China’s Latest Move Could Send the Dollar Spiraling

Editor’s note: Even if you don’t follow crypto investments, something HUGE just happened that could ultimately affect the U.S. dollar.

Beth Canova, the Managing Editor at our sister publication, Weiss Crypto Daily, unwraps what China just did …

Why it could set off a wildfire of pain for the dollar …

And how to protect yourself with real assets.

|

| By Beth Canova |

China just changed the game with a new “first.” And it’s a big one.

It used its digital yuan to buy crude oil.

China has been buying oil using its yuan, rather than U.S. dollars, since 2023.

But this marked the first time it used its own Central Bank Digital Currency, or CBDC, to do so.

The ramifications of this move will ripple through multiple markets.

But we’ll likely see the first impacts hit right at home in the U.S.

It Starts with Stablecoins

In crypto, there’s one powerful trend that’s unlikely to hit the brakes anytime soon: stablecoins.

Thanks to new regulatory frameworks like in the U.S. and the MiCA framework in the EU, stablecoins — digital assets pegged 1-to-1 to a fiat currency, usually USD — have broken blockchain containment.

Many traditional finance firms have jumped on the chance to benefit from the instant and always-on nature of the blockchain while still staying in the realm of fiat-backed currency.

Even accounting giant PwC — which has remained notably cautious regarding all crypto assets — believes that stablecoins will help improve payments and cross-border transactions.

The stablecoin sector is currently valued at around $280 billion, and the U.S. Treasury believes it could grow to $3 trillion by 2030.

That’s growth you’ll want in on.

But as investors, it’s paramount that you remember one key truth …

Not All Stablecoins Are Equal

I’m talking, of course, about CBDCs.

They’re pegged 1-to-1 to a fiat currency.

Nearly 93% of banks have been exploring their own CBDCs since 2022, according to a Bank of International Settlements survey.

And 60% of those surveyed say that the rise and expansion of stablecoins in general have fueled this push.

At the time of writing, only a handful have actually launched.

But China’s latest move could be the start of a more determined effort for others to roll out their own CBDCs.

Because its purchase of crude oil with its digital yuan confirms the utility of CBDCs on a global scale.

Other nations — especially those weary of the dollar’s dominance in light of the U.S. freezing Russian-held USD — are paying close attention.

Unlike your typical stablecoins, CBDCs come with central bank control … just like their fiat counterparts. Which is why crypto tech expert Jurica Dujmovic recommends investors steer clear.

But if this is the start of a greater trend, we cannot ignore them.

If CBDCs like the digital yuan start being used more often for assets previously priced in U.S. dollars ...

That could put real pressure on the value of the dollar.

Fortunately, this is a subject that’s often covered in these pages. And you have the prescription to profit from the dollar’s decline …

Real Assets Even Central Banks Need

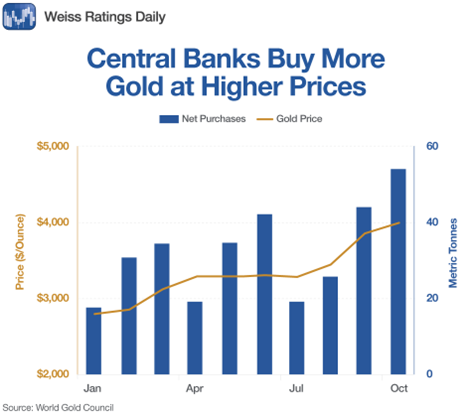

Here’s a chart Sean Brodrick shared with you last month:

Even with gold at all-time highs — it just surpassed $4,600 yesterday — central banks are buyers.

There’s a pretty simple conclusion here …

Central banks around the world could start issuing CBDCs in droves this year …

And they are backing those currencies in gold rather than U.S. Treasurys …

You might want to join them.

Of course, you could always pick up the yellow metal in physical form.

You could also add an ETF like the SPDR Gold Shares (GLD) or the iShares Gold Trust (IAU).

But the best way to play this is to follow Sean’s suggestions here.

Best,

Beth Canova

Crypto Managing Editor