|

| By Nilus Mattive |

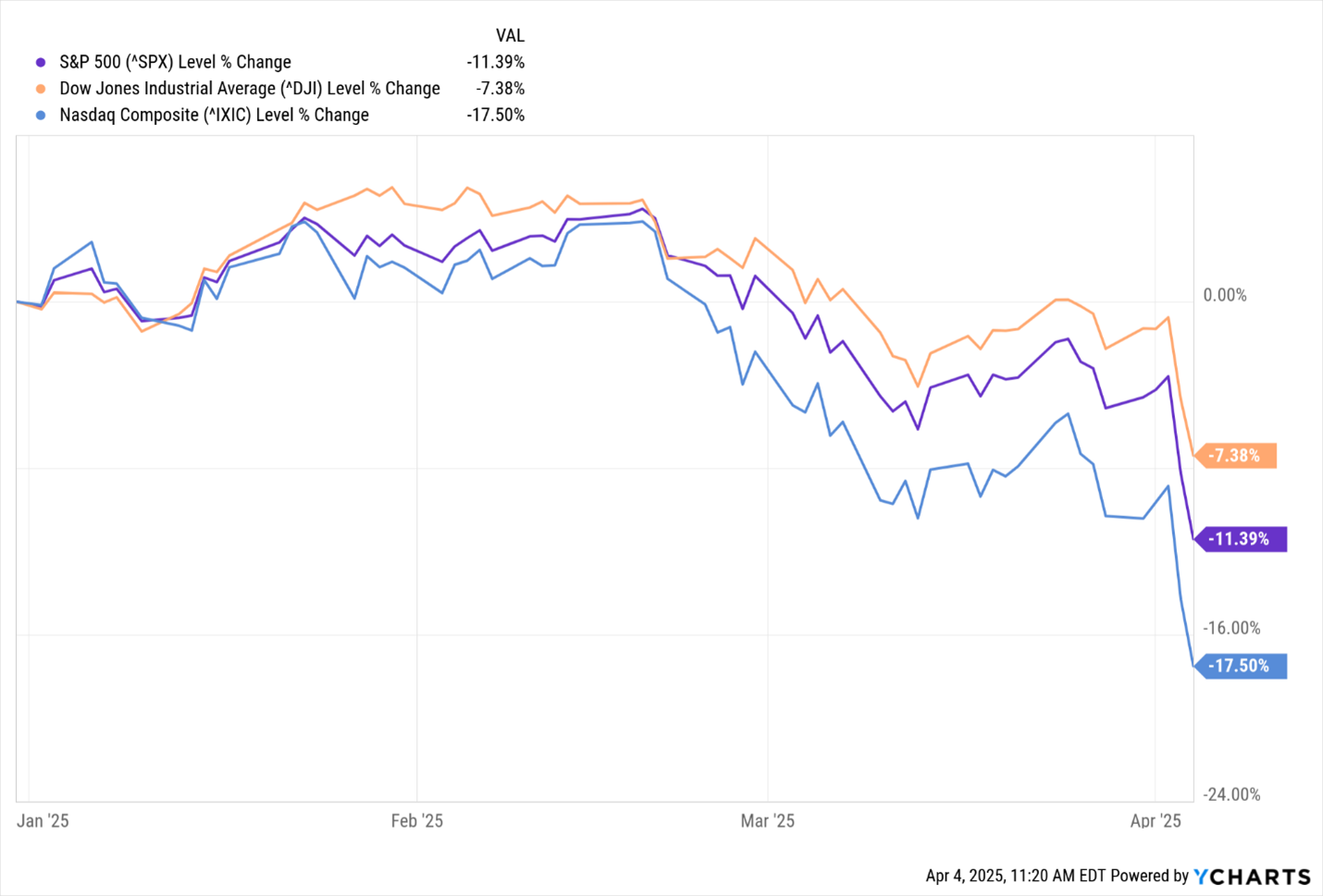

I probably don’t need to tell you that the stock market’s been getting hammered.

Nor can I say I’m surprised.

This is precisely the type of big drop I’ve been warning about for many months now … not just to my paying subscribers but also many times right here in these free articles.

For example, last August after a quick market drop, I told you …

“Despite a pullback, equities are nowhere near fairly valued — let alone UNDERVALUED — given all the possible risks in the world today.

“It’s actually quite laughable to see headlines about ‘buying the dip’ already hitting the wires …

“Bottom line: I think the broad stock market — particularly high-flying tech companies — has a far greater likelihood of dropping further over the next few months.”

Yet most people did keep buying the dip despite sky-high valuations and markets kept on rising.

Which is why, in November, I wrote an entire article telling you to start favoring more defensive companies with recession-proof businesses. It ended like this …

“Sure, there are lots of exciting trends to latch onto. Some are even profitable at the moment. But do the valuations make sense?

“What must happen for you to continue getting adequate returns on your capital?

