We're still in a crypto bear market, but global adoption is growing, and overall, the industry is proving to be resilient against a tough macroeconomic backdrop.

In this segment, I interview well-known crypto analyst and Weiss Ratings Moderator & Host Max Wright — one of the world's first Bitcoin millionaires! — about BTC's deflationary power, its promise to investors and the market within crypto that he believes will take charge in the next bull run.

You can watch the video here or continue reading for the full transcript.

Jessica Borg (narration): He's known as the "Contrarian Dude" on YouTube.

Max Wright (on YouTube): "The SEC approved a number of crypto and Bitcoin (BTC) futures and it's through that mechanism that they wish to control the price of Bitcoin and manipulate it."

JB (narration): Max Wright was among the world's first Bitcoin millionaires, after scooping up the asset in 2012 when it was just $10 per coin.

Click here to view full-sized image.

Max (moderating a Weiss Crypto team discussion): "You're predicting a little bit of a rally, a significant crash and a Fed pivot, all in the remaining months of this year?"

Crypto & Cycles Analyst Juan Vilaverde (in team discussion):"I think the worst is behind in crypto, in terms of the sell-offs, in terms of the liquidations."

JB (narration): He's now part of the Weiss Crypto team, moderating lively discussions about growing trends.

Max (interviewing NFT Analyst Joel Kruger): "What is the promise of an NFT at a very high level, and where are we with the market right now?"

Joel Kruger (in Max's interview): "NFTs are all about the registration of unique digital assets."

JB (narration): Max has been a strong believer in one particular crypto for years.

JB: How did you know back then that this digital asset called Bitcoin was something to be hopeful about? What appealed to you?

Click here to view full-sized image.

Max Wright: This is the solution to the world's biggest problem, and the world's biggest problem is the corruption of money.

Unless the money is fixed, then everything else will be corrupted downstream of that because money is at the top of the pyramid.

It's through the mechanism of inflation, which is printing money — today, called quantitative easing — that is where the corruption comes along.

JB (narration): He says Bitcoin is a major deflationary tool that's critical in this macroeconomic environment.

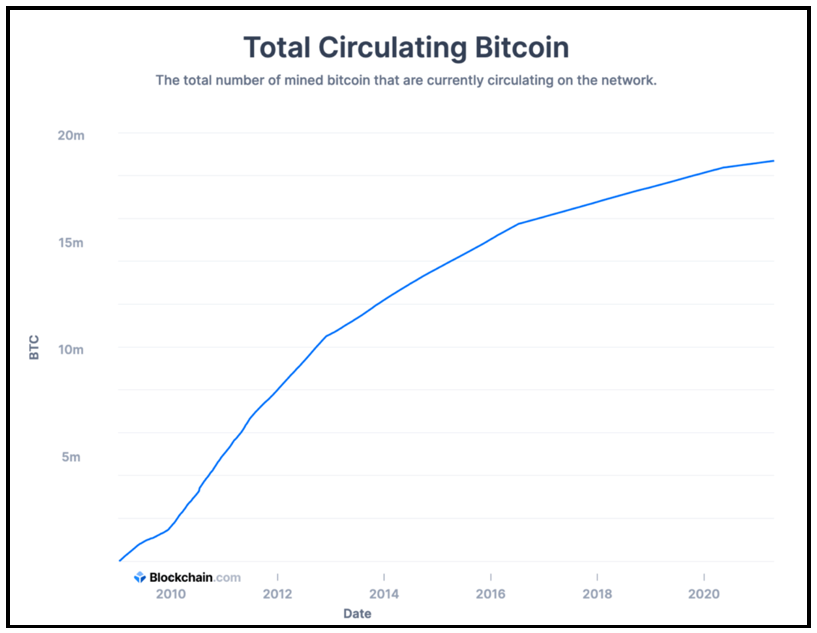

MW: Once you understand that, you get Bitcoin and understand that you have a fixed money supply, it's a level playing field, everyone knows the exact schedule of when bitcoins will be minted, when they will stop being minted.

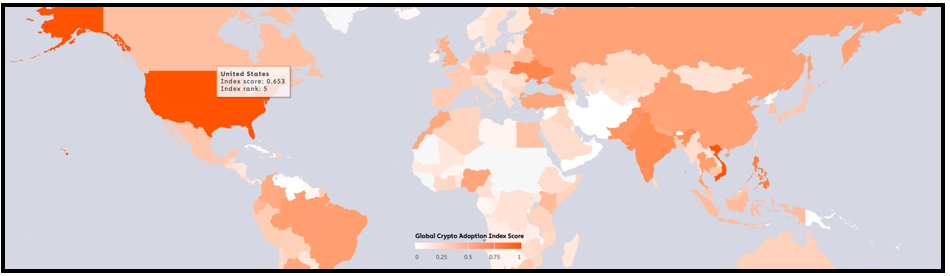

You add the second component which is the democratization of it, which means it's easy. Anybody, anywhere in the world has access to this money, and there are no gatekeepers saying, "No, you're not allowed to play in this game."

JB (narration): The transparency of the blockchain is crucial.

MW: There's an open ledger that the world can see, and I can tell you to the penny — and provably — how much Bitcoin is on all the exchanges.

I can tell you how much Bitcoin Michael Saylor has, how much Bitcoin this person has. It's all there. With gold and silver, you don't know that.

JB (narration): Max believes that Bitcoin adoption will continue to explode.

MW: I think there will probably be about a billion users within three or four years.

