|

| By Gavin Magor |

Ladies and gentlemen, start your engines … because another season of earnings is here.

New data, new financials and, consequently, many new ratings are right on the horizon.

Having the latest financials is extremely important for the Weiss Ratings. We strive to have our ratings always reflect the most up-to-date information.

We’re only in the early stages of this season. But so far, earnings have been generally positive.

As is tradition, the big banks like JPMorgan Chase (JPM) and Goldman Sachs (GS) unofficially kicked off earnings season. I was impressed with their results.

I always encourage investors to look at the earnings results for names they are invested in. That goes for all four quarterly earnings reports each year. That’s especially important for a stock’s annual report, which is released no later than 60 days from the end of its fiscal year.

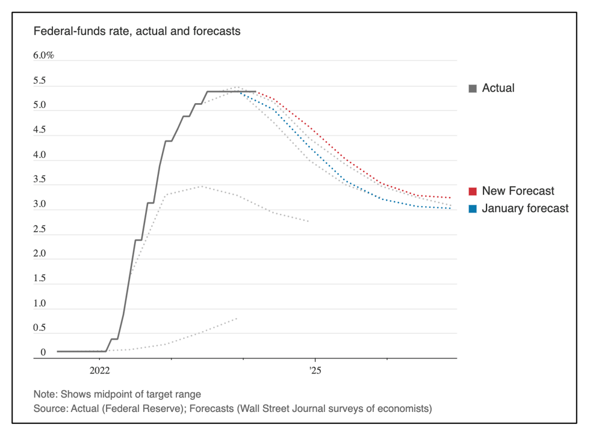

According to some early earnings reporting, this economy is still quite hot. In fact, it is still too hot for the Fed to have any idea about interest rate cutting for that matter.

This leads me to believe that — to a certain extent — higher interest rates are actually further heating up the economy.

I don’t want to sound like too much of a contrarian. But it’s an economic theory called modern monetary theory — where higher interest rates lead to more money being in consumers' pockets … leading to more economic stimulation.

I’ve explained this concept to our premium readers, but I will expand on it in a future issue.

New Data, New Ratings

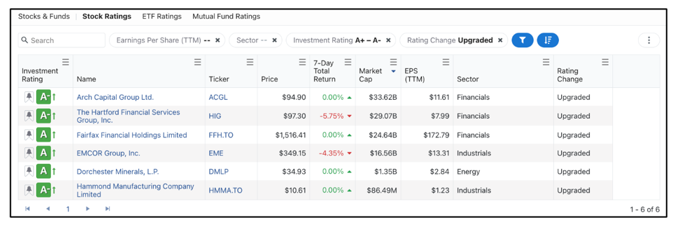

For now, I want to head to the Weiss Ratings Stock Screener and take a look at some of our newest upgrades into the highly elusive “A” range.

Currently there are only 18 stocks in the “A” range out of the 12,492 total names. Out of those 18, only six of them have been recently upgraded … making now a great time to highlight them.

After a few easy filter changes on the Weiss Stock Ratings site for Investment Rating of “A” and “A-” and Ratings Change to “Upgraded,” here’s what populated:

One interesting observation about these six stocks is that four are in the financials sector. One is in energy. And the final one is an industrials name.

I highly encourage you to explore all these names and all of our “Buy” rated stocks for that matter. But I want to focus on Arch Capital Group (ACGL) today.

It’s a name that I’ve had my eyes on for a while now. We’ve been rating it as a “Buy” for the better part of three years now.

An Arch Within Reach

Arch Capital Group is a Bermuda-based company that provides insurance, reinsurance and mortgage insurance products worldwide.

It currently operates in Bermuda, the U.S., Canada, Europe, Australia and Hong Kong.

Financially, and unsurprisingly with its “A-” rating, the company appears to be doing exceptionally well.

In the stock’s most recent upgrade on April 12th, we noted “an increase in the growth index, total return index and valuation index. Earnings per share increased from $1.88 to $6.1111, EBIT increased 70.65% from $753M to $1.29B and total revenue increased 19.41% from $3.33B to $3.98B.”

Arch executives are growing the business through more underwriting and diversifying their business model. They are offering new insurance policies, working within reinsurance and mortgages.

In terms of future growth, it appears they are doing quite well and actually continuing to expand through new business acquisitions.

Let’s take a look at the chart:

Over the past five years, shares are up a very nice 176%. Over the past three years, the 50-day moving average appears to be a strong level of support.

And while Arch Capital doesn’t pay a dividend, it’s clear that management is using that excess capital to aggressively expand.

If you’re looking to get some exposure to the insurance and reinsurance market through what we view as a strong name, ACGL could be an arch worth reaching for. Always be sure to do your own research.

We here at Weiss Ratings certainly are working hard to help. And we want to be your first destination for investment research … especially during this earnings season.

Cheers!

Gavin Magor

with

P.J. Amirata

P.S. While we discuss our stock ratings in these pages most often, we take pride in our other ratings — banks, insurance companies and cryptocurrencies. On this last one, we cover much more than just the big ones like Bitcoin and Ethereum.

That’s good too, as Juan Villaverde recently put together a presentation on why those are NOT what you should be buying for the best crypto returns this bull cycle. I urge you to check it out.