Editor’s note: Sean Brodrick is on the road today.

But he wanted to share one of his top predictions to get you ready for 2026.

Well, as is Sean’s way, he actually has two predictions for you today …

And two explosive ways to play them …

|

| By Sean Brodrick |

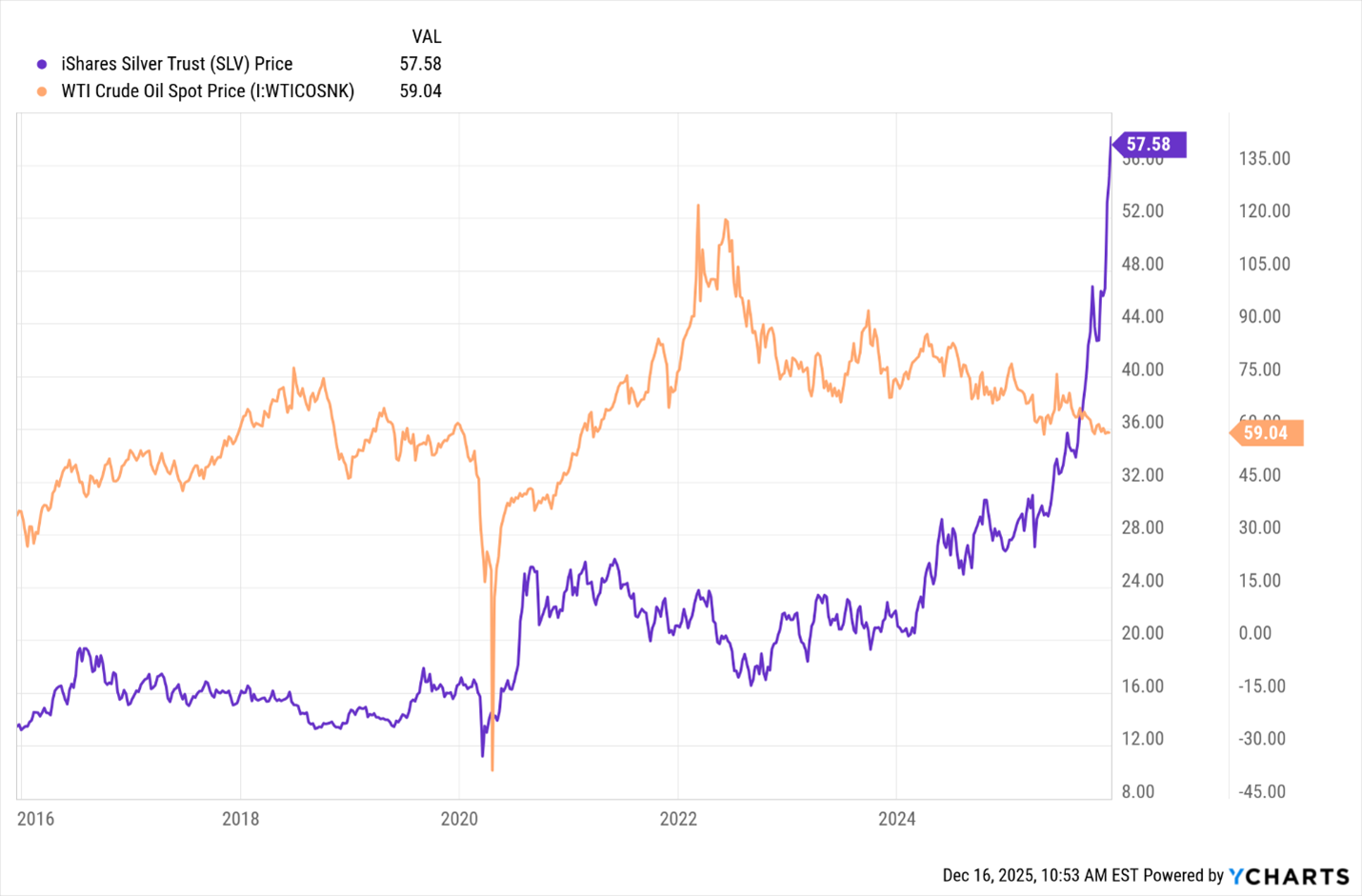

For the first time in history — with the exception of the Covid oil collapse — an ounce of silver will buy you a barrel of oil with change left over.

These two commodities have been on diverging paths throughout 2025.

But they could start to head in the same direction soon.

You see, a bull market emerged this year in precious metals, industrial metals and select agricultural commodities.

In 2026, I expect that rally to continue and broaden to other commodities.

A steadily expanding global economy should push up oil profits AND extend the precious-metals bull market.

Let’s start with the laggard …

Oil’s Comeback

Global GDP is projected to grow 3% to 3.2% in 2026.

Add ongoing geopolitical disruptions to oil and refined-product supply, and you get a setup stronger than the mid-$60 oil narrative dominating Wall Street.

Fiscal breakevens for major OPEC+ exporters remain well above recent spot prices, keeping the cartel biased toward production management and cushioning downside risk.

For equity investors, this isn’t about a parabolic oil spike but about stable, high-margin upstream and integrated producers using dependable cash flow to fund buybacks, dividends and disciplined, selective growth.

That said, any supply shock could ignite a spike that sends oil stocks ballistic.

The straightforward way to play this prediction is to buy shares in the Energy Select SPDR Fund (XLE).

It holds the largest oil producers — Exxon Mobil (XOM), Chevron (CVX), ConocoPhillips (COP) and more — all of which take advantage of either a steady high-margin environment or a sudden spike in oil prices.

