Buy Dream Stocks, Not Meme Stocks

|

| By Gavin Magor |

The meme stock buying frenzy is back, and the reasons behind it are just as wacky.

When it comes to investing, I continuously advocate smart, data-based decisions. Is that a bit old school? Perhaps, but I wholeheartedly know it’s always going to be the right move.

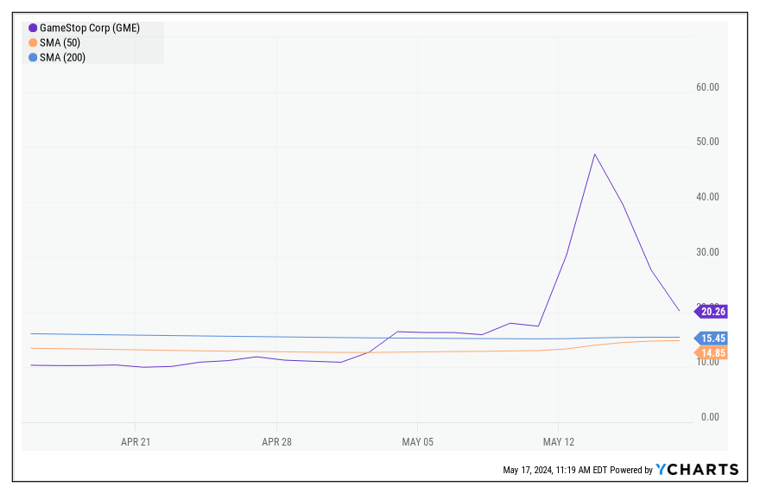

Last week, meme stock darlings such as GameStop (GME) and AMC Entertainment Holdings (AMC) took off with GME shares up 170% in only a few days, and AMC shares up 135%.

As of this writing, and very unsurprisingly, both stocks are down massively since those recent highs. What goes up irrationally will always come down — and hard.

You may recall that the meme stock frenzy started back in 2021 when an army of retail traders, and irresponsible hedge-fund managers, started the trend.

The story has been well documented, and there was even a major Hollywood film made about it titled “Dumb Money,” starring Pete Davidson and Paul Dano, who played Keith Gill. Despite being an entertaining movie, the only problem is that the actual meme stock story is not over, as we’ve seen in recent trading days.

The meme stock trading frenzy stems from Reddit user Keith Gill, who became the face of meme stock traders in 2021. By now, you may know him better by his online handle, “Roaring Kitty.”

Millions of average retail investors across the United States began buying shares of the declining video game store, GameStop.

Meanwhile, financial experts mocked investors, citing the store’s poor underlying metrics (they had a point there).

But action by the masses proved powerful: They pushed GameStop’s price from under $3 to as high as $483 in late January 2021, causing the hedge funds that had bet against it to lose billions of dollars.

Gill invested $53,000 in shares of GME, and (depending on who you ask) turned it into a multimillion prize as hype exploded around meme stocks.

Well, after a three-year hiatus, he’s back making waves — and investors are happy to ride them.

After GME's price run up last week, the luster faded, leaving everyone to wonder what’s next.

Well, you don’t need to be a Wall Street wizard to know we’ll see continued volatility — on the up and down sides. Some investors will win, others will lose depending on how they play the game.

I don’t use the word “game” lightly, by the way. To win the meme stock game, you need to submerge yourself in minute-by-minute market activity. You’ve got to time the ups and downs perfectly or go broke trying.

And you can forget about setting a trailing stoploss for protection. What makes you think you’ll be able to sell shares at a specific price when no one wants to buy them?

Call the trading of meme stocks what you will: speculation, gambling, recklessness, a waste of time and money ...

Now, if you or someone you know happened to get in and out and made a decent chuck of change, let me be among the first to congratulate you! However, that’s just not my cup of tea.

For me, I’m all about real, sustainable gains and winning in the long run. That’s why I’m such a strong advocate for the Weiss Ratings.

