|

| By Sean Brodrick |

With inflation likely peaking, investors are hopeful that the Federal Reserve will finally slow its aggressive rate hike campaign.

Chairman Jerome Powell’s speech yesterday added fuel for investor optimism.

Specifically, Powell said, “The time for moderating the pace of rate increases may come as soon as the December meeting.”

While Powell’s comment lifted the market higher, he did add that there is a “long way to go in restoring price stability.”

Interest rates have jumped nearly four full percentage points since the first 25-basis-point hike in March, and there has often been a disconnect between the market’s hopes and the Fed’s official comments.

After four consecutive 75 bps rate hikes, the market is pricing in about a 75% chance the central bank finally slows down to 50 bps in December.

Still, not all comments from Fed officials point to an upcoming pivot.

St. Louis Fed President James Bullard claimed, “We’ve got a ways to go to get restrictive.” In fact, he wants the target policy rate to hit at least 5%–5.25%, which is another 125 basis points away from the current 3.75%–4% range.

October’s yearly Consumer Price Index and core CPI inflation of 7.7% and 6.3%, respectively, boosted sentiment, but committee members’ comments cast doubts as the central bank prioritizes bringing inflation back to its 2% historical norm.

After Powell and other committee members backed themselves into a corner with incorrect “transitory” inflation claims, it makes sense why they’re cautious. They don’t want to risk looking like fools again.

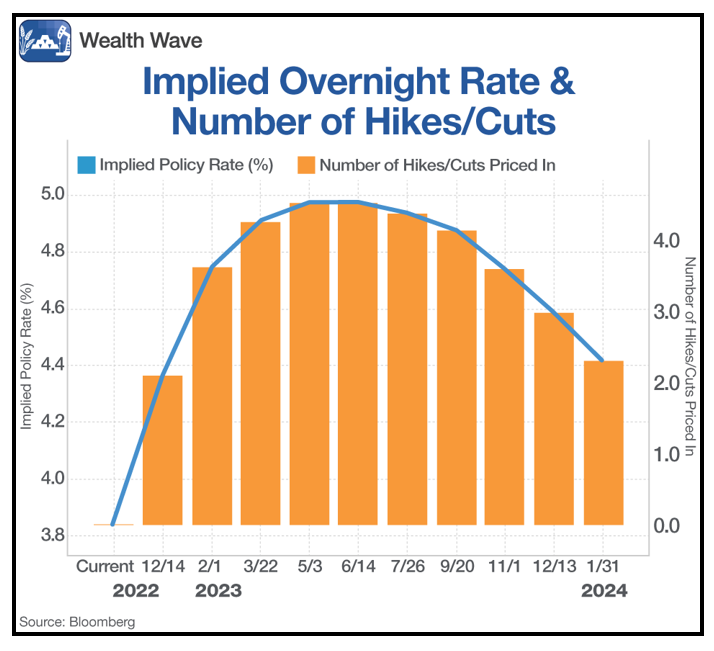

Even without Fed reassurance, traders see two rate cuts by the end of next year. The following chart shows the implied overnight rate and the market’s continued expectations for a pivot:

Click here to see full-sized image.

The Fed’s next official interest rate decision will come after its two-day policy meeting ends on Dec. 14. Notably, the Bureau of Labor Statistics will release November’s CPI data the day before. The inflation reading should play an important role and show the effectiveness of past hikes.

A slowdown would bode well for stocks, but forward-looking statements will be most important. A lack of clarity would open the door for greater volatility.

Whether or not the Fed eases its foot off the gas, it helps to bet on proven winners. One way of doing that is by joining my colleague Tony Sagami’s trading service, Disruptors & Dominators. Members are currently sitting on large double-digit gains regardless of the Fed’s indecisiveness.

Another way is by …

Prioritizing Historical Outperformance

Dividend raisers historically outperform companies that don’t pay dividends, hold their payments steady or decrease them.

Ned Davis Research found that between 1972–2018, dividend growers recorded the highest annual returns with the least risk. Dividends can account for up to 90% of returns in sideways markets. In the current environment, that could help amplify gains and cushion downside while investors wait for a policy pivot.

One fund to look into for exposure is the ProShares S&P 500 Dividend Aristocrats ETF (NOBL), which only holds companies with the strongest dividend-raising histories. They must track a minimum of 25 consecutive years of annual dividend growth, but most have over 40.

NOBL’s holdings are equally weighted, but it holds over 50% of its $10.5 billion in net assets in the consumer staples, industrials and materials sectors.

It trades with average daily volume of about 120,000 shares. The fund’s expense ratio is 0.35%, but its dividend recently yielded 2% annually.

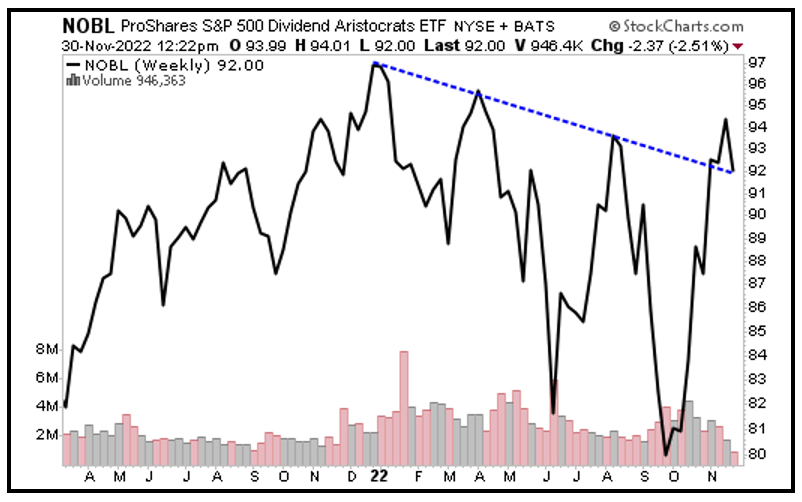

Looking at NOBL’s weekly chart, the fund managed to break out of its recent downward trend after rallying throughout most of October:

Click here to see full-sized image.

NOBL could consolidate for a brief period given the recent rally, but a broader market upswing would build more momentum. Investors might have to weather more volatility, but it helps to position your portfolio with long-term outperformers.

All the best,

Sean