|

| By Nilus Mattive |

Circle (CRCL) is circling the drain.

I warned you not to buy after its red-hot IPO …

And I hope you followed my lead to avoid or even short the stock.

Here’s why.

At the end of June, I explained why — even though Circle hadn’t yet gotten a Weiss Rating — it was clearly a “Sell” based on its ridiculous valuation.

In fact, I told you I was taking the rare step of buying a put option on the stock.

Doing so gave me the potential to profit from a future decline.

(I am usually a seller of options, as my Weekend Windfalls Members can concur, it is the best way to use options to go for consistent cash payouts.)

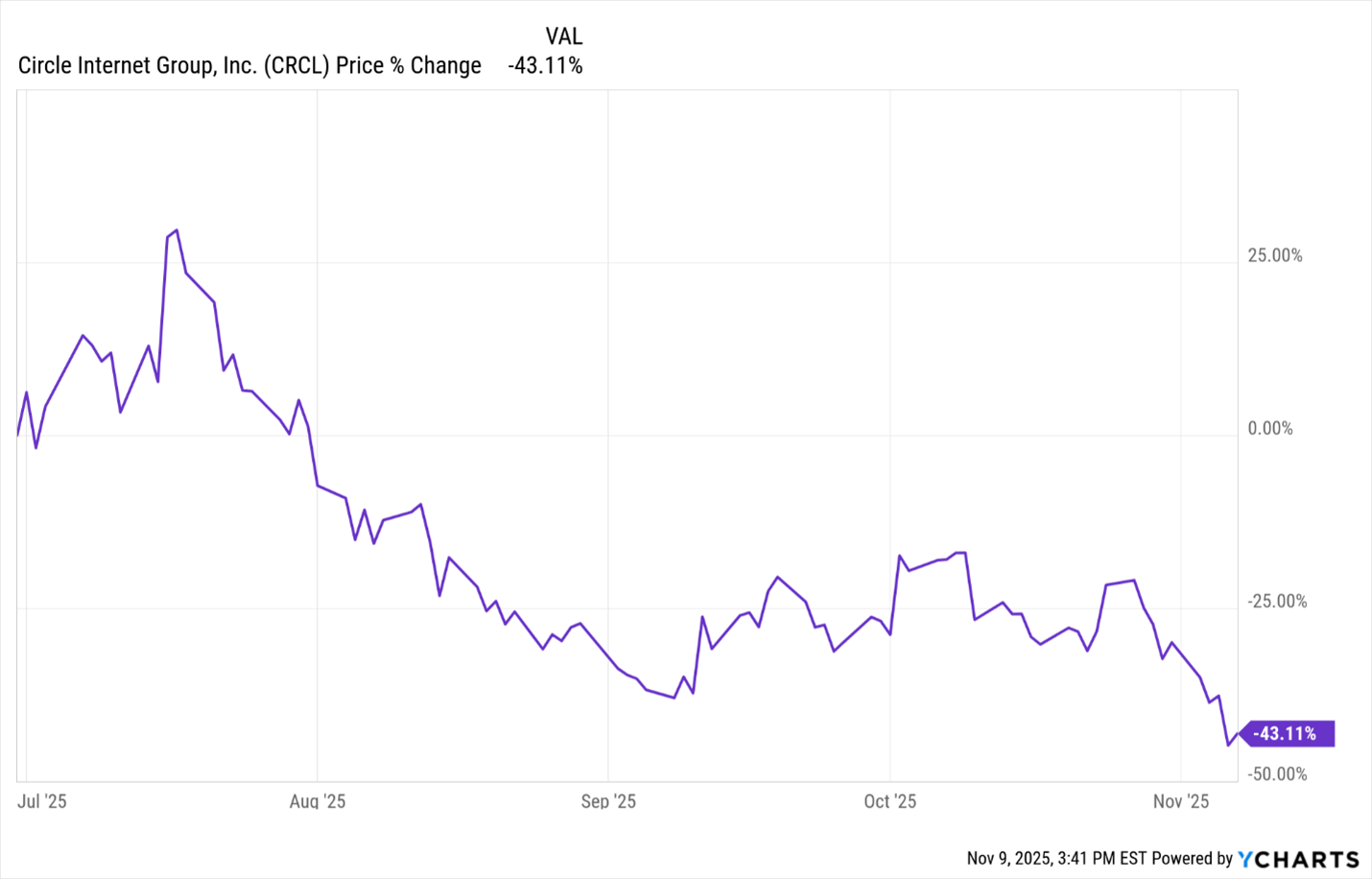

Here’