I spend a lot of time digging through the Weiss Ratings looking for patterns. And if you read last Thursday’s issue, you’ll know that right now, I’m looking for companies that are working their way up.

And Big Tech earnings are in, so let’s see how the data is moving the Ratings.

Sometimes we see companies make their way up to the “A” range and then share prices don’t move that much. That makes sense though. The “A” range rating means the company is a safe place to park your money.

By looking at companies that are currently climbing, we may find that there’s a little more price movement now … which could mean more gains.

Now, I’m not saying you should be looking for a “D”-rated stock that’s finally making its way into the “hold” range. Instead, I’m suggesting you look for companies climbing through the “B” range.

• Remember, our stock ratings are processed daily ... so each and every day, you can find new opportunities.

Since earnings season is in full swing, that means more data flowing into the model. And I’m a firm believer that you can never have too much data.

If you haven’t been following earnings season, this week might just be one of the most important of the whole season. Tech giants Alphabet (Nasdaq: GOOGL) and Microsoft (Nasdaq: MSFT) already reported this week. So have consumer giants Coca-Cola (NYSE: KO) and McDonald’s (NYSE: MCD).

But today is a monster of a day.

The list of companies reporting earnings goes on and on: Apple (Nasdaq: AAPL), Amazon.com (Nasdaq: AMZN), Samsung Electronics (OTC: SSNLF), Altria Group (NYSE: MO) and Caterpillar (NYSE: CAT) just to name a few.

The companies span all industries and sectors, and they are of all shapes and sizes. But investors and analysts really pay attention this week because of the tech giants.

So, today I decided to focus on the information technology (IT) sector and look for the three highest-rated companies that saw a ratings upgrade over the past week.

1. KLA (Nasdaq: KLAC)

A Silicon Valley pioneer since 1976, the company claims that virtually no electronic device would have made it to the hands of consumers without KLA.

Source: KLA Corp website That’s because the company is ingrained in the chip manufacturing process: the process, not the chips themselves.

It has an extensive portfolio of packaging solutions, inspection and data analytics systems, reticles and substrates … all the things needed to manufacture the components for all the electronics above.

The company has nearly 60,000 tools worldwide and spent almost $3 billion in research and development (R&D) over the last four years.

Companies depend on them, and they’re continuing to improve every chance they get.

KLA tends to stay in the “buy” range but hasn’t seen the “A” range since 2018. Just last week, it was upgraded from a “B” to a “B+” due to improvements in the total return, valuation and volatility indexes, which are generated from the Weiss Ratings modeling.

Shares are up 32% so far this year and 69% over the past 12 months. Plus, it currently pays shareholders a 1.09% dividend.

2. Motorola Solutions (NYSE: MSI)

I probably haven’t had a Motorola phone in a decade, but when I hear Motorola, my brain goes straight to the Motorola RAZR circa 2004. Motorola phones are now made by Lenovo, and Motorola Solutions has gone back to its foundations: mobile radio communications.

Source: Motorola Solutions website These are communication systems used every day by both enterprise and public safety customers. Motorola Solutions has over 13,000 networks used by its 100,000 customers spread out over 100 countries. And most of these systems are considered mission critical — meaning a disruption would cause an entire operation or business to halt.

Last week, MSI saw its rating upgraded from a “B” to a “B+” due to an increase in earnings before interest and taxes (EBIT), earnings per share (EPS) and total revenue. The company hasn’t seen an “A-” rating since the end of 2019 but it’s back up at the top of the “B” range. And I think this is one you should keep an eye on.

Shares are up 50% year to date and the company pays a 1.14% dividend.

3. ASML (Nasdaq: ASML)

ASML claims it’s changing the world one nanometer at a time by giving the world’s leading chipmakers the power to mass produce patterns on silicon.

Since 1984, the company’s been a leader in lithography solutions for the semiconductor industry.

This is another company that tends to stay in the “buy” range but it can occasionally drop into a “hold.” It hasn’t seen the “A” range since 2018. Just last week, it jumped from a “C+” to a solid “B.” Yes, it jumped two grades from a significant increase in both the total return and volatility index.

Shares are up 62% year to date and 115% over the past 12 months. Plus, it currently plays a dividend of 0.35%.

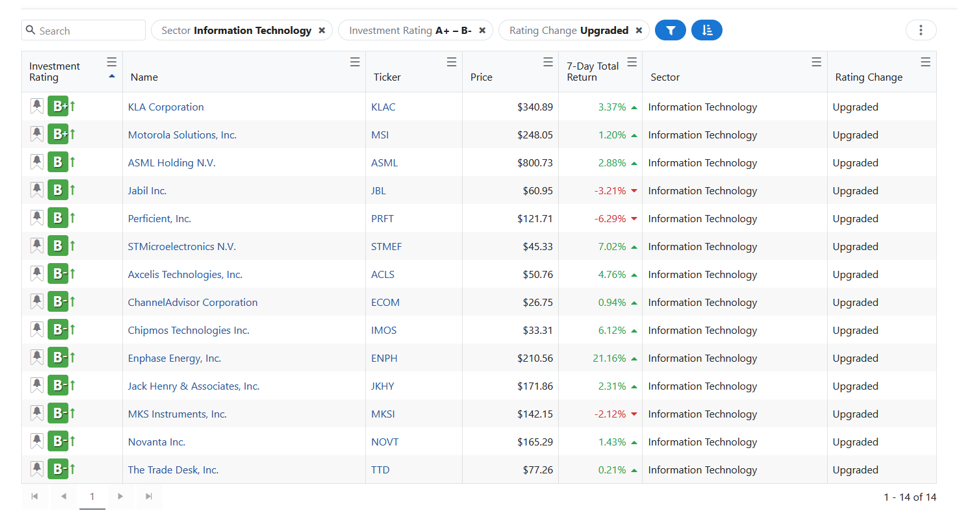

Of course, these were just three companies out of the 14 that popped up during my search:

|

If you’re not looking to add any more technology companies to your portfolio right now, you can see the filters I used at the top of the image above. Change the sector to whichever one is on your radar at the moment!

And if you haven’t checked out the screener in the past two weeks, I highly recommend looking through all the filters. There are some new options that I’ll be looking at and highlighting over the coming weeks.

Best,

Kelly Green