“And can you rely on these investments if the economic tide turns?”

Well, these are the very questions Wall Street has finally started asking itself. And the answers are spelled out in red all over the ticker tape.

Of course, as recently as three weeks ago — before this new leg down began — I was still singing the same song, saying …

“The best time to start diversifying was back when I first told you to. The next best time is right now.

“Because the broad stock market still looks overvalued to me at current levels … especially with more risks surfacing on the horizon.”

So, if you heeded those warnings, congrats!

Hopefully, you’ve been avoiding the worst of the carnage.

But what comes next?

In my opinion, there’s still more potential downside ahead.

Whether you agree with President Trump’s end goals or not, we are clearly entering uncharted economic waters right now.

Yes, it’s entirely possible that we will see President Trump make additional changes on the fly … especially if other countries come to the table with attractive concessions or other proposals.

It’s highly likely that the uncertainty over the last several weeks, along with this week’s more-aggressive-than-expected tariffs, have already created shockwaves throughout the business world that will ripple forward into earnings reports down the line.

Likewise on the consumer spending side. I imagine many households are starting to reconsider their budgets and bracing for the possibility of higher prices on certain things they buy … especially since the latest inflation numbers already came in hotter than expected BEFORE any tariffs have gone into effect.

Even after all the selling, I do not believe market valuations have come to a place that accounts for all of this.

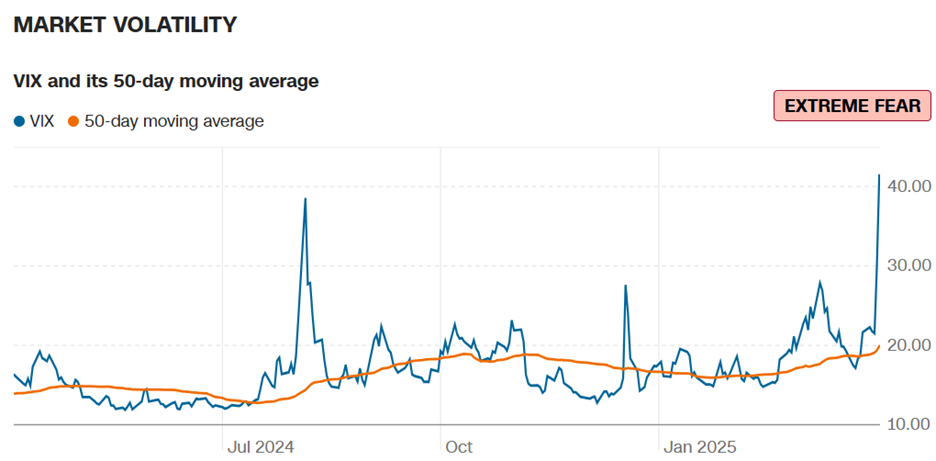

And no matter what, I expect volatility to remain quite high for the foreseeable future.

So, let me give you two different moves to consider right now.

