|

| By Sean Brodrick |

I sure hope you listened to me a month ago. That’s when I explained why uranium was on the launch pad.

The fund I recommended in that column is now up more than 28%, while the S&P 500 is down more than 1% at the same time. In fact, uranium is providing the protection against a market correction that gold bugs WISH gold could provide.

The fact is … uranium is blasting off. And if you don’t believe me, believe Wall Street analysts, who say uranium has much higher to go by the end of the year.

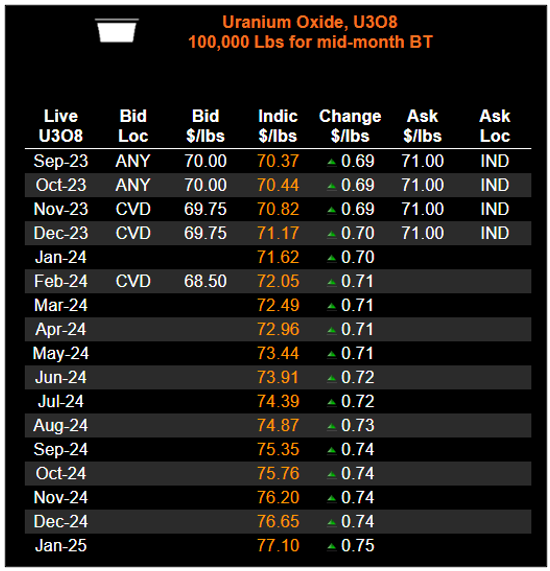

First, let’s look at where uranium is now, using data from nuclear fuel broker Numerco …

Click here to see full-sized image.

You can see the indicated settlement price is over $70 a pound. That’s the highest level since January 2011. That’s when a tsunami and resulting meltdown at the Fukushima nuclear power plant caused the price of uranium to crater.

This time, we are seeing demand surge as new atomic reactors come online, and more are planned. There are now 434 operational reactors globally, with 59 under construction and 111 planned. Heck, even Japan — which suffered the most from the Fukushima disaster — is restarting many of its nuclear power plants.

In 2021, global demand for uranium from nuclear reactors was estimated at 62,500 metric tons. By 2030, that’s forecast to rise to 79,400 metric tons … and by 2040, 112,300 metric tons.

Even the shorter term is quite bright. Demand for uranium in nuclear reactors is expected to surge 28% by 2030. That’s just seven years away!

The price of uranium is up more than 40% since the start of the year, and Wall Street analysts are putting an $80 price target on the energy metal for the end of the year.

That’s fine as far as it goes … but they just can’t think big enough.

I believe uranium is easily going back to its high of $137 a pound, last seen in 2007.

After all, from January 2005 — well after the last uranium bull started — the energy metal soared 833% in a little over two years to hit the old high. History doesn’t repeat, but it often rhymes. When uranium rallies, it can MOVE!

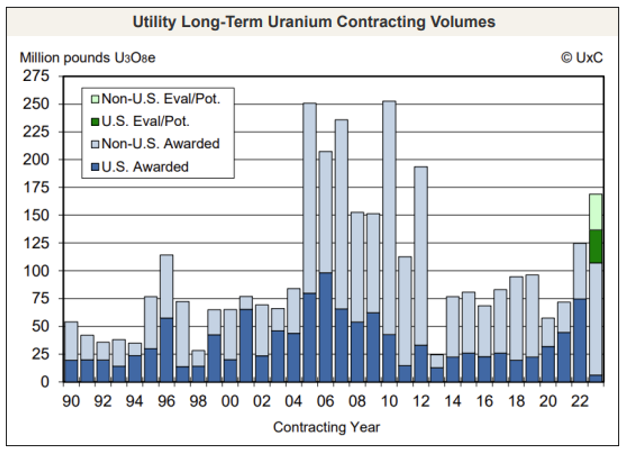

In the shorter term, the squeeze could come fast and furious. Analysts at nuclear fuel market tracker UxC report that utilities are accelerating uranium purchases. So far, they’ve contracted 107 million pounds year to date. That puts utility uranium demand on track to exceed last year, which was a 10-year high!

Click here to see full-sized image.

The groundwork for the rally in uranium prices was already laid out when I wrote about it last month. But something has changed.

First, Cameco (CCJ) — the largest of the Western uranium producers — lowered its production forecast for the year. Cameco expects to produce 16.3 million pounds of U3O8 this year, down from the previous forecast of 18 million pounds.

That squeezed the market in a heartbeat.

Then, the Economist reported that the two largest producers of uranium —Cameco and Kazakhstan’s Kazatomprom — are sold out until 2027. The Economist also reports some utilities are thought to be caught short of the enriched uranium they need for 2024 alone.

Where is that supply-demand gap going to be made up? I don’t know, and neither does the market. That points to much higher prices until it gets worked out.

How You Can Play This

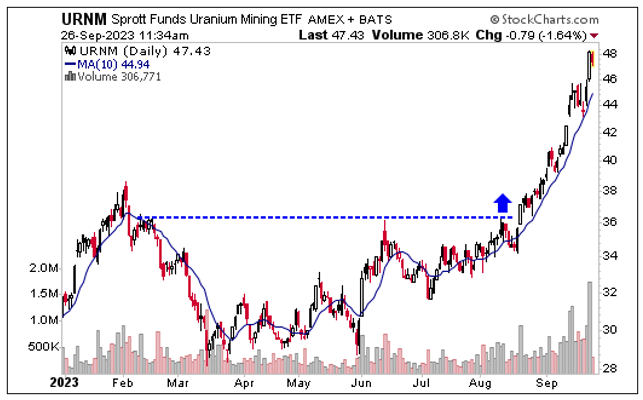

A month ago, I recommended the Sprott Uranium Miners ETF (URNM). It has an expense ratio of 0.85%. It owns Cameco along with Kazatomprom, which is Kazakhstan's national uranium company … and many more top names.

Click here to see full-sized image.

You can see that URNM broke out and has charged higher. You don’t have to chase it — just wait for a pullback to the 10-day moving average. URNM touches that moving average pretty regularly.

Sure, URNM could pull back BELOW the moving average. Nothing is written in stone. But my working target on URNM is $80 — a 66% move higher from recent prices.

You can also play this move with individual uranium stocks. I’ve recommended some in my Resource Trader service. Some are outperforming URNM — and ALL are leaving the S&P 500 in the dust.

So, yeah, tt sure looks like Uranium is the new gold. It’s providing insurance against a shaky market, and it has the potential for a face-ripper of a rally to the upside.

That’s all for today. I’ll be back with more soon.

All the best,

Sean

P.S. This is just one of the major megatrends I’ve recently identified. In fact, there’s an even larger one you want on your radar right now. Click here to check out my latest presentation on this major profit opportunity.