When your money is being eaten away by inflation, by money-printing, you can buy Bitcoin and your purchasing power will be preserved. That's the store of value.

That's very powerful and the whole world can participate in that.

There's another thing, which is the lightning network and the payment rail.

You go to countries like El Salvador, and a minority of the country is banked because banks may charge $15 a month. Most poor people can't afford that.

So, they're locked out of credit cards, they're locked out of merchant accounts, they're locked out of the entire financial system that the First World uses.

For someone who makes an amazing product, but they have no mechanism for receiving an online payment, this means that all of a sudden, they can sell to the whole world.

They can sell it online and anyone in the world can pay crypto.

They get paid immediately and then they can send out the product. On the payment side, we're seeing it explode in Africa and in Vietnam.

JB (narration): He sees one facet of the space taking off.

MW: I think something that's most interesting is DeFi — decentralized finance. It's currently centered around borrowing and lending, and insurance products on the blockchain, in a secure and trustworthy way.

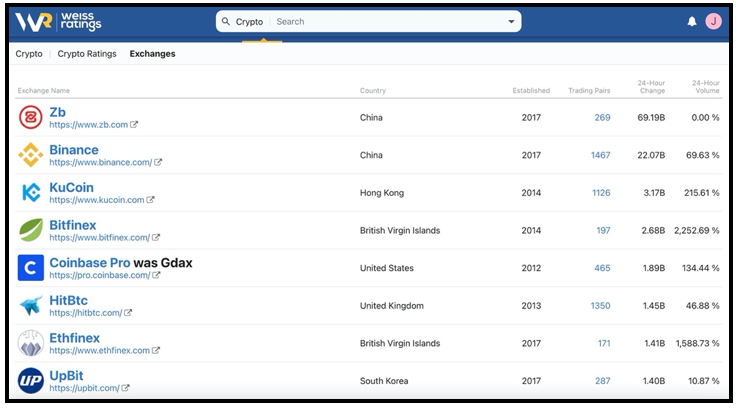

I think one of the more interesting things that will come out of the next boom will be cross-chain DEXs. DEXs stand for decentralized exchanges.

As it stands now, if you want to interact with the Ethereum (ETH) chain and the Cardano (ADA) chain, you can do that in isolation.

On the Ethereum chain, there are hundreds of projects. You can go to different coins inside of Ethereum. But to go to Ethereum from Cardano, generally the way people will do it, is they'll use a centralized exchange.

They'll use a Kraken, or a Coinbase (COIN), or a Binance, or something like that.

Click here to view full-sized image.

The next evolution will be to cut those guys out of the picture and those guys will be exclusively on off-ramps between fiat and any kind of crypto, and once you're going from crypto to crypto, that's going to happen on cross-chain DEXs.

And I think that's going to be one of the most exciting places to take off during the next bull run.

JB (narration): Max says for investors, bearish cycles can be hard, but they are short-lived. Informing the public, he says, is key to crypto's growth.

Max (interviewing Crypto Analyst Marjia Matic): "As a general rule, it's absolutely impossible to have invested in crypto and held for four years and lost money. It's almost impossible, I think, to do it in three or two years."

Marija Matic (in Max's interview): "Once you've been through a few of these cycles, you just learn to 'HODL' (hold on for dear life) and put your emotions aside."

Click here to view full-sized image.

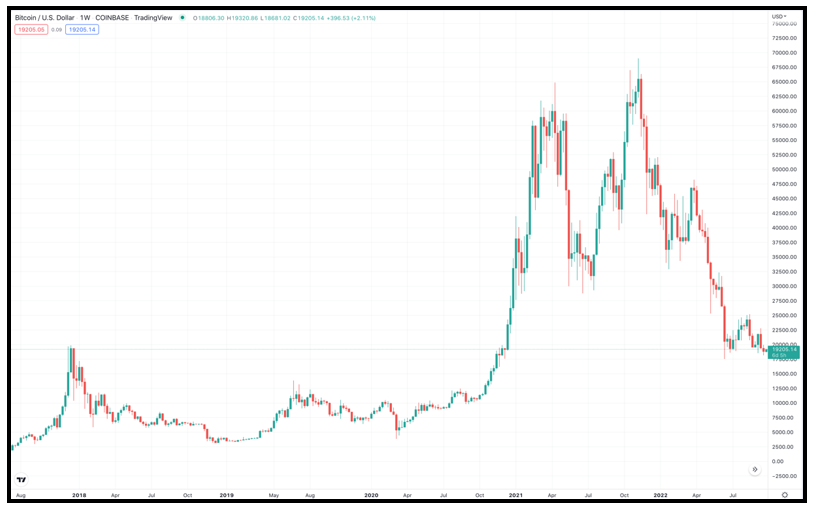

JB: In many ways you see holding Bitcoin as risk-free. Tell us about that.

MW: Any investor is somewhat foolish to not have any Bitcoin, is what I would suggest.

It goes up 100% a year! Yes, you could find something that goes up 200%, 300% a year, but with that comes risk.

To me, Bitcoin is almost a risk-free investment on a long-term time horizon.

It's a glorious, powerful system.

JB (narration): It's a system that he feels will only grow more vital over time.

JB: Crypto analyst and Bitcoin aficionado Max Wright, it was such a pleasure speaking with you. Thank you so much for making time for me today.

MW: My pleasure. Thanks so much for having me.

Best wishes,

Jessica Borg

Financial News Anchor

Weiss Ratings