3 Superb Spring-Cleaning Tools with the Weiss Ratings

|

| By Gavin Magor |

It’s time for a different type of spring cleaning.

If you can believe it, spring is now only 15 days away.

Longer days, beautiful budding plants and warmer weather are just on the horizon. And if you live in a colder climate, I’m sure you are counting down the days. I know this well, as I used to live in Michigan.

I now live in Florida, and we have generally nicer weather now. But we are counting the days down for a different reason. That’s us wishing for less traffic after many snowbirds leave in what seems like a mass exodus every year around the start of April.

Regardless of where you are, many use this time of year to partake in spring cleaning by sprucing up their home, dusting all round, vacuuming and cleaning vents for the summertime AC on full blast … certainly we’re doing the latter here in the Sunshine state.

But are you doing that same type of cleaning within your portfolio?

Markets move quickly, new data comes in so fast and economic conditions can change quicker than ocean seas. Are you prepared?

With the Weiss Ratings, you certainly can be.

King of Comparison

For investors, deciding which stocks to keep and sell can be a difficult decision. But when you factor in the Weiss Ratings, it is much easier.

If you’re not already familiar with our comparison tool, I want to cover it today.

Say, for example, you are wanting to add some tech exposure to your portfolio and were to be deciding between Apple (AAPL) and Microsoft (MSFT). Both are now the two largest stocks in terms of market capitalization in the market.

I recommend your first stop being the Weiss Stock Ratings page.

Although we currently rate both stocks as “Buys” at the moment with a “B” rating, the Weiss Ratings have loved both of these names for quite some time now … before they were market behemoths.

We first rated Microsoft as a “Buy” on April 2, 2003. Since then, shares climbed around 1,522%.

We rated Apple a “Buy” on Sept. 27, 2004. That is now up around 1,364%.

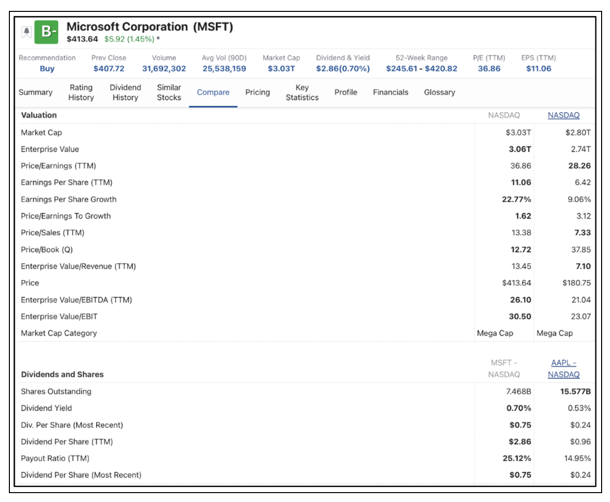

Under the “Compare” tab, you can get a nice conceptual overview on important financial metrics for each name. Here is what populated when I compared the two. (Note: On the left side is MSFT, and on the right side is AAPL.):

Both of these mega cap names may be in a realm of their own with a market cap of around $3 billion for each, but they differ in several ways … as we can glean right above.

One thing that stands out to me is that Microsoft’s dividend is currently yielding 0.70%, slightly larger than Apple’s 0.53%. However, Microsoft’s price/earnings ratio is slightly higher. That means traders are willing to pay more of a premium for the name.

Certainly, Microsoft’s stock has been performing better lately. A large reason for that is due to the AI market craze. Microsoft has made a bigger splash in AI compared to Apple. And traders clearly realize that.

There are many angles you could take when comparing stocks like these. But what is for certain is that the Weiss Ratings comparison tab makes it easy.

Another amazing feature to help with your portfolio spring cleaning is our stock downgrade feature.

Deciphering Downgrades to “Hold” Territory

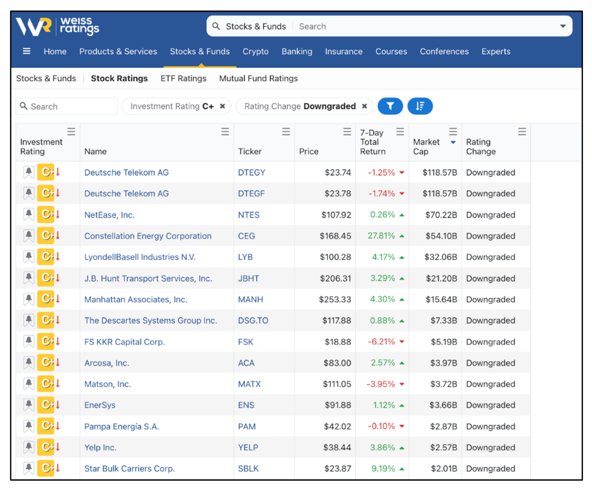

Say, for example, you wanted to check which stocks just downgraded into “Hold” territory from “Buy” territory.

You would simply hit the “Stock Ratings” tab and then filter for “Investment Rating” of “C+” and “Rating Change: Downgraded.”

28 results populated in total. Here are some of the top names, ranked by market cap:

You may possibly own some of these names or have them on your investment radar currently. Whatever the case, be sure to explore and see why we have downgraded these names within our system.

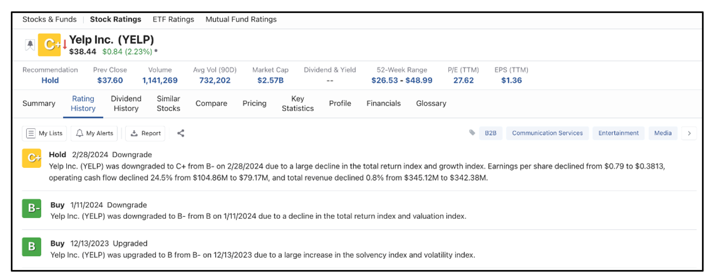

I am familiar with the 14th name in the list above, Yelp (YELP), and you may be too. It has become an increasingly popular app to review and rate restaurants.

By clicking on the name and then clicking “Rating History,” you can see the rationale behind the grading change.

Here’s what we viewed as our rationale for the downgrade of Yelp:

Yes, the company reported its quarterly earnings on Feb. 15 and did beat analyst expectations on both top and bottom lines. However, we viewed the results to be not as stellar.

Among the top reasons for the downgrade: EPS declined, operating cash flow declined and total revenue declined.

This is not just for Yelp. You can utilize this incredible feature for all of our rated stocks. And it just may be the perfect tool to help with your portfolio spring cleaning.

I also encourage you to do this with stocks that just got downgraded from “Hold” to “Sell” territory.

And lastly …

Private Deal Hunting Made Easy

My colleague and fellow editor here at Weiss Ratings, Chris Graebe, is an early stage investing expert. He and our team use our reams of data, technical know-how and models to pinpoint the best possible new private equity or crowdfunding deal there is each quarter.

And there’s big news from his corner of the market. In fact, you might want to add it to your portfolio spring cleaning checklist.

Early stage investing is a great way to invest, because it allows you to be among the very first investors in line for a company. And these aren’t just any companies. These are vetting extensively by Chris and our Ratings team.

Chris will be revealing his favorite new private deal soon. However, he will only be doing so to his loyal members of Deal Hunter’s Alliance.

It all starts tomorrow, a presentation by Chris at 2 p.m. Eastern. To sign up, be sure to click here now.

Cheers!

Gavin Magor, Ratings Director

with

P.J. Amirata