|

| By Sean Brodrick |

The precious metals bulls are on a rampage!

Would you like some insight into gold and silver companies that Wall Street hasn’t discovered yet?

This week, we’ve seen gold surge past the $4,000-per-ounce level, hitting fresh highs on heavy safe-haven demand amid escalating U.S.-China trade tensions.

Silver’s rally was even more dramatic.

It surged to an all-time high above $50 per ounce, driven by acute supply constraints and rising industrial demand.

The combination of central bank buying, dovish Fed expectations, ETF inflows and geopolitical risk has supercharged gold …and silver’s going along for the ride.

And while the metals may zig and zag, they have enough strength that there’s plenty of upside yet.

Last month, I went to the Precious Metals Summit in Beaver Creek, Colorado.

It was a great time, and I had the opportunity to talk to many interesting companies.

I recorded some of those conversations.

Today, I want to share a few of them with you.

Video No. 1: McEwen

First, here’s an interview with Rob McEwen, CEO of McEwen (MUX).

I showed another video interview with Mr. McEwen on Sept. 17, in which he talked about the forces driving this bull market.

The forces driving McEwen’s company are equally strong.

We added MUX to the Resource Trader portfolio on Sept. 18. It was recently up more than 50%!

That’s a heck of a move in less than a month!

Here's my interview with Mr. McEwen …

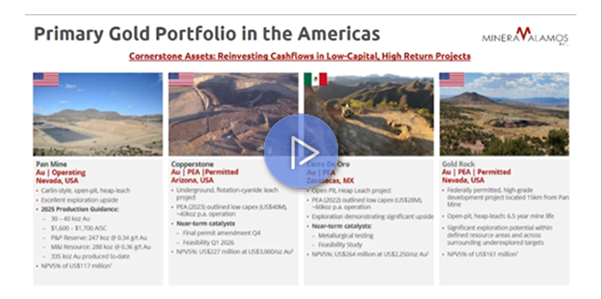

McEwen has a billion-dollar market cap and operates a portfolio of gold, silver and copper assets in the Americas.

Major producing assets in Q2 were Gold Bar, Fox Complex and the company’s interest in San José, with robust development activity at Los Azules and ongoing exploration successes.

The company produced 27,554 gold equivalent ounces (GEOs) in Q2, up 15% quarter over quarter but down year over year as the company shifts projects.

Higher gold prices boosted revenue to $46.7 million, and net income swung from a loss to a gain of $3 million.

So, McEwen is still in the early stages. But it’s making the turn into profitability.

McEwen’s guidance for this year is 120,000 to 140,000 GEOs.

Looking ahead, the company aims to double its output by 2030, targeting a range of between 250,000 and 300,000 GEOs. Wow!

Video No. 2: Minaurum Gold

Minaurum Gold (MMRGF) is a Canadian explorer with a recent market capitalization of $120 million.

It is hard at work validating a silver district in Mexico.

It has two resource estimates scheduled for release within the next year, aiming for a 100-million-ounce silver estimate on the deposit at a grade of ~300 grams per tonne silver equivalent.

CEO Darrell Rader explained Minaurum’s plans in the video below.

Minaurum makes new mineral discoveries, particularly in silver and gold … then monetizes these projects through sales or spinouts.

There are not one but two new resource estimates for the Alamos Silver Project in Sonora, Mexico.

The company also has several other significant projects in the pipeline, including the Adelita Copper-Silver Project in Sonora, Mexico and the Santa Marta VMS Gold-Copper Project in Oaxaca, Mexico, among others.

Video No. 3: Borealis Mining

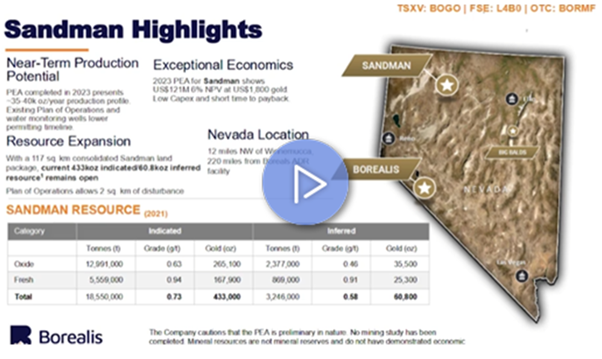

Borealis Mining (BORMF) is a $147 million market cap miner that is resuming and expanding production at its flagship Borealis Mine in Nevada.

It has a second project, Sandman, in the development pipeline, and it’s exploring a third project.

Borealis recently poured its first gold and will rapidly ramp up production, as explained by founder and CEO Kelly Malcolm.

Watch my video interview with him here:

The Borealis Mine began a rapid restart process in mid-2025, initiating crushing and heap leaching of a 327,000-ton mineralized stockpile ahead of schedule in June 2025, with the first gold pour in August 2025.

Analyst forecasts suggest that Borealis could see its revenue grow from roughly $3 million in fiscal 2025 to over $68 million by 2027, with positive free cash flow expected to begin in 2027.

The company expects a post-tax internal rate of return of 81% at a gold price of $1,800 per ounce.

Gold prices are currently double that!

So, what’s not to like?

While Borealis is liquid enough for Canadian investors to buy on the TSX-Venture, its U.S. listing on the OTC Pink will give some investors pause.

I’ve explained before that OTC Pink volumes can dry up in a blink.

So, IF you buy it, be careful — go in with both eyes open … and use a limit order.

Note: After I sent my Resource Trader readers a bunch of videos from Beaver Creek, Borealis is one of the stocks I added to my own portfolio.

I’m glad I did. I believe it has much further to go!

Know Your Own Appetite for Risk

I’ve arranged these videos purposely.

McEwen is the least risky. Borealis is the most risky.

You’re in charge of your own investment destiny.

If you want more insight into small gold and silver plays that Wall Street hasn’t discovered yet, I urge you to watch this video to the end.

Good luck to us all, and I’ll see you at $6,900 gold!

All the best,

Sean