|

| By Dawn Pennington |

It’s one of those cases of you either love ‘em or you hate ‘em — there’s no middle ground.

I’m talking about Cathie Wood and her infamous exchange-traded fund, the ARK Innovation ETF (ARKK).

The flagship fund is one of the most followed ETFs in the market today. Not because investors love it per se, but because many would like to know just what the heck to do with it.

If they’re holding it, should they continue to hold or should they sell?

If they’re interested in buying it, should they buy it now or wait?

Will it go up in the near term or continue its slide?

Some of the fund’s top holdings became household names during the pandemic, including Zoom (ZM), Roku (ROKU), Block (SQ) and Tesla (TSLA), to name a few.

Yet popularity alone isn’t enough to get a “Buy” rating from Weiss. If it doesn’t have at least a “B” … or if it isn’t on its way to being upgraded to a “B” … we typically recommend running the other way.

[Tomorrow – Friday, Aug. 26 – we’re giving our All-Weather Portfolio Members our top 10 list of stocks to buy NOW. If you’re not on the list to receive it, click here and fill out the form at the bottom of the page.]

The fund itself has a Weiss Rating of “D,” making it a “Sell” from a safety perspective.

Its individual holdings aren’t faring much better.

Tesla and Zoom both earn a Weiss Rating of “C,” making them “Holds.” Here’s a look at ARKK’s technical chart:

While the above are all valid questions to be asking about the ETF’s future and whether it’s lucrative or not to follow Wood’s moves, most investors are missing the bigger picture.

Stocks and ETFs come and go. But …

Innovation Is a Forever Trend

At its core, ARKK is focused on long-term growth of capital by investing in disruptive innovation. We saw this firsthand during the pandemic, when video chats and online payment processing helped us adapt to life in extended lockdown.

Some of the most innovative … and fastest … advances were products of the pandemic.

The lockdowns caused both companies and consumers to move everything from shopping to education and to business meetings online. Those who could help companies adapt in a hurry saw their fortunes grow just as quickly.

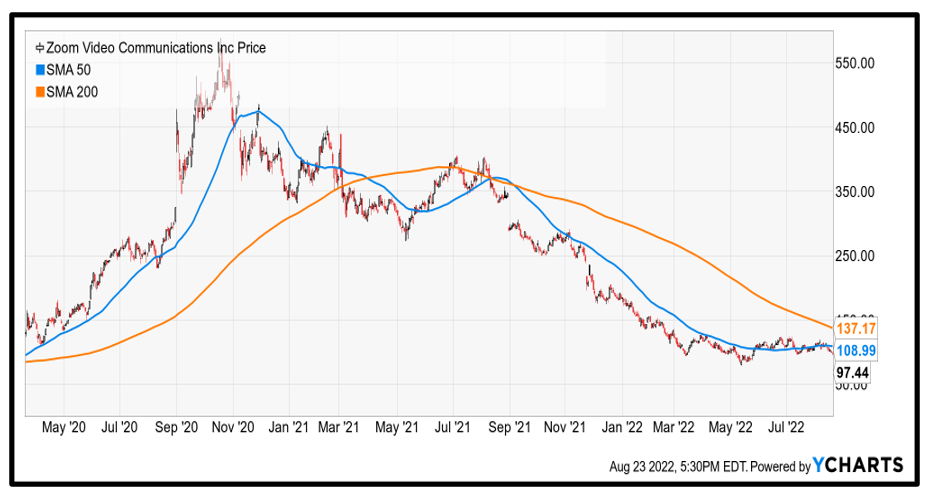

This, in turn, helped their stocks soar to new heights during the COVID-19 rally. Take a look at Zoom’s tech chart from May 2020 to July 2022 to get an idea of just how much it shot up in the midst of the pandemic:

The point is that tech stocks may rise and fall, and people like Cathie Wood may be revered by investors one day and shunned the next …

But as far as trends go, innovation is here forever.

That’s because in today’s messy, constantly shifting and unpredictable world, innovation is a necessity.

