|

While everyone wants to find the next hot stock or ride the fastest-growing trend higher, there’s a powerful strategy you can use right now to boost your gains by the end of 2025.

It’s called mean reversion.

It may not be the sexiest idea.

But it is simple … and effective.

The idea behind it goes like this …

If the overall market is going in one direction over time, there are always going to be laggards.

In general, stocks that lag will catch up.

This, obviously, is not a foolproof plan. There are several reasons why some stocks lag the market during various time periods.

Small caps, for instance, usually lag larger-cap ones when interest rates and/or volatility are high.

That appears to have happened over the last several years, as I wrote recently.

Note: I also told you that it looks like now is the time for that to turn around.

Part of that is mean reversion.

Small caps aren’t the only laggards that look poised for a comeback.

In fact, one sector looks like it’s just now breaking out: Health care stocks.

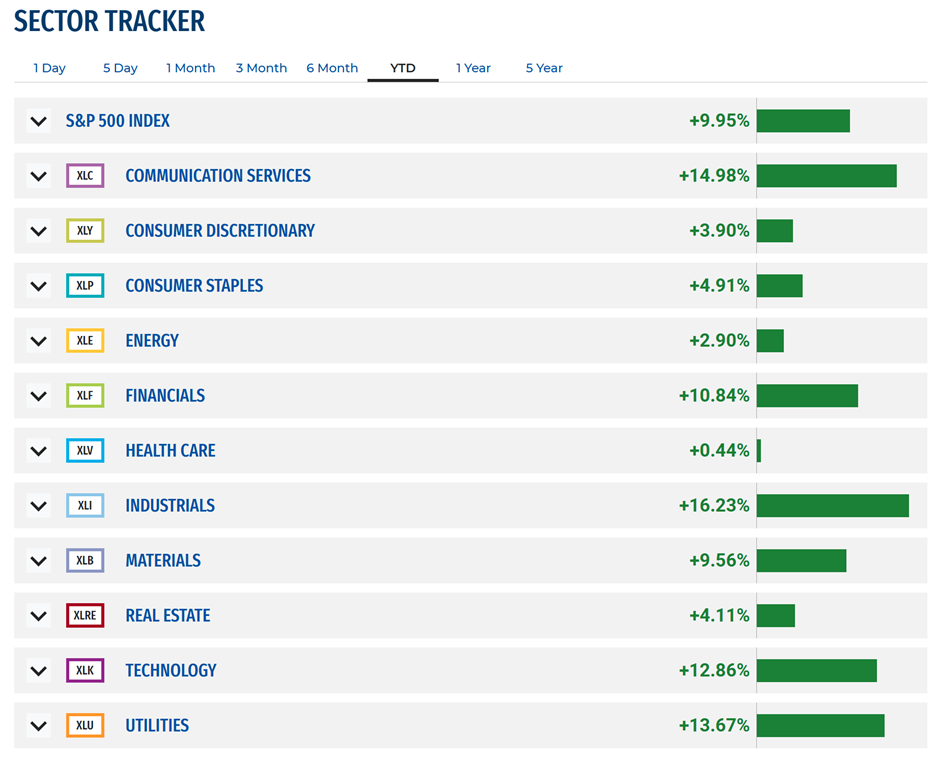

As you can see, health care as a whole has not taken part in the S&P 500’s sizeable rally this year:

