Editor’s note: Growing your wealth isn’t just about picking a hot stock and hoping someone will buy it off you at a higher price.

As Nilus Mattive has noted time and again, using financial “hacks” can be quite profitable.

Today, we go a step further. Something big is happening in this area.

So, we asked our crypto income expert, Marija Matić, to explain it …

|

| By Marija Matic |

The crypto market is having its moment.

Total market capitalization recently hit an all-time high of $4.34 trillion.

But beyond the price action, something more fundamental has caught my attention: the buzz around neobanks.

Neobanks are digital-first banks with no physical branches.

These companies offer banking services entirely online. Checking accounts, debit cards, money transfers and more, all managed from your phone.

But that’s just the TradFi iteration.

The crypto version takes this further by building on blockchain technology instead of traditional banking infrastructure.

And there’s one crypto neobank feature that is quickly gaining popularity.

The Quiet Rise of Crypto Cards

While not yet dominating headlines, interest in this space is already brewing.

Ripple was recently recognized as a neobank back in July.

Its $144 billion valuation shows the scale of institutional interest in this space.

But for most people, the proof isn't in market caps.

It's in whether you can actually use crypto to buy groceries or fill up your gas tank.

That's where crypto cards come in.

Crypto cards bridge the gap between your digital assets and everyday spending.

Using familiar Visa or Mastercard networks, these improved cards let you …

- Spend your crypto holdings,

- Earn cryptocurrency as rewards on purchases,

- And even generate yields on crypto you already own, similar to earning interest in a savings account.

These aren’t futuristic goals. There are several cards already available that work with Apple Pay and Google Pay for contactless payments.

Some also provide physical cards.

The key difference between cards comes down to custody.

Some let you maintain full control of your crypto until the moment you spend it. Others are custodial and require you to deposit funds with the provider.

Here's a breakdown of some of the best options.

1. Gemini Credit Card (Mastercard)

This is a traditional USD credit card that gives rewards when you spend money.

The crypto twist? Rewards are paid in cryptocurrency instead of cash back or points.

That said, this card rewards responsible spenders, not borrowers.

With this option, you’d want to pay your borrowed balance in full each month. This will let you avoid interest charges that could wipe out your rewards.

Rewards:

- 4% back on gas, EV charging and transit (for up to $300 per month, then 1%)

- 3% on dining, 2% on groceries, 1% on everything else

- Welcome bonus: $200 in crypto after $3,000 spent in the first 90 days

Cost: $0 annual fee, no foreign transaction fees

Availability: All 50 U.S. states + Puerto Rico

Simple explanation: This is a regular credit card that pays rewards out in Bitcoin, Ethereum or 50+ other cryptos.

You can change which crypto you earn as rewards at any time — no staking and no hidden crypto management needed.

Best for:

- Everyday spending.

- Those who want to passively build a crypto portfolio without actively buying it.

2. Coinbase Card (Visa Debit)

This is a debit card that lets you spend USD or crypto from your Coinbase account anywhere Visa is accepted.

When spending crypto, it automatically converts to USD at the moment of purchase.

There’s also no credit check required. And setup can be done instantly if you already have a Coinbase account.

Plus, you have the option of both virtual and physical cards.

Rewards: ~0.5% back in select cryptocurrencies

Cost: No annual fee, no spending fees

Availability: All U.S. states except Hawaii

Note: Each purchase using crypto (like BTC or ETH) is a taxable event that must be reported as it involves sale of these cryptocurrencies.

But spending USD or stablecoins results in no tax implications if the stablecoin maintains its $1 peg.

Best for:

- Existing Coinbase users who want the simplest way to spend crypto when needed.

- Users looking to earn modest rewards without managing a credit line or worrying about interest charges.

3. Tria Card (Visa – Credit Against Crypto Collateral)

Imagine being able to put your crypto up as collateral to gain spending money.

That’s exactly what Tria Card does.

It allows you to borrow against your crypto rather than sell it when you need liquidity. And you maintain custody of your assets all the while.

There’s no interest. But you must maintain your collateral to avoid liquidation.

Collateral rules: You must provide eligible crypto as collateral. Tria may liquidate collateral if payments are missed for 21 days or if your crypto's value falls below thresholds. Credit limits adjust based on collateral value.