Move No. 1: Consider Inverse ETFs

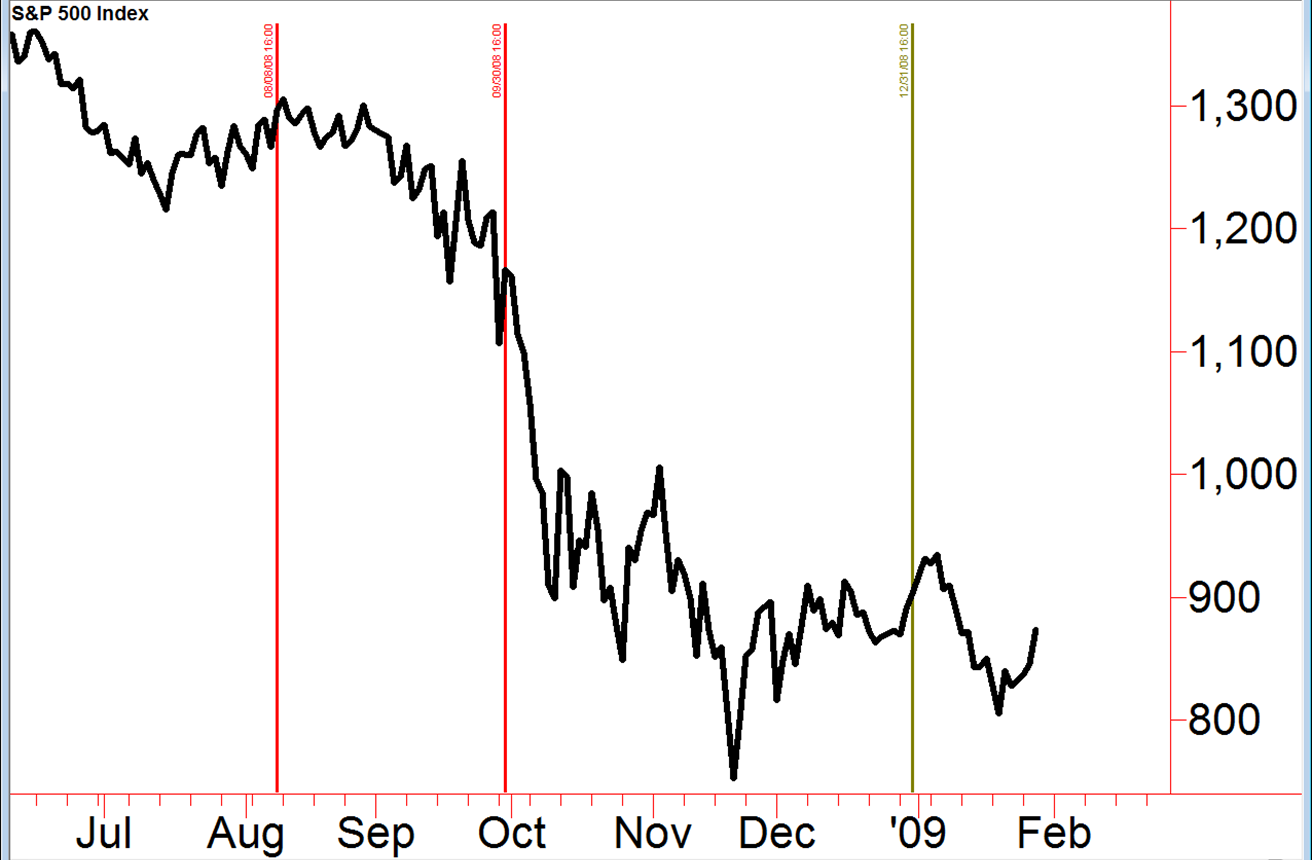

What’s happening right now reminds me a lot of the action in the summer of 2008.

I was right here at Weiss, writing a newsletter focused on dividend stocks.

The market had already dropped about 20% over the previous 11 months, but I thought the burgeoning financial crisis could send the stock market plunging even further.

At the same time, I didn’t want to tell my readers to give up their steady dividend payments or abandon their core stock holdings.

So, I turned to a type of investment that had become available two years earlier — an inverse exchange-traded fund (ETF).

You probably already know the basics about ETFs, including some of advantages they bring to the table.

Inverse ETFs carry all those same advantages while allowing you to profit whenever a particular market or group of investments goes DOWN.

On August 8, 2008, I told my readers to consider hedging their portfolios with a simple inverse ETF that would rise in value if the Dow index dropped. (First red line in my chart.)

Sure enough, the market DID start cracking as you can see from this chart of the broad market.

So, on Sept 30, I recommended they double their stake in the same inverse Dow ETF. (Second red line in my chart.)

Again, that proved to be a good call … because shortly afterward, the market REALLY caved … dropping as much as 36% in just the next two months.

And so, what happened to the value of that inverse ETF?

It took off!

In fact, because it was the ProShares UltraShort Dow30 ETF (DXD) — which is designed to surge TWICE AS MUCH as the Dow falls — it actually rocketed in value more than 70%!

Once it looked like things were starting to settle down a bit by the end of the year, I recommended readers close out their entire stake in the ETF (green line in my chart).

Total tracked profits?

My records show readers could have earned as much as 65.4% on the initial recommendation and another 43.7% on the follow-on recommendation.

Those are huge double-digit wins while most regular stock portfolios were getting crushed.

There is just one other thing you need to know about inverse, and especially, LEVERAGED inverse, ETFs: You should only use them for very short time periods because of something known as tracking error.

In simple terms, the idea is that these funds are constantly resetting themselves to a baseline, so the effect of compounding can skew their longer-term movements.

That can be a serious drawback depending on your time horizon.

But there is no doubt that inverse ETFs are a great tool for most portfolios.

They can be bought and sold easily. They can be held in any type of brokerage account. They require no special clearances. And they do not require any type of external leverage like margin.

So, if you’re looking for a simple way to hedge against any further weakness, now’s a good time to get reacquainted with these very simple — but powerful — tools.

Move No. 2: Consider another — even more powerful — strategy that I’ve developed.

Since 2022, my research team and I have been refining a unique approach to generating income.

We’ve taken the same kind of income technique the big institutional investors use …

And customized it specifically to help individual investors bring in consistent income — no matter what the market is doing.

In fact, the more volatility we see, the more income potential we typically see!

And the most remarkable part?

These trades have demonstrated a success rate of 97.4% over eight years of history and real-time results.

Better yet, since August 2022, we haven’t closed a single losing investment.

That’s a 100% success rate over 32 straight months.

Sound interesting?

Then I encourage you to click here to learn exactly how it works.

Best wishes,

Nilus Mattive

P.S. As you’ll see in the video I mentioned above, I actually taught my own Dad how this strategy works in the wake of the financial crisis … and he’s been using it ever since. Just click here and you can hear him tell the story directly.