuation index, solvency index and total return index. The quick ratio increased from 1.14 to 2.21.”

Let’s look at the chart:

Since their top on March 13th, shares are down around 32%, which could mean shares are now at more justified levels.

Be sure to do your own research, but this recently-upgraded name may be a nice addition to your portfolio.

And the next step I would take to aim for AI profits is to check out Weiss Rating’s newest achievement and AI breakthrough …

Step 2: Check Out IRVING’s AI Profit Machine

Our newest product features technology that has been under development for several decades, and we are just releasing it now.

In fact, this AI-driven product has been able to beat the performance of the S&P 500 by 51-to-1 over the past 10 years.

Whilst around 94% of professional traders can’t even beat this benchmark, this product torched it with 51x returns.

Be sure to check it out by clicking here now.

Cheers!

Gavin Magor

With PJ Amirata