If there’s another pandemic — or worse — we need innovative tech companies to step up and solve those tough, seemingly unsolvable problems. They help us adapt to a world that’s constantly changing.

You might be of the opinion that ARKK Innovation and Wood herself are overrated. Heck, you might have even lost some money following Wood’s lead.

Yet, innovation kept happening regardless. And it will keep happening, no matter what the stock prices are right now.

Additionally, you can’t deny Wood’s success, staying power, bold investing approach and unyielding belief in innovation.

As for ARKK, it should have no problem returning to its old highs … eventually.

Especially if, as technology evolves, so do its holdings.

Every Company Is a Tech Company Now

What Cathie Wood and her team at ARK Innovation understand, perhaps better than anyone, is that technology has the power to transform entire industries.

And what they may understand on a deeper level is that companies within those industries are using this technology to change our lives for the better.

Just look at what’s happening in healthcare …

Online health consultations were quickly normalized when the pandemic highlighted the benefits of safe, contactless doctor’s “visits” via video chat.

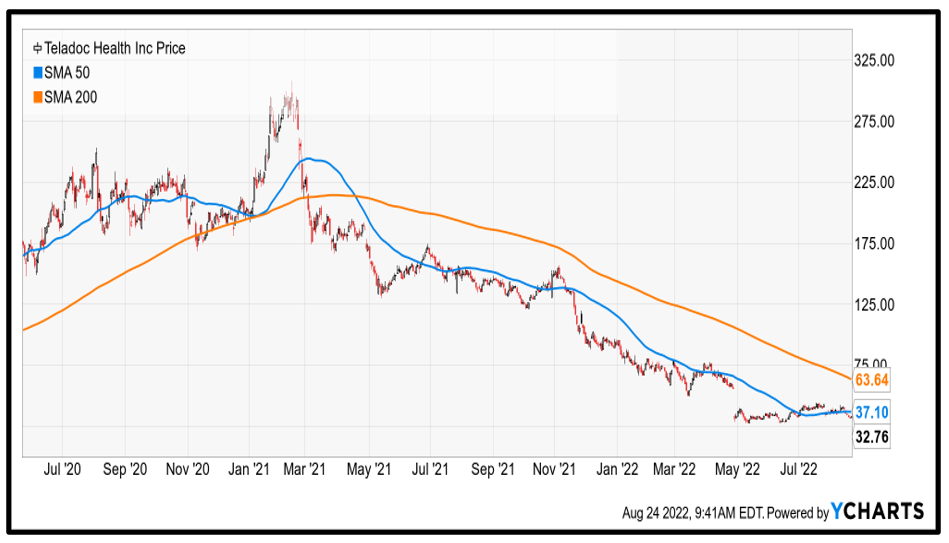

Companies like Teladoc Health (TDOC) and Amwell (AMWL) were at the helm of this innovation in healthcare … and their stocks soared during the pandemic as a result.

Here’s TDOC’s technical chart from August 2020 to August 2022 to again show you how its stock exploded at the height of the world’s need for its innovation:

So, for my money, I’m not zeroing in on traditional technology stocks. But I am looking at companies to see how they are using technology to improve our lives and, in turn, their bottom lines.

And that’s happening regardless of what’s happening in the broader economy and markets.

If you want to know about cutting-edge companies in cybersecurity, sustainability, digital transformation, decarbonization, healthcare innovation and tech-enabled consumption, you need look no further than Jon Markman’s Pivotal Point.

I know Jon will agree that savvy investors would do well to bet on innovation as the way to build lasting wealth.

As for the ARKK stocks, if they can float up to the “B” range on the Weiss stock ratings, that would speak volumes about their potential longevity.

In the meantime, speaking of building lasting wealth …

Dr. Martin Weiss recently hosted a free tutorial for an all-weather strategy to help you consistently beat the market. Testing shows this simple strategy would’ve beaten the S&P 500 nearly 5-to-1 over the past 19 years!

See how it works by clicking here.

To your wealth,

Dawn Pennington

Editorial Director