|

| By Gavin Magor |

Rule No. 1 for investors: Never get caught up in the headlines.

Here at Weiss Ratings, we do things with a very analytically based approach, and it’s what makes our ratings truly unique.

In 2023, there were certainly lots of reasons to worry as an investor. New major geopolitical tensions and ongoing raging inflation creating huge economic issues are some of the first to come to mind.

But in the midst of all this, 2023 was actually a very positive year, and we here at Weiss have been embracing some of the major breakthroughs.

From a market performance standpoint, as I talked about last week, it was historically strong.

One of the major reasons for the market’s strong performance was due to the technology sector’s rapid rally from AI-related hype. Investors drove into many top tech names to try and grab a piece of the potential profits from these huge technological breakthroughs.

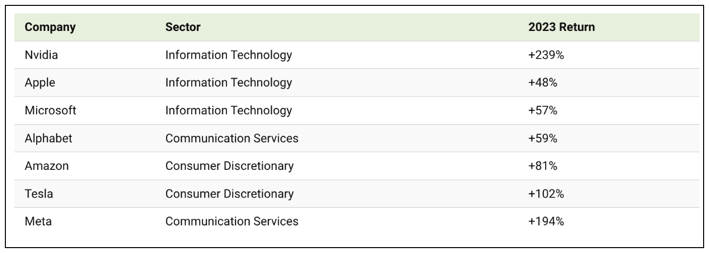

And for many, it paid off. Take a look at the 2023 performance of what has become dubbed as the “Magnificent Seven” of tech stocks:

Those are some strong returns, and it’s great to see that many of our premium Weiss Ratings Members were able to take advantage on some of them.

Last year, we saw breakthroughs in artificial intelligence, medicine and manufacturing. I am disappointed those things are not nearly getting the same attention as many of the negative headlines you see so frequently. And I know this firsthand …

I Give AI Investing an “A” Rating

Sure, our Members have been able to grab nice gains on AI stocks, but we’re also utilizing it within several of our trading services. The results have been very impressive.

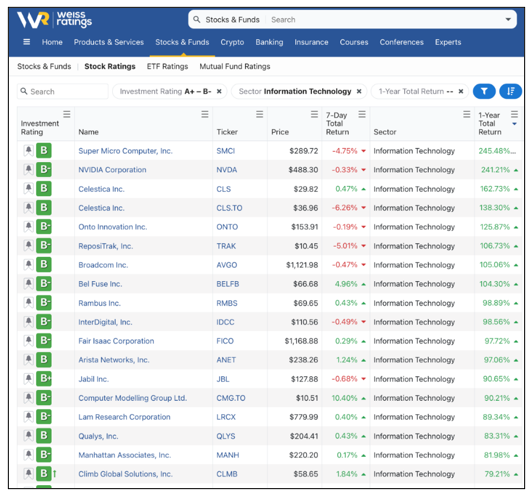

Although AI has propelled the tech industry to once-unthought-of levels over the past year, I want to take a look at ALL of our “Buy”-rated technology names and see how they’ve fared.

Many, as you can see below, are names in the semiconductor industry, which are a vital hardware component for AI.

On our Stock Screener page, after filtering for a stock rating of “A” through “B-” in the “Information Technology Sector” and ranking by “1-year performance” here’s what populated:

I recommended seven of these names to my Weiss Intelligence Portfolio — formerly All-Weather Portfolio — Members.

I am sure you’ve heard of Nvidia (NVDA), as it’s constantly being talked about. It is now the fifth largest stock in terms of market capitalization.

But there may be names like Super Micro Computer (SMCI) and Rambus (RMBS) that aren’t currently on your radar.

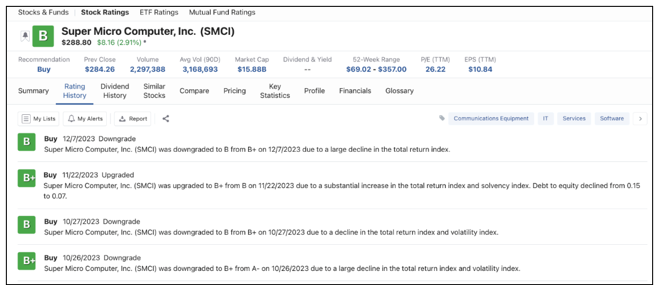

Purely for example reasons, let’s take a closer look at Super Micro Computer out of the above list. Here’s its ratings history:

SMCI, which is up around 252% over the past year, has been in our “Buy” territory since 2021. To earn that “Buy” rating, we saw increases in its growth index, valuation index and efficiency indexes. At the time in 2021, its operating cash flow increased, its EBIT increased and its EPS increased to “Buy”-rated levels.

And as you can see above, it earned a recent “Buy” upgrade thanks to its debt-to-equity declining from 0.15 to 0.07.

Make no mistake: 2023 was a historic year for many technology stocks, thanks to AI-driven hype, and 2024 could easily be another very strong year.

It’s easy to get trapped in a nervous Nellie state of mind, but the reality is that we are on the precipice of major technological breakthroughs … just as we were decades ago.

I hope you continue to choose to make Weiss Ratings a part of your investment journey.

Cheers!

Gavin Magor