|

| By Nilus Mattive |

As I’ve explained many times before, getting true diversification into your portfolio is one of the most important steps you can take for better, safer returns.

To understand why, just look at gold’s performance so far this year …

As you can see, the yellow metal had risen an astounding 65% from Jan. 1 through Oct. 20.

That’s more than THREE TIMES better than the Nasdaq 100 over the same period … and one of gold’s strongest, fastest runs in history.

So, a portfolio with an allocation to gold, like we have in the Safe Money Report, has gotten a huge boost.

Indeed, we were showing a 215% open gain on our long-standing core position in the SPDR Gold Shares ETF (GLD) …

And mining shares — which we also own — were breaking out and rising much more sharply than gold itself.

Then, on Oct. 21, the yellow metal had its worst one-day drop in 13 years.

That suddenly got everyone asking whether we just saw a top in the gold markets.

My short answer: No.

It would be crazy to think gold WOULDN’T have some type of pullback after such a blistering run.

But even if we see a more prolonged period of consolidation, I believe we could see the yellow metal top $5,000 an ounce in the shorter-term … meaning anytime between now and the middle of 2026.

Furthermore, I think $6,000 an ounce is very attainable a year or two into the future.

Note: Your resident precious metals expert, Sean Brodrick, has been calling for a gold target of $6,900 for quite some time.

And ultimately, it wouldn’t be crazy to see gold north of $10,000 an ounce before it truly tops out.

Why?

Basic history.

One thing we’ve seen in past bull markets is that once gold starts climbing, it often does so furiously and for very extended periods of time.

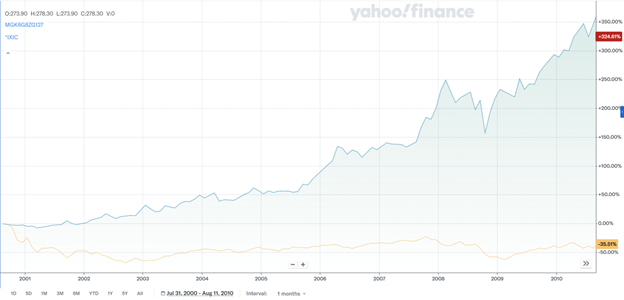

Just take a look at this longer-term chart going back to the middle of 2000 …

You can see that gold had a spectacular decade starting around the time the Tech Bubble was just topping out.

All told, it rose roughly 350% from the beginning of 2000 through the middle of 2011.

Meanwhile, the Nasdaq was DOWN 35% over that same time period — a brutal lost decade for momentum stocks!

And if you measure from the absolute bottom to the top, the entire gold run was even better — taking the metal from $250 an ounce in 2001 to more than $1,900 by 2011.

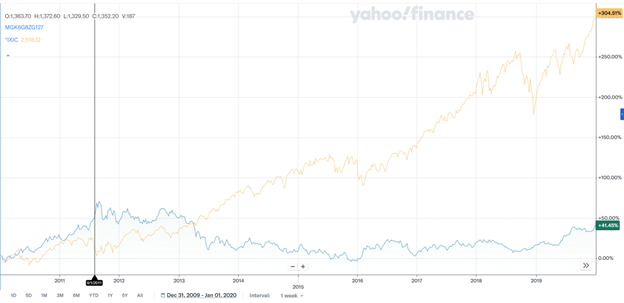

Then, as equities started going on a massive new bull run, gold got sleepy for the next 10 years.

The Nasdaq rose more than 300%, while gold gained just 40% … with the metal experiencing a shallow but prolonged pullback for most of the middle of that decade.

Yes, am I oversimplifying the story … ignoring a bunch of other related inputs … and painting with a broad brush.

However, you can’t deny the basic implication that the ten-year cycle is flipping once again right before our very eyes.

Tech stocks are once again very richly valued. Gold has once again started pulling ahead around the very same time.

So if we merely take the last big run and apply it to gold now, it’s easy to see how a new bull run could last for several more years at a bare minimum …

And take the yellow metal from $2,000 an ounce at the start of the breakout in the beginning of January 2024 to $6,000 an ounce or more without even breaking a sweat.

Just consider — gold went from $250 to $1,900 during its last big decade.

If we start at $2,000 in 2024 and project the same type of run going forward, the yellow metal would actually top out above $15,000 an ounce!

Even if you missed the beginning of this ride, you could still buy GLD now.

But I have a better way …

If you like gold … want a unique way to invest in it … and like the idea of also getting big cash payments even though most gold investments don’t produce any income at all …

Then you’ll want to make sure you register for my FREE online event happening TOMORROW at 2 p.m. Eastern.

I plan on showing our precious metals expert, Sean Brodrick, and everyone else who attends how to get big upfront payments from gold using a special strategy that I’ve perfected over the last several years.

All you have to do is click here to get your name on the list.

Best wishes,

Nilus Mattive

P.S. It won’t just be about gold, either.

I’m also going to show Chris Graebe, Michael A. Robinson and even Dr. Martin Weiss how they can apply this same technique to everything from private companies … to tech stocks … to crypto investments.

Better yet, you can get these cash payments without having to buy any gold, stocks or cryptos up front!