|

| By Sean Brodrick |

Man, the market is poised on the brink of a fantastic rally!

That may run counter to what the doom-meisters are telling you. Let me show you why they’re wrong, why I’m right and how you can play this.

First of all, the market had a couple of down days this week — but that’s AFTER the S&P 500 hit an all-time high and its 13th record close on Friday. Nothing travels in a straight line, so we’re seeing some giveback before the next thrust higher.

Could we be at a top? Not likely. Any year when the S&P 500 hits an all-time high, history shows it makes more all-time highs an average of 29 times!

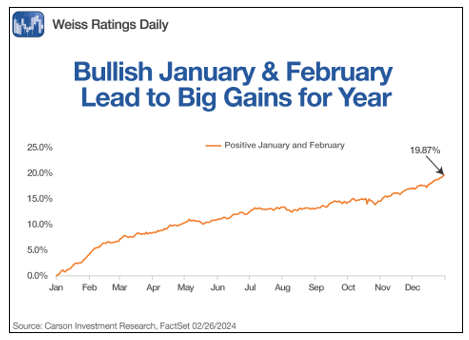

Want another fun fact? Since 1950, when both January and February are positive for the S&P 500, the average annual gain has historically been 19.87%, as this chart from Carson Research shows …

What’s more, a positive close this month would be the fourth month in a row — November, December, January and February — that the S&P 500 has closed higher. The full calendar year has NEVER ended lower when that happens. It’s happened 14 times before, and the S&P 500 has ended higher all 14 times, up an average of 21.2%.

So, now that I’ve talked about the technicals, what could be the FUNDAMENTALS driving such a rally? I’ll give you three.

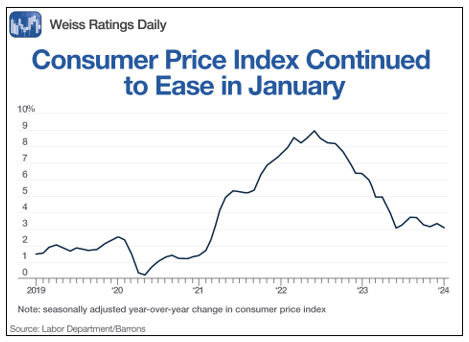

Fundamental No. 1: Falling Inflation

Despite what you hear from professional grumblers, inflation is cooling quite a bit.

While that doesn’t mean prices will go down — though prices of eggs and some other staples are finally moving in the right direction — it does mean that prices will go up more slowly. And it’s important that inflation goes up more slowly than worker wages.

That’s been happening all year. Hourly wages rose 0.6% in January from the previous month and are up 4.5% from a year earlier — outpacing inflation, which is cooling month after month.

With wages outpacing inflation, consumers can afford to spend more. And that’s one of the things driving economic growth. No wonder the Atlanta Fed’s GDPNow forecast for Q1 is now running at 3.2%. Consumer spending is responsible for 1.8% of the increase.

That 3.2% GDP growth forecast is far above the Wall Street consensus of 1.8%. And you know what? The same thing happened last quarter because Wall Street keeps talking itself into believing a recession is imminent!

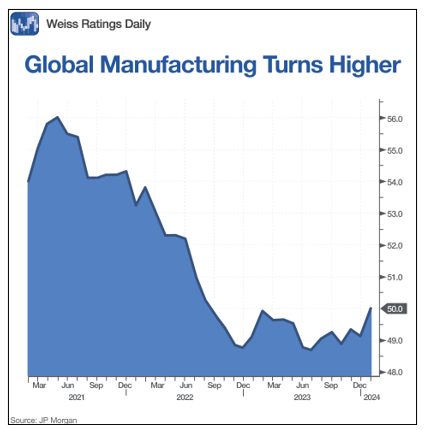

Fundamental No. 2: Global Manufacturing Rebound

We’ve all heard the news about China’s economic woes. Construction has stalled, and many of China’s manufacturing plants are gathering rust.

That makes many people think that the global economy is suffering. After all, China is the factory to the world, right?

That used to be true. But more and more manufacturing is fleeing China, with its mercurial government and higher costs … and moving to other places in Asia. Particularly India and Vietnam. As a result, global manufacturing not only bottomed, but it is also ramping up, as this chart of the JPMorgan Global Manufacturing Index shows …

After all, somebody has to make all the stuff that flush American consumers want to buy.

And there’s one more fundamental I want to talk about today.

Fundamental No. 3: AI Is Driving New Tech Boom

I strongly believe we’re in the middle of a new tech boom. And artificial intelligence, for all its faults, is shifting that boom into overdrive.

According to the McKinsey Global Institute, AI is going to dramatically accelerate all other new technologies. It’s going to be adopted in some capacity by 70% of companies by 2030. And it’s going to contribute $13 trillion in new economic growth.

You add these things together and OF COURSE we’re going to see an economic boom this year. It’s likely to send stocks higher. So, how do you want to play it?

How to Play the Big 2024 Rally

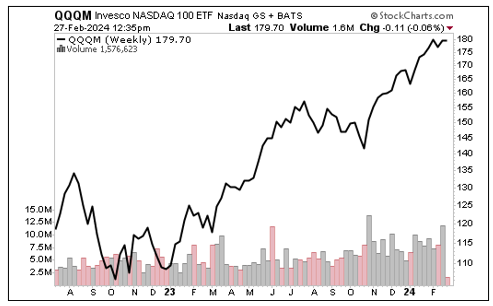

In Supercycle Investor, we’re playing this move with individual stocks — and already grabbing fat gains with both hands. There is a lot more to come. But if you want to buy an ETF, consider something tech-heavy. After all, AI is going to power tech higher.

You can buy the Invesco QQQ Trust (QQQ). But that’s pricey, and it has an expense ratio of 0.2%. You can buy the same thing for much cheaper with a lower expense ratio — 0.15% — with the Invesco Nasdaq 100 ETF (QQQM). It has a Weiss Rating of “C” and is basically a cheaper version of the QQQ.

You can see that the tech-heavy QQQM is already ramping up. Despite the warnings from Wall Street’s doom-meisters, I believe it has a great year ahead of it, for all the reasons I told you and more. My target on QQQM is $260 per share.

This is going to be a great year. I hope you join me for what is going to be an extraordinary profit opportunity.

All the best,

Sean

P.S. AI is such a powerful driver for this rally, we recently put together a town hall event on the best ways to play it. To check out that presentation, click here.