|

| By Sean Brodrick |

If you read my Wednesday columns, you know gold is booming and hitting new highs.

Last week, I told you why the yellow metal is on its way to $3,000 an ounce.

Today I want to make sure you know that it’s not the only metal on the move.

Long history shows us that when gold booms, silver zooms!

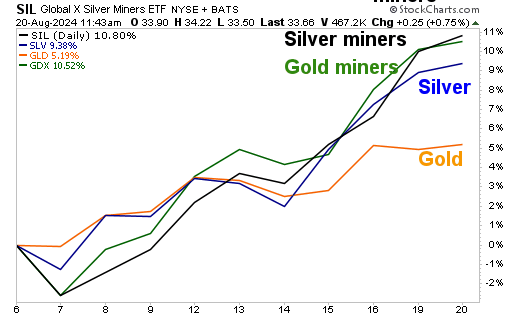

By some metrics, silver is already outperforming. You can see it on this chart that tracks precious metals from their most recent bottom on Aug. 7 …

Not only is silver outpacing gold, but it’s DOUBLING the yellow metal’s percentage gain.

Silver miners, as tracked by the Global X Silver Miners ETF (SIL), are doing only a little better than gold miners, as tracked by the Van Eck Gold Miners ETF (GDX).

Do you think the performance of gold and silver miners will stay the same? If silver keeps outperforming gold by 2-to-1, it seems likely that silver miners will lead the pack higher.

Why Silver Is Outperforming

Some might think it odd that silver is outperforming. After all, something gold has going for it is that central banks use it to alleviate all kinds of risk — geopolitical, inflation and currency risks.

They don’t do that with silver.

The plain fact is that central banks are the leading force in gold rallies. The total quantity of gold held in central bank reserves has increased by almost 19% by weight since the summer of 2004.

These factors don’t affect silver. On the other hand, silver has some of the same factors that drive it as gold.

Bullish Forces for Both Metals

Like gold, silver sits on the opposite end of the seesaw of pain with the U.S. dollar.

Gold and silver are priced in U.S. dollars. When the dollar goes down, these metals usually go up. The U.S. Dollar Index just fell to its lowest level of the year.

That’s powering up gold and silver.

The dollar is falling as traders price in a 25-basis-point rate cut at the Fed’s September meeting, with two or three more cuts in the rest of 2024.

Other factors weighing on the dollar are rising U.S. debt levels and a weakening economy.

Fed Chair Jerome Powell will speak in Jackson Hole on Friday. Investors assume he will acknowledge the case for a cut.

Also, like gold, there is a lack of new discoveries of big silver deposits. In fact, most silver comes as a byproduct of other metals. That means that silver supply can’t be cranked up in response to demand.

As a result, according to the Silver Institute, the global silver market is expected to see a deficit of 215.3 million ounces this year.

That’s up 17% from the previous year. And it’s the second-largest deficit in over two decades.

Silver’s Special Drivers

Now, let’s get to the force that silver has that gold does not.

Because of silver’s high electrical conductivity, it is in high demand for solar panels.

As a result, solar is a significant and growing driver of silver demand.

In 2023, global demand for silver in the photovoltaic industry increased by 64% to 193.5 million ounces. That’s up from 118.1 million ounces in 2022.

Looking forward, silver demand for solar PV panels is forecast to increase another 85% by 2030 to roughly 273 million ounces.

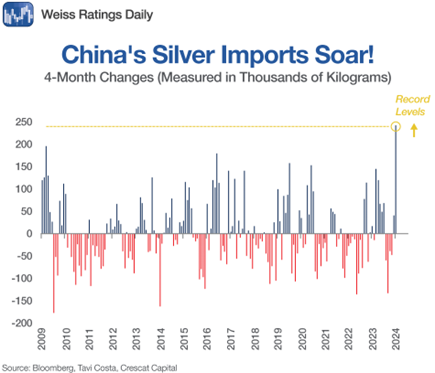

A lot of those solar panels are made in China. Not coincidentally, China imported 432.3 metric tonnes (13.9 million troy ounces) of silver in June.

The country exports silver, too. But the four-month net change in China’s silver imports is significant — 250 metric tonnes, according to Tavi Costa, using Bloomberg data.

And if you think that’s a lot, India imported 4,172 tons in the first four months of 2024, driven by rising solar panel demand and investor interest.

That’s more silver than India imported ALL of last year.

Bottom line: Silver may not have the central bank purchases that gold does. But it has its own driver in solar panel manufacturing. And that demand is going to grow and grow. That, in turn, should drive silver prices higher.

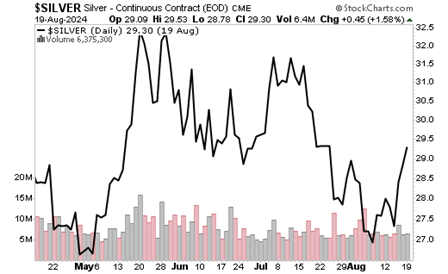

Here’s a recent chart of silver’s daily price action …

Silver was recently trading just under $30. My price target for silver is $38. But it can go much higher.

How You Can Play the Silver Surge

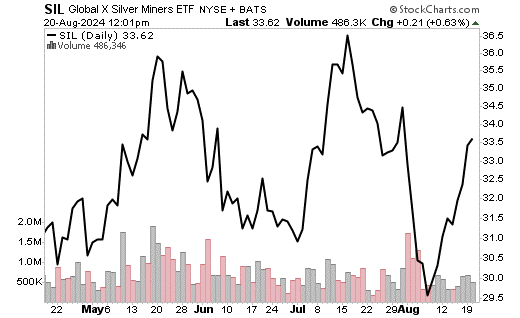

For an easy way to get into this rally, I recommend you buy something I mentioned in the first chart, the Global X Silver Miners ETF (SIL).

SIL is doing well here at $33.60. It still needs to get through that July high just above $36.

I believe it will do that on its way to $50 a share and perhaps higher.

Gold is on the march higher, and silver is ready to sprint. The race is on! Place your bets. There are potential fortunes to be made.

All the best,

Sean

P.S. Silver is on the move, partly powered by solar. But there’s opportunity much closer to home. Specifically, in what’s called low orbit.

My colleague Chris Graebe is set to unveil the name of a private company with the technology to get there faster and cheaper than Elon Musk’s SpaceX.

And other companies that want to get around Elon to get to space are starting to see … and take advantage of … it.

Learn how to get in on its PRE-IPO shares now. Before VCs and other big-money investors get their chance!