And its low expense ratio (0.08%), along with a nice 3.19% dividend yield, gives you solid net income even if oil takes a few months to get going.

Let’s get to my second prediction for this broad commodity rally in 2026 …

Ride the Silver Rocket

Silver doesn’t enjoy the same central-bank bid as gold. But it has a unique supercharger: industrial demand.

Industrial silver use hit a record ~680 million ounces in 2024 — 59% of total demand.

Solar manufacturing alone now accounts for more than 30% of industrial use, and photovoltaic installations could require 250 million ounces of silver per year by 2030.

Automotive, 5G, semiconductor packaging and AI-driven data centers add further demand.

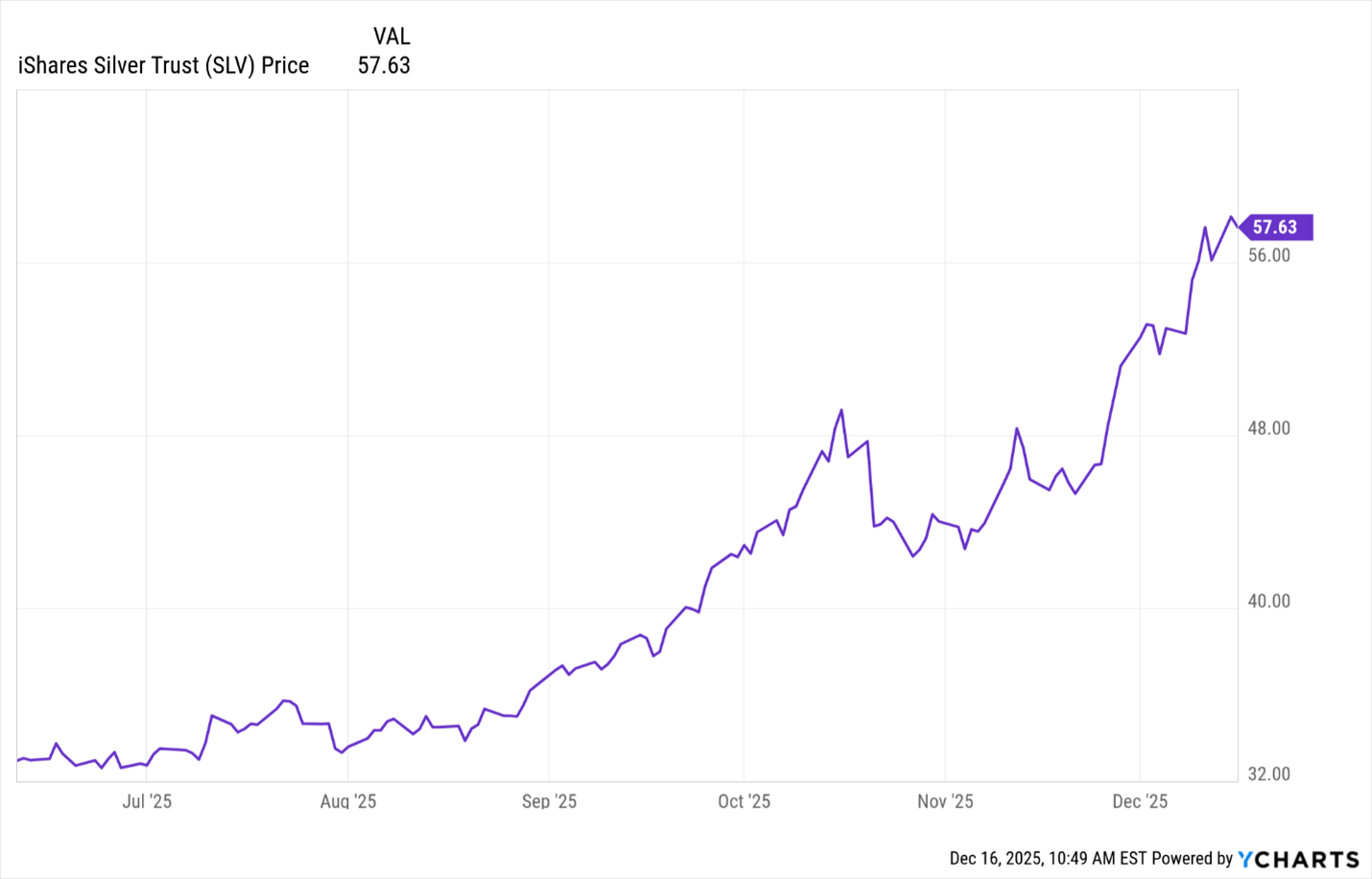

With silver already up more than 100% in 2025 — outpacing gold’s 60% rise — the setup remains explosive.

I believe we’ll see silver hit $100 in 2026. My long-term target is over $200 an ounce.

Back in June, I told you how to play this one: the iShares Silver Trust (SLV).

It holds physical silver. So, it tracks the price of the metal pretty well.

If you bought it back then, you’d already be up 75% in just six months.

But when silver starts to hit my targets next year, that will look like a small-time gain.

These two commodities couldn’t look more different.

Oil has been declining throughout 2025. Silver has been exploding.

But both will be key players in next year’s broad bull market in commodities.

And I recommend you load up before the crystal ball drops in Times Square.

All the best,

Sean

P.S. If you want more ways to play silver’s ride past $100, I recommend you watch this to the end.

I’ll show you how to grab way bigger gains from both it and gold.

In fact, this is how to 1,000x your gold profits without buying another ounce.