|

| By Sean Brodrick |

Here’s a not-so-fun fact: If you’ve been holding dollars for the past 25 years, you’ve lost almost half your purchasing power.

The Fed’s own FRED database shows it: The greenback has dropped about 46.5% since the late ’90s.

Nilus Mattive covered this a bit last week.

But holding dollars longer term is a slow leak from your wallet.

Gold, on the other hand, is a rocket in your pocket.

Over the same time frame, gold has blasted higher by more than 1,052%.

That’s not a typo. While your dollars wilted, gold went vertical.

Every trip to the grocery store or gas pump proves the point.

The dollar buys less and less. Inflation compounds.

That’s why a $1 bill today won’t even buy you a candy bar.

Inflation is the silent tax on savers, quietly stripping away wealth year after year.

The U.S. dollar’s purchasing power over the past 25 years has declined due to economic policy and global factors.

Some of the factors are long term and chronic. Some are new.

A turning point came in 1971 that started a downhill slide for the dollar ... and a mountain goat climb for gold.

I’m talking about the end of the gold standard.

This made the dollar a fiat currency subject to inflation driven by monetary policy and government spending.

Indeed, the dollar has lost about 87.75% of its value since 1970 in terms of the Consumer Price Index (CPI).

Beyond that major turning point, there are forces still crushing the value of the dollar …

Forces Hammering the Dollar

Monetary Policy: The Federal Reserve’s policies, such as quantitative easing and low interest rates, have increased the money supply, contributing to inflation.

Since 2000, expansive monetary policies, especially post-2008 Great Financial Crisis and during the Covid-19 pandemic, injected trillions into the economy, diluting the dollar’s value.

Fiscal Policy: The U.S. national debt has grown from $5.6 trillion in 2000 to over $36.2 trillion by 2025.

More recently, Trump’s 2017 tax cuts and the 2025 “One Big Beautiful Bill Act” added to concerns about debt sustainability.

This has prompted investors to question the dollar’s long-term value.

Fed Crisis: Threats to Federal Reserve independence further undermined investor confidence and are an ongoing and increasing threat to the U.S. dollar.

For example, a single comment by Trump about dismissing the Fed Chair on July 16, 2025, caused a 1.2% drop in the dollar within an hour.

As the dollar goes lower, gold, which is priced in dollars, tends to go higher.

Be Bold, Own Gold

Inflation is unavoidable, but you don’t have to let it eat away at your wealth.

A strategic allocation to gold — through bullion, ETFs or miners — can help you stay ahead of the erosion.

You often hear gold called “insurance.” As the charts show, this insurance is paying off in spades.

Sure, gold zigs and zags in the short term. But over long cycles, while the dollar deflates, gold inflates.

The big trend is that gold keeps its power, and it multiplies it.

That’s why central banks are hoarding the stuff.

They know there’s an inexhaustible supply of paper money.

That’s not the case with gold.

- Scarcity matters: Dollars are printed by the trillions, while gold supply grows at just 1% to 2% a year.

- Global Trust: No matter if you’re in New York, Zurich or Beijing, gold is real money.

- Crisis insurance: Geopolitical shocks, trade wars, bank failures — gold thrives when confidence in paper money falters.

Central banks get it. Shouldn’t you?

3 Easy Ways to Buy Gold

You don’t need a vault in Switzerland to protect yourself. Here are three simple paths:

-

Bullion: Coins and bars are the classic way to own gold outright.

You get the security of holding it yourself, though it comes with storage and insurance costs.

Tangible, but you’ll need to think about storage.

-

ETFs: Funds like SPDR Gold Shares (GLD) or iShares Gold Trust (IAU) track the gold price and are easy to buy or sell through any brokerage account.

They give you exposure without worrying about storage, and they’re easy to trade in your brokerage account.

-

Mining stocks: the high-octane option. If you want leverage to gold’s upside, miners are the ticket.

When the metal rises, their profits and share prices often rise faster.

They’re riskier than bullion or ETFs but can amplify gains in a gold bull market.

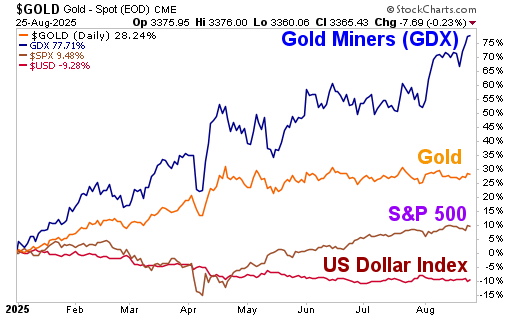

Mining stocks will give you the most leverage, as you can see from the following chart …

You can see that gold miners, as tracked by the VanEck Gold Miners ETF (GDX), are leaving the dollar, the S&P 500 AND gold in the dust so far this year.

I believe its biggest outperformance is ahead of it. The GDX holds a basket of leading gold miners.

If you’d bought the GDX when I recommended it in my Jan. 8 column, “This Chart Points the Way Higher for Gold,” you’d already be up 27%, MORE THAN DOUBLE the gain in the S&P 500.

So, what are you waiting for now? The dollar should continue to crumble.

Your golden rocket awaits on the launch pad. The biggest move yet is coming for gold!

All the best,

Sean

P.S. I just put together a brand-new gold report for my Wealth Megatrends subscribers, and it’s going out next Friday.

The previous gold report I sent them last August saw positions rise 73% … 87% … 115% … and more!

This time around, I have brand-new picks packed with potential and ready to rocket.

If you want your own piece of the new gold rush, click here so you’re on the list to receive it.