|

| By Sean Brodrick |

There are three very bullish things happening for gold right now. Things that will power the yellow metal to my target of $2,931 and beyond.

These are in addition to big cyclical forces and a worsening supply and demand squeeze that I have pounded the table about for a while now.

These are forces that could send gold higher, faster than most believe possible. Let’s take a look …

Development #1: The Fed Blinked

The U.S. Federal Reserve’s cycle of interest rate hikes is over. Sure, last week we saw the Fed raise interest rates by 25 basis points. Just a week before that, about 90% of traders were expecting the rate hike would be double that.

What happened? I warned you two weeks ago that a series of bank failures would tie the Fed’s hands on rates. Silicon Valley Bank and Signature Bank were the second- and third-largest bank failures in history.

In Switzerland, once blue-chip Credit Suisse was sold off for parts to UBS Group (UBS). Plus, the bank failures may not be over just yet. Bank failures suck liquidity out of the system, as bank lending standards tighten way up. Bank failures also weigh on economic growth.

To be sure, the Fed says it is expecting another 25-basis-point increase in its benchmark rate, but Wall Street flatly does not believe this. In fact, it is expecting the Fed to cut FOUR TIMES, by 100 basis points — or a full percentage point — by the end of the year.

Sure, Wall Street has misread the Fed for about a year now. I am not expecting severe cuts in rates. Rather, I believe the Fed’s hiking days are done because every extra hike risks another bank failure.

This all relates to gold because Fed rate hikes prop up the U.S. dollar, and gold is priced in dollars. Sure enough, the mighty greenback has been slumping since the bank failures. Traders know that the dollar’s march higher is over … and gold’s ramp-up has just begun.

Development #2: Central Banks Keep Buying Gold

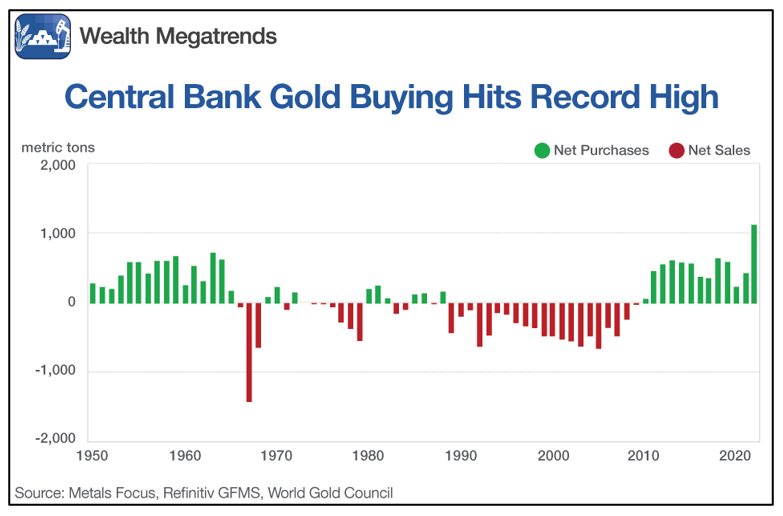

Last year, central banks added a whopping 1,136 tonnes of gold worth some $70 billion to their stockpiles. That was by far the most of any year in records going back to 1950, according to the World Gold Council. That is when it started keeping records.

Here is a chart using World Gold Council data showing what happened with central banks’ gold purchases last year.

Click here to see full-sized image.

And the buying spree has not stopped. Around the globe, central banks added another net 77 metric tonnes to their gold reserves in January. January’s shopping spree was a 192% month-on-month increase from December.

The bullishness does not stop there, either. Despite last year’s buying, central banks’ gold holdings as a percentage of total reserves are around 16%.

The historical average is 59%. If the central banks just move toward the historical average, they’re going to buy a LOT more gold.

Development #3: Foreigners Are Dumping U.S. Treasurys for Gold

Citigroup reports that in January, foreign investors sold $36.6 billion of U.S. Treasurys. That means we have seen outflows in four out of the past five months.

And sure, a lot of these Treasury sellers are foreign banks — they are turning around and buying gold.

But it’s not just central banks. All sorts of big foreign funds are ditching Treasurys. The percentage of U.S. government debt held by foreigners has now fallen to 29.3%, from 39.2% at the end of 2019.

Why? I can think of a few reasons. First, America uses its currency like a cudgel. And other nations are learning the hard way that if they get on the wrong side of Uncle Sam, he will freeze your dollar assets. But Uncle Sam has no power over gold.

Also, the thought of the NEXT crisis terrifies everyone from small investors, to big funds and central banks. We see banks groaning under the weight of bad real estate loans … fears of a global recession are rising … inflation is still running rampant … and on and on.

In such scary times, gold adds a lot of peace of mind to any portfolio.

I suggest you get some gold to protect your own portfolio and enjoy the next surge in prices. And for more speculative investors, consider buying the VanEck Gold Miners ETF (GDX).

Looking at a weekly chart, you can see that GDX is getting squeezed right now between converging trendlines.

Click here to see full-sized image.

That sure looks to me like a breakout is coming one way or another. And I believe that breakout is going to be higher.

My target on GDX is $55 — a sweet move from recent prices. Consider buying it before it blasts off.

That’s it for today. I will be back with more soon.

All the best,

Sean

P.S. According to my friend, colleague and Weiss Ratings Startup Investing Specialist Chris Graebe, the recent banking panic is already driving promising companies to equity crowdfunding, an alternative funding that allows regular, nonaccredited investors to invest in early, pre-IPO companies. This presents a huge opportunity for Weiss Members. This week, Chris is unveiling one such opportunity that is well positioned to disrupt a $100-billion industry. Click here to learn more about how to claim an early stake.