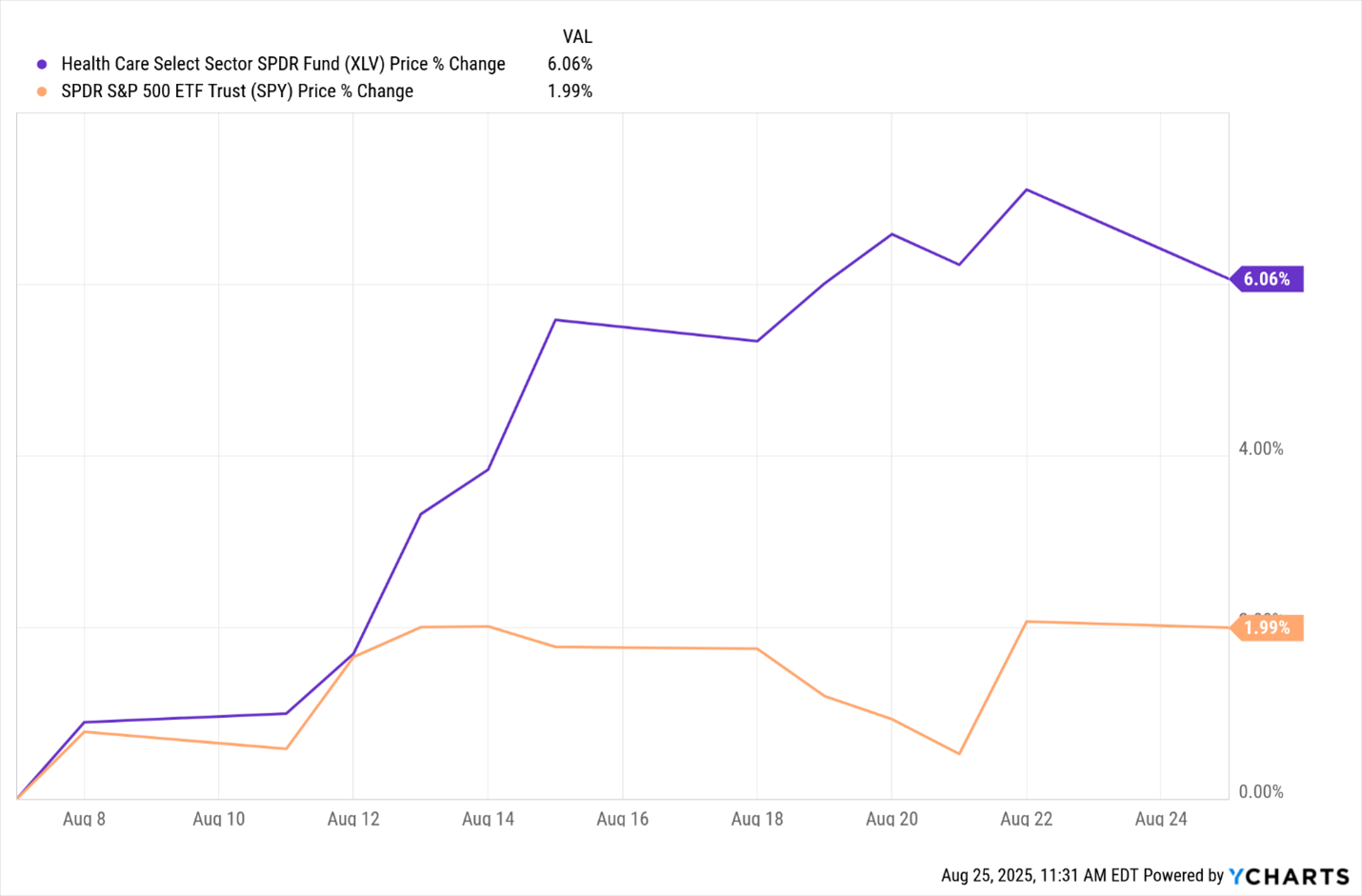

But over the past two weeks, that started to change.

It’s too early to tell if this will kick off a larger sector rally for health care stocks.

But we can look at the top four of these that are likely to lead that rally whenever it comes.

For that, we need to consult our Weiss Ratings …

3 Filters for Health Care Profits

The way we go about this is simple. But it does require access to the Weiss Ratings Plus “Stock Ratings Analyst” tool.

You can learn more about that here.

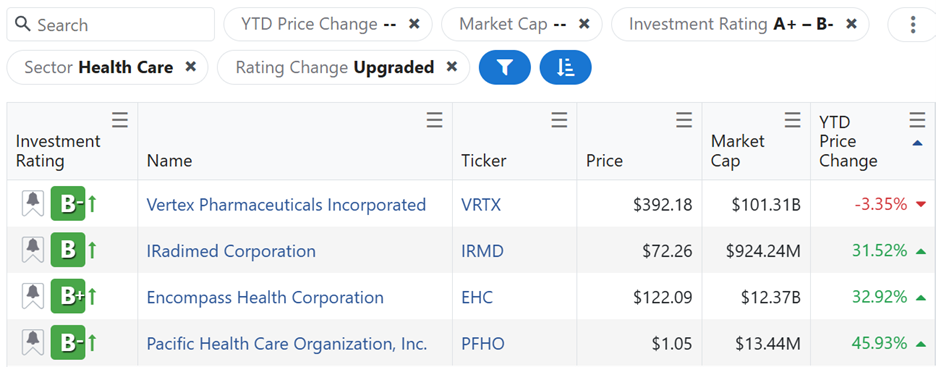

There are three filters you can use to get started.

- Investment Rating — All stocks with a rating between “B-” and “A+”

- Rating Change — Stocks that have been recently upgraded.

- Sector — Health care stocks.

You can see the results here:

Obviously, there aren’t many.

These four health care plays are all rated “Buy” and have recently been upgraded.

Meaning they are showing momentum or have recently improved one of their “Rating Factors.”

I also added a market cap column and year-to-date price change column, so you can see where they stand today.

This last, the price change, is important.

Often, stocks in a lagging sector that have been able to buck the trend will be the ones to lead that sector going forward, too.

So, if health care stocks pick up speed in the second half of 2025, you can expect these three to be among the best performers:

- IRadimed (IRMD)

- Encompass Health (EHC)

- Pacific Health Care Organization (PFHO)

The other — Vertex Pharma (VRTX) — has lagged with the rest of its sector. But its strong operational performance may help it turn around faster.

I always encourage readers to dig in further to all stocks found using a screener.

You can do so with the tools you’ll get as a member of Weiss Ratings Plus.

Of course, this opens the door to much more than finding out which health care stocks have the best shot of outperformance when the scales tip back to that sector.

In fact, we recently put together a special tool to help you find the best stocks to take advantage of AI’s “second wind.”

Watch to the end to see this list.

Cheers!

Gavin