A Terrible Market Week Means Opportunity at Weiss Ratings

|

| By Mahdis Marzooghian |

I probably don’t have to tell you what an awful week the market’s had this past week.

However, we did see stocks gain a bit heading into the last trading day of September, with the Dow Jones Industrial Average rising 116 points, or 0.4%, the S&P 500 gaining 0.6%, while the Nasdaq advanced 0.8%.

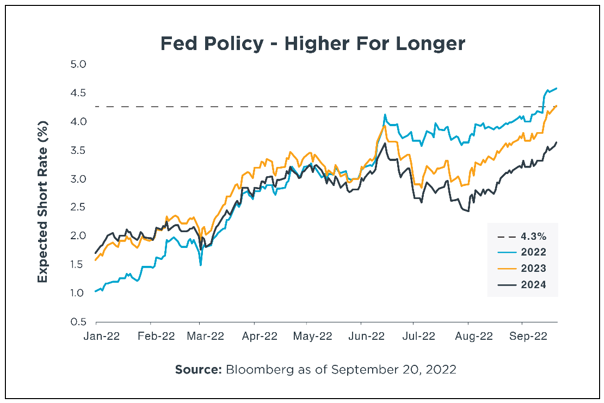

Now, the overall bad trading week was mainly due to the market having to swallow the Fed’s bitter pill of “higher-for-longer” interest rates.

Even though the Fed’s “hawkish pause” — meaning no change in interest rates, while convincing the market that higher rates were more likely in the future — took place last Wednesday, its effects on the market lasted the rest of this week.

Indeed, the Fed is determined to keep rates higher for longer, until the core inflation finally goes down to the Fed’s target of 2%. It’s currently sitting at 4.24%, up from 4.09% a month earlier.

So, the Fed hiking rates again is very likely, maybe even more than once. We’ll see if the broader market will finally accept the Fed’s stance and Friday’s gains will continue into next week or if the sell-off will resume.

As always, though, where most analysts and investors see seasons to sell and run for the hills, our experts here at Weiss Ratings see one thing: opportunity. And they’ve got a handful of them, plus some new ideas for you in their latest research. Take a look …

Last week, Weiss Founder Dr. Martin Weiss described the ominous parallels between the 1920s and the 2020s. Now, he’s going to show you some of the invisible forces behind them.

Why Retail Investors Like You Are Dominating the Startup Space

Find out what’s currently happening in the startup world and where Startup Investing Specialist Chris Graebe sees the sector going in the near future — and why it presents retail investors with such a big opportunity.

Natural Resources Analyst Sean Brodrick sure hopes you listened to him a month ago, when he noted uranium’s rally-in-waiting. Today, he’s going to show you why it’s the new gold.

Invest in This ‘When Pigs Fly’ Moment

Weiss Megatrends Analyst — and Pulitzer Prize winner — Jon D. Markman points out that some really smart people are taking a keen interest in clean energy. He’s also showing savvy investors how this could be an excellent opportunity to get on board the green energy train … by investing in this oil and gas behemoth.

Explore the Top-Performing ‘Buy’-Rated Tech Stocks of 2023

Yesterday, Gavin Magor, our director of research & ratings explored highly rated Weiss Ratings tech stocks that have surged in performance so far this year. And as always, he encourages you to check out our entire stock database, which is entirely free and conveniently located on our Weiss Ratings site.

Until next time,

Mahdis Marzooghian

Managing Editor

Weiss Ratings Daily