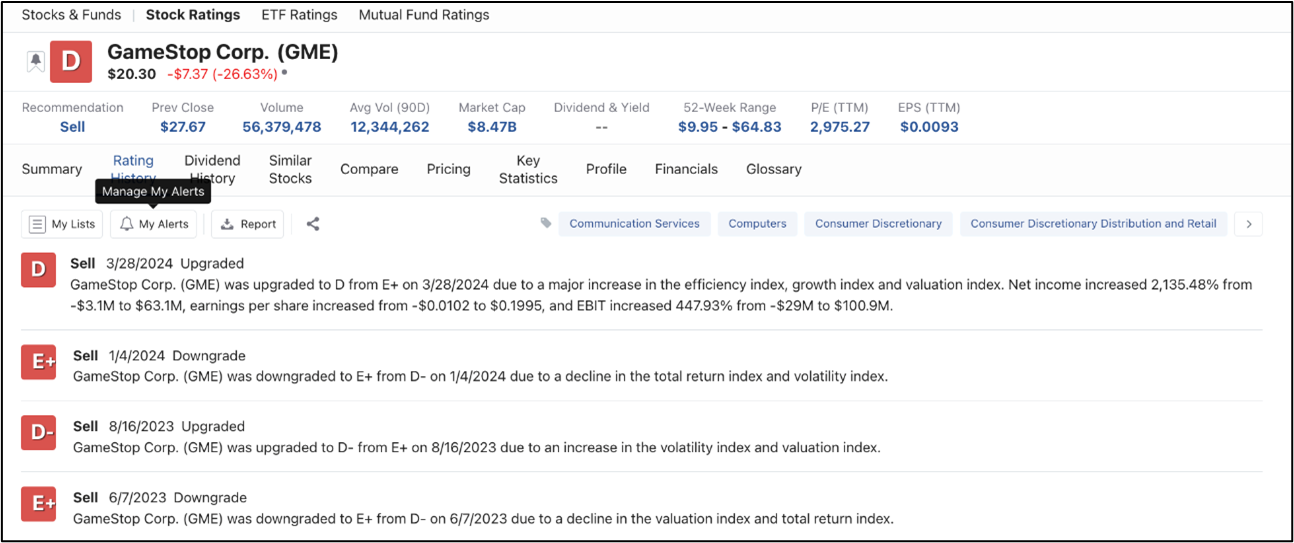

The Weiss Ratings puts such a strong emphasis on judging valuations and safety. As such, it should come as no surprise that we haven’t rated GameStop as "B”-rated or higher since 2015, and we haven’t rated AMC as “B”-rated or higher since 2017.

GME shares are far from what constitutes a strong, highly-rated Weiss Ratings stock.

What I Suggest Investors Do

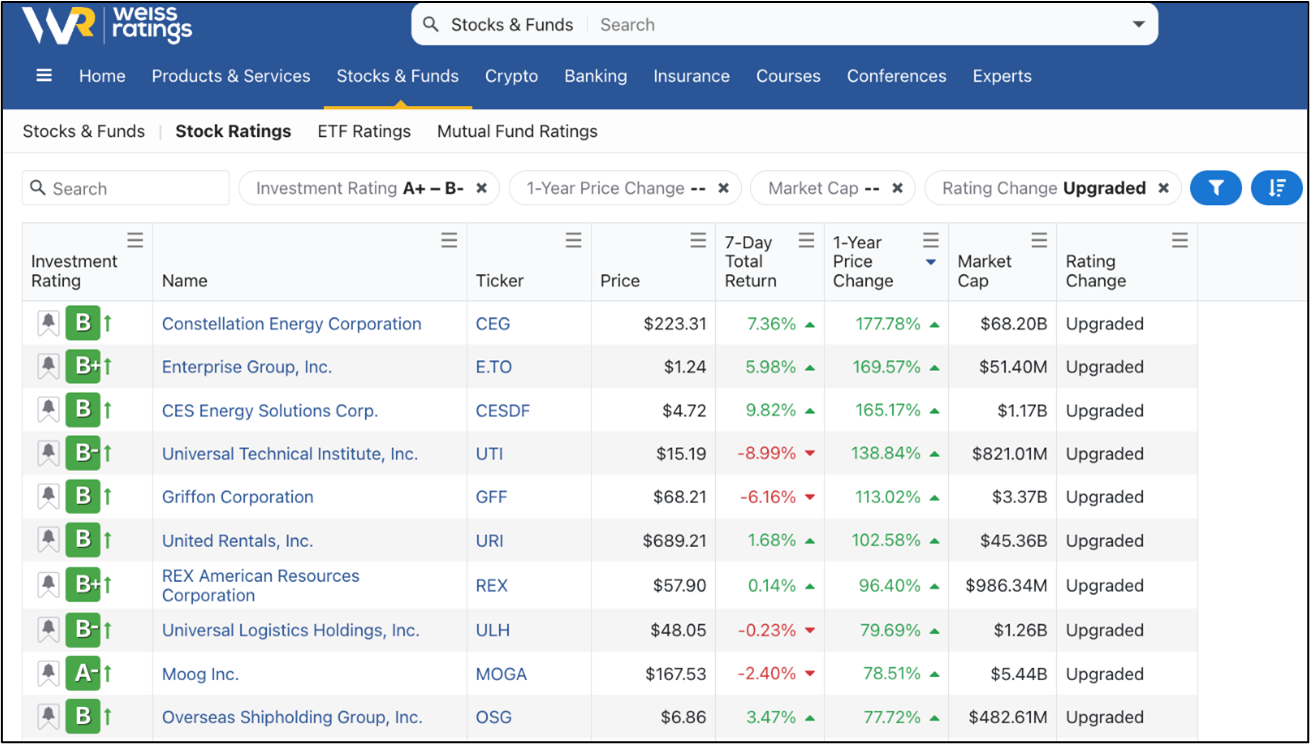

Instead of getting caught up in the greed-driven, short-term meme stock trading frenzy, I recommend looking at “Buy”-rated Weiss stocks for starters.

These are what I would call more of the long-term “dream” stocks versus the short-term, undesirable “meme-stocks.”

Buy stocks with conviction and a long-term plan. Otherwise, in most cases, you will get burned.

On our Weiss Ratings page, you’ll get a slew of options to fit your search criteria in a very easy and user-friendly fashion.

This is one great way to find stocks that may meet your investment needs. Another great way is with our premium services.

In fact, we just launched a new, purely AI-driven service that directly targets more of those “dream stock” type of names.

It has beaten the S&P 500 by 51-to-1, but it won’t be available to investors for very long because it may fill up, so I urge you to check it out here.

So, whilst the retail army of meme stock “dumb money” traders fight the almighty so-called “smart money” hedge funds, you have the best option ... the “rational money” Weiss Ratings.

Cheers!

Gavin Magor

With PJ Amirata