Beware: Holiday Spending ‘Homerun’ May Be Precursor to Strike 3

|

| By Gavin Magor |

I’m not a big shopper, but if you are and joined the millions who contributed to the $38 billion spent in the five-day period between Thanksgiving and Cyber Monday, you probably didn't use money you already had to buy those gifts.

Whilst economists and analysts alike call it a home run for the economy, it’s more of a precursor to strike three to me.

I blame the Fed, quite frankly, for what I believe is the current unstable state of the consumer. Fed Chair Jerome Powell and company went way overboard with interest rate hikes. And while it took some time for high-priced everyday goods to drain savings accounts and pandemic handouts, it’s happening big time today.

The result: changing spending habits and buying behaviors.

The most popular ways to buy gifts this year involve using credit cards and buy-now-pay-later services like Affirm (AFRM), Klarna and Afterpay. Adobe Analytics estimated way back in October that the use of BNPL will ramp up by 17% this holiday season. As of Nov. 27, shoppers spent $7.3 billion with the help of these services.

On top of that, consumers are more likely to spend more when using BNPL. They spent $598 on average on Black Friday, versus $452 among those who didn’t use a deferred payment method, according to PYMNTS Intelligence, a data analytics company.

If you’re not familiar with BNPL, it’s like past layaway programs. If you pay the balance over a specified period of time, you don’t accrue interest. If you don’t pay it on time, you’ll pay in more ways than one — just like with credit cards.

As of September, the cumulative record balance reached $1.079 trillion on the 1 billion credit cards in circulation, which was the highest since the New York Fed began tracking in 1999.

Plus, the average individual credit card balance is now more than $6,000, the highest in 10 years, a new report by TransUnion found.

For those who only pay the minimum, miss payments or carry balances month after month, using credit cards as their default purchasing choice can become very costly.

Of course, this shift doesn’t change the bottom line for retailers. They’ll collect their money one way or another. And consumers will pay one way or another.

It’s so bad that people who are struggling most aren’t spending a cent this holiday season. A WalletHub survey revealed that more than one in three Americans will not give gifts this year due to inflation. To make matters worse, nearly one in four Americans is still paying for items they purchased during the holidays in 2022.

In addition to delaying the inevitable, people are hunting for bargains more than ever — not so much for big-ticket items, but at lower-cost discounted goods from retailers like Dick's Sporting Goods (DKS) and Academy Sports and Outdoors (ASO).

Some economists suggested that what we saw between Black Friday and Cyber Monday was consumers who’ve been pulling back on discretionary items waited until that weekend to get the best deals.

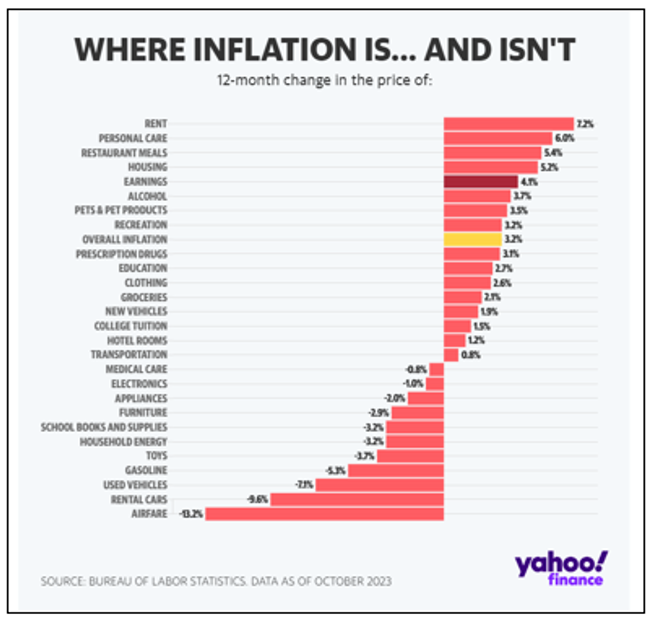

I’m talking about clothes, appliances, toys, furniture, electronics, jewelry, sporting goods and things of that nature that they had previously balked at. Ironically, these were the types of goods that showed the biggest decrease in prices in October’s inflation numbers.

I’m not convinced, like others, that robust holiday spending will carry into 2024. We could very well see a dry spell until staples like rent, food, energy, etc. fall in price like their discretionary counterparts.

In the meantime, we’re seeing consumer discretionary stocks gain strength. I told you recently that the AI model we use in my Weiss Intelligence Portfolio service identified these consumer discretionary stocks as likely outperformers over the next 90 days and thus far, they’ve delivered admirable gains over the past month:

- Tractor Supply (TSCO), +7%.

- e.l.f. Beauty (ELF), +12%.

- Ulta Beauty (ULTA), +7%.

- Dick's Sporting Goods (DKS), +10%.

- Academy Sports and Outdoors (ASO), +13%.

So, if you’re looking for winners to close out the year, consider any of the five stocks above. I’d also take a look at BNPL providers like Affirm and the king and queen of plastic: Visa (V) and Mastercard (MA).

Shares of Affirm popped 12% on Cyber Monday and have tripled in 2023 as the popularity of BNPL soars.

I just don’t advise that you buy any shares unless you actually have the money to pay for them — I’m not fond of using margin accounts, either.

Cheers!

Gavin Magor