|

| By Sean Brodrick |

Ouch! Gold prices plunged yesterday.

But this happened after the price of gold surged to a fresh all-time high above $4,254 per ounce on Monday!

Are you confused? Don’t worry.

I’ll explain the major forces driving gold and what might kick off the next leg of the rally.

Plus, I’ll give you two shiny new ideas — undiscovered names that could be on the verge of greatness!

Central Banks Buy-Buy-Buy!

The pullback is just profit-taking.

This week’s new high reinforces that gold is materially smashing previous overhead resistance.

So, what’s driving that?

The most significant driver is that central banks just can’t get enough!

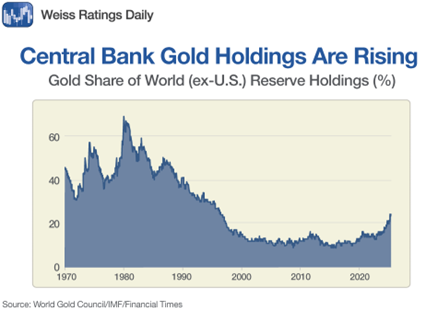

Central banks’ purchases hit record territory in 2024 — over 20% of total global demand, roughly double their 2010s share — and have stayed elevated into 2025.

World Gold Council monthly tallies show July net additions of 10 metric tonnes and a surge to 19 tonnes in August.

And you know what? Even with all that buy-buy-buying, central banks still don’t own nearly as much gold as they have in the past.

Central banks are buying gold for diversification, long-term stability and protection against uncertainty in the global economy.

One reason is more important than the rest: The U.S. has immense power to use its currency like a cudgel to punish countries that displease it.

Gold is a way for countries to keep their assets from Uncle Sam’s thumb.

And as you can see on the chart above, central banks have a long, long way to go to get back to historical gold levels.

And in a recent Goldman Sachs survey, 95% of central banks expect their global gold holdings to increase over the next 12 months.

Investors Don’t Own Enough Gold

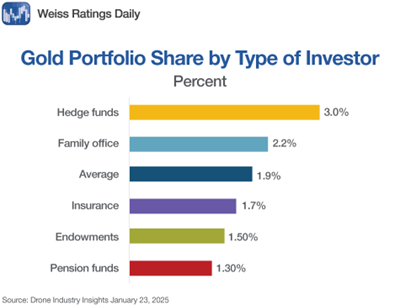

Despite the recent rally, many investor portfolios still have little or no gold.

However, that’s about to change.

According to a July 2025 survey cited by HSBC, “roughly half of the global affluent-investor respondents … plan to own alternative investments within the next 12 months.”

Among those allocating to alternatives, those who intend to invest in gold jumped meaningfully.

Now to the next big catalyst.

Gold Price Adds to Earnings Ka-Ching!

The world’s biggest gold miner, Newmont (NEM), reports after the bell tomorrow.

Street consensus clusters around roughly $1.27 to $1.28 in earnings per share, up about 77% year over year.

I believe that Newmont is going to beat those earnings like a drum.

What we need to watch is Newmont’s forward outlook. It should be exceptionally bright.

Once investors realize how higher gold prices turn miners into cash machines, the race to rush into miners will be on.

Two Ideas from Beaver Creek

I recently attended the Precious Metals Summit in Beaver Creek.

There, I got to interview many miners, developers and explorers.

I shared these interviews with my Resource Trader readers first. Now, I’m sharing them with you.

I sent you three video interviews last week. I have two more for you now.

Blue Lagoon: A Tiny Miner with Big Ambitions

Blue Lagoon Resources (OTCQB: BLAGF | CSE: BLLG) began production at its flagship Dome Mountain project in Q3 of this year.

It recently had a market cap of $75 million — it’s tiny. But it has a producing mine and big ambitions.

At Beaver Creek, I had a chance to sit down and talk to Blue Lagoon’s CEO, Rana Vig.

He explained what the company is aiming to do.

You can watch that video here:

It seems to me that Blue Lagoon Resources is at a key inflection point, having entered initial production, with ambitions for double-digit annual gold output and robust FCF growth.

A Nasdaq-Listed Junior

with the Potential for a Double

U.S. Gold (USAU). This explorer/developer has a market cap of $273 million, a Nasdaq listing and a flagship project that is going full steam ahead and could enter production in 2027.

Company co-founder Edward Karr gave us the scoop on the company's activities.

The CK Gold Project is fully permitted and targeting first production of gold-copper concentrate in 2027 or 2028.

The project’s pre-feasibility study outlines a 10-year mine life, averaging over 100,000 gold-equivalent ounces annually, with higher output in the first three years.

This one has plenty of blue sky, so the resource will likely increase.

And U.S. Gold has two more projects in the pipeline!

To sum up:

- Gold is already on a great run, driven by central bank purchases …

- Investors don’t own nearly enough …

- Portfolio buying could send gold much higher …

- And the spark for that next gold rush could start after Newmont Mining’s earnings come out.

Gold has pulled back, sure.

Irresistible forces are lining up to push it higher again.

And gold miners, leveraged to the underlying metal, are on the launch pad.

You could buy Newmont.

But if you want to swing for the fences, small, undiscovered gold miners are where the real potential lies.

Good luck and good trades.

All the best,

Sean

P.S. There is a third option.

I’m joining my colleague, Nilus Mattive, on Tuesday, Oct. 28, at 2 p.m. Eastern for “The All-In Retirement Income Challenge.”

There, we’ll sit down to discuss how he’s able to collect huge income from companies like Newmont without even buying shares.

In fact, two months ago, he showed readers how to collect $828 in just 14 days without picking up a single NEM share.

I hope you join us to see how it all works.