|

Most people love to buy big, blue-chip stocks. And for good reason.

The largest stocks tend to be what most other investors hold. So, you’re in good company.

I like to think that investors are also following our ratings very closely. And, if I may toot our own horn here …

If we made a Venn diagram of “Buy”-rated stocks and companies that generate bigger profits and higher stock prices, it would practically be a circle.

I say practically because there’s a sliver of the market that sometimes gets overshadowed by the Magnificent 7 and the meme stocks that may not be worth the paper their stock certificates were once printed on.

History shows that often it’s the smallest stocks that outperform over the long haul.

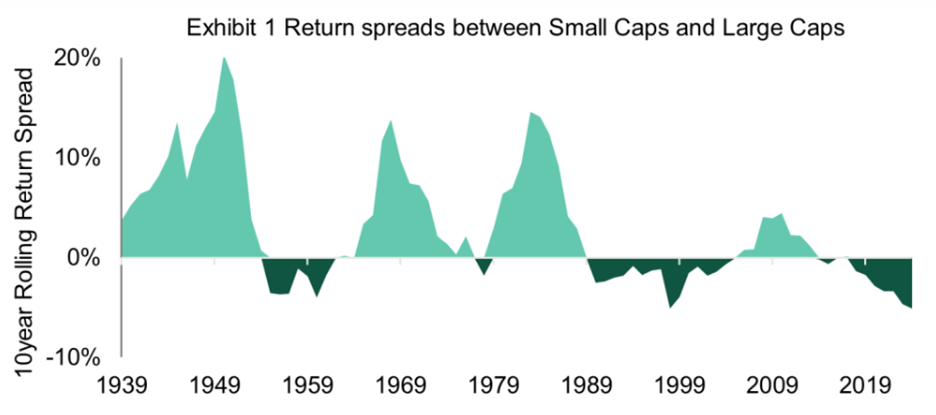

It’s just not been particularly true in recent history:

This chart shows that small-caps have been underperforming their larger brethren of late.

But there are three reasons why that could change in a hurry …

As early as this year.

Small-Cap Driver No. 1: Interest Rates

Smaller companies simply don’t have the same deep pockets as companies with market caps in the billions or trillions.

They often rely on financing their growth and expansion plans.

That means they are more affected by swings in interest rates.

Today’s rates are not astronomical by historical standards. But they are still quite elevated from where they were over most of the past 15 years.

Now, with pressure on the FOMC to reduce rates — and one member openly supporting three cuts this year — that bodes well for small-caps.

Small-Cap Driver No. 2: Deregulation

It’s no secret that the current administration is prioritizing deregulation policies.

In fact, this has been the main theme of President Trump’s dozens of executive orders in his first half-year.

While deregulation can help larger businesses expand, it is even more helpful for smaller companies.

As a percentage of costs, small-cap stocks spend more to meet higher regulatory and compliance hurdles than large caps.

So, it’s natural for them to see larger margin expansion when those hurdles are lowered or removed.

Small-Cap Driver No. 3: AI to the Rescue

There’s one additional driver behind the likely small-cap resurgence: AI.

As Dawn Pennington wrote yesterday about AI spending:

“Tech mega-caps now plan to spend more than $300 billion in 2025, with Microsoft (MSFT), Meta (META), Alphabet (GOOGL) and Amazon.com (AMZN) expected to spend a record $270 billion on capex this year. That’s according to Goldman Sachs’ estimates.”

That’s great. But it’s the small caps that benefit.

You see, without needing to compete with the AI infrastructure buildout, they can still take advantage of it.

Increased use of AI tools can streamline a small company’s operations and improve efficiency.

And while the big Mag 7 continues to compete with each other, the cost to implement AI solutions continues to be cost-effective for small companies.

So, all these drivers point to one thing … I suggest that you:

Add These 8 Small Caps to Your Radar

We currently have “Buy” ratings for 877 companies.

And while that list does include several mega caps like Nvidia (NVDA) and Microsoft (MSFT), there are plenty of small-cap stocks here as well.

In fact, since small caps outnumber large caps in general, there are even more to choose from.

So, I decided to narrow down the results.

I screened for companies with market caps between $50 million and $500 million that trade on a U.S. exchange and were recently upgraded.

Here are all the “Buys” that came up:

There are plenty of financial companies on this list. And that makes sense.

After all, deregulation often gives a huge initial burst of profit potential to the financial sector.

They are also beneficiaries of changes in interest rates AND are able to utilize AI tools to improve everything from data keeping to loan approvals and even customer service.

So, feel free to dig deeper into the above eight small caps for the right fit for your portfolio.

Of course, if you want an even better way to take advantage of AI and shifts in the market, you’re in luck.

In just seven hours, at 2 p.m. Eastern, Dr. Martin Weiss will open up access to his game-changing AI trading system.

If you bookmark this link, or open it at 2 p.m., you can hear directly from him how it all works.

But here’s a quick preview. It always starts with the Weiss Ratings you can see in action above.

From there, we use AI to drill down into the companies with the highest probabilities of beating the market in the immediate term.

And that’s produced some incredible results … like 94x outperformance of the S&P 500 over the past 10 years.

Be sure you check it out today.

Cheers!

Gavin