Rewards:

- Yield in native assets or stablecoins

- Up to 6% cashback

- Promotional rewards via campaigns, lounge pass access

Costs & Fees:

- Virtual card: $25/year, plastic card: $109/year, metal card: $250/year (that's steep)

- Foreign transaction fee: 1% (that's steep)

- No late, over-limit or returned payment fees

- Document statement fee: $10.

- Small-transaction fee: up to $0.50 for purchases under $50.

- APR: 0% — no interest on purchases, balance transfers or cash advances

Availability: Active in the U.S. under Puerto Rican jurisdiction.

Best for:

- Holders who want to spend against their crypto without selling it.

- Those who value non-custodial control and don't mind posting collateral.

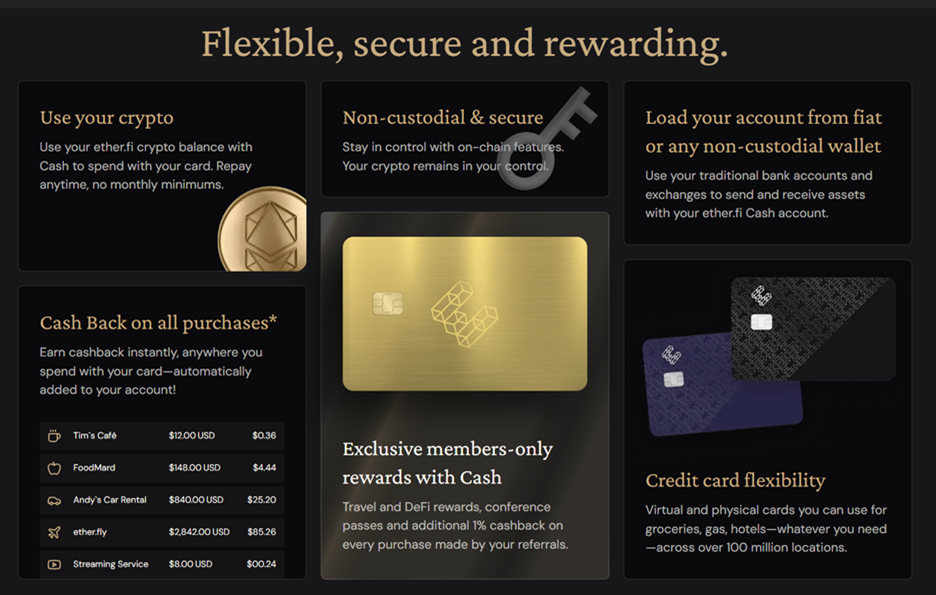

4. Ether.fi Cash Card (Visa)

Like Tria, Ether.fi is a non-custodial credit card that allows you to borrow against your crypto.

But with Ether.fi, your crypto continues to earn yield even as you spend.

It works with Apple Pay and Google Pay.

Rewards:

- 2-3% cashback on spendings (paid in SCR tokens).

- Separately, your collateral can earn 8%+ APY on stablecoins, while remaining liquid, plus yield on BTC and ETH.

Cost: No annual fee.

Availability: Live in more than half of U.S. states, including Florida, with further expansion underway.

Best for:

- DeFi users comfortable managing collateral who want to spend without selling their crypto.

Which Card Is Right for You?

If you're just getting started, Coinbase Card is probably the obvious entry point.

No fees, no staking requirements … and it plugs straight into an exchange most Americans already use.

It's crypto spending without the complexity.

For serious rewards, you may consider the Gemini Card. It delivers 3%-4% back on everyday purchases with no complicated staking. All you need to do is spend and stack crypto.

For those who refuse to give up custody — which is many crypto enthusiasts — the landscape gets more interesting.

Ether.fi and Tria let you borrow against your crypto. All the while, your collateral continues to earn yield and give you liquidity without selling your position.

So, if you want to ease into crypto, you have options with these “hacks.”

If you already have crypto and want to be rewarded for it, these new crypto cards might be for you.

Best,

Marija Matić

P.S. While these new crypto cards can help you earn rewards, there’s another way to force even larger rewards out of crypto.

Dr. Martin Weiss will join Nilus Mattive and many of your other experts on Tuesday, Oct. 28 to show you how.

It’s not just a trick to make crypto pay you … it works on other traditionally non-income assets like gold and even private equity.