|

| By Nilus Mattive |

As I told you last week, I’ve been saying the broad stock market is wildly overvalued for quite a long time now.

So when, a few days later, Federal Reserve Chairman Jerome Powell said, “By many measures, equity prices are fairly highly valued,” I could only smile.

Because, yes, my “opinion” is rooted in very clear historical data … data that even the Fed itself is now starting to acknowledge publicly.

The problem is that most people still don’t want to hear it.

I can’t blame them. Nobody wants a good party to end!

Yet parties DO always end at some point … with a big mess to clean up afterwards.

So, as many Wall Street analysts continue to up their price targets on both individual stocks and the broad market indexes — which is exactly what they have done during the end stage of every other massive bull run in history — I think now is a good time to revisit two of the ways you can hedge against any big market drop that could be coming our way.

The first was extremely popular back when I was a young guy on Wall Street watching the Dot-Com Bubble inflate: Short selling.

The process involves borrowing an investment and hoping you’ll be able to buy it back at a lower price in the future.

While it gets a bad rap, short selling can still be a great approach if you’re very sophisticated and watch your portfolio like a hawk.

But for most regular investors, it simply involves too much risk and complication.

For starters, you have to use a margin account — which requires special clearances.

In addition, the very use of margin can potentially expose you to big risks, including the possibility of having to sell other investments to cover losses … or even the chance of losses piling up beyond the total value of your entire nest egg.

So overall, I do NOT recommend short selling as a hedging strategy.

Especially now that a much better alternative has become available: Inverse exchange-traded funds (ETFs).

You probably already know the basics about ETFs, including some of the advantages they bring to the table.

Well, inverse ETFs carry all those same advantages while allowing you to profit whenever a particular market or group of investments goes DOWN.

The very first inverse ETF became available back in 2006, and the timing was great.

In fact, I personally helped my readers use them to profit as the Housing Bubble turned into the Financial Crisis …

It was the summer of 2008, and I already sensed that the burgeoning Financial Crisis could send the stock market plunging.

At the same time, I didn’t want to tell my readers to give up their steady dividend payments or abandon their core stock holdings.

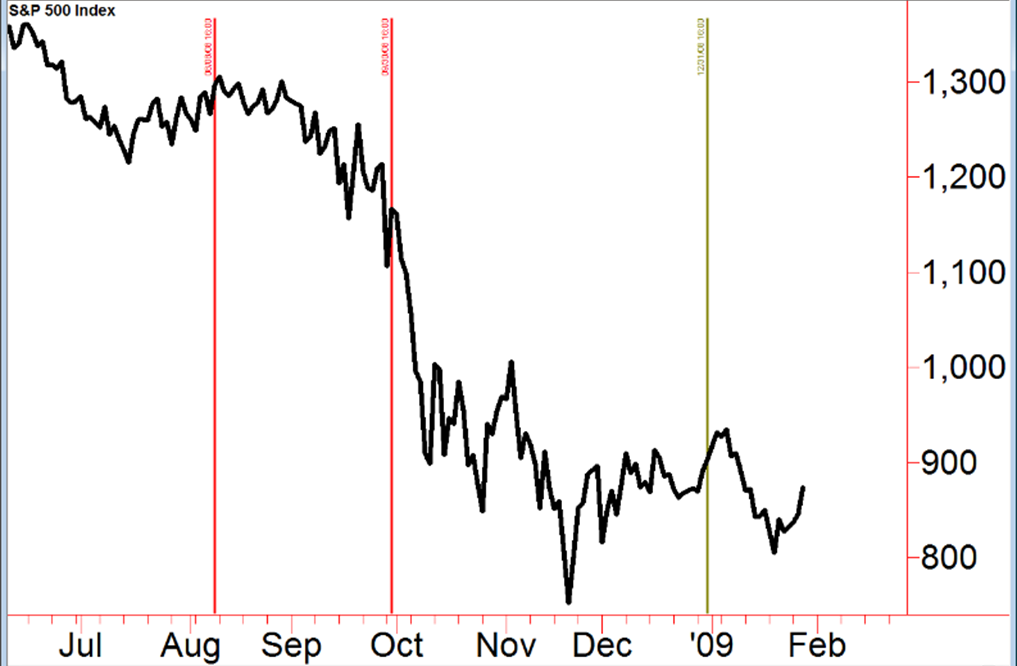

Instead, on Aug. 8, I told them to consider hedging their portfolios with a simple inverse ETF that would rise in value if the Dow index dropped. (First red line in my chart.)

Sure enough, the market DID start cracking as you can see from this chart of the broad market.

So, on Sept. 30, I recommended they double their stake in the same inverse Dow ETF. (Second red line in my chart.)

Again, that proved to be a good call … because shortly afterward, the market REALLY caved … dropping as much as 36% in just the next two months.

And so, what happened to the value of that inverse ETF?

It took off!

In fact, because it was the ProShares UltraShort Dow30 ETF (DXD) — which is designed to surge TWICE AS MUCH as the Dow falls — it actually rocketed in value more than 70%!

Once it looked like things were starting to settle down a bit by the end of the year, I recommended readers close out their entire stake in the ETF (green line in my chart).

Total tracked profits?

My records show readers could have earned as much as 65.4% on the initial recommendation and another 43.7% on the follow-on recommendation.

Those are huge double-digit wins while most regular stock portfolios were getting crushed.

There is just one other thing you need to know about inverse, and especially, LEVERAGED inverse, ETFs …

You should only use them for very short time periods because of something known as tracking error.

In simple terms, the idea is that these funds are constantly resetting themselves to a baseline. So, the effect of compounding can skew their longer-term movements.

That can be a serious drawback depending on your time horizon.

But there is no doubt that inverse ETFs are the perfect solution for most portfolios.

- They can be bought and sold easily.

- They can be held in any type of brokerage account.

- They require no special clearances.

- And they do not require any type of external leverage like margin.

We already have an inverse ETF position in the Safe Money Report model portfolio right now, and I won’t hesitate to recommend more of them if we start to see serious cracks develop in the markets.

If you’re worried about the market dropping further from here, now is a great time to take another look at these unique investments for your own portfolio, too.

Best wishes,

Nilus Mattive

P.S. And if you are worried about the market dropping, you’ll want to watch this.

Our ratings system just uncovered a 100-year-old investment secret that is signaling a radical shift in the stock market.

So, in addition to potentially adding an inverse ETF or two, you’ll also want this list of stocks you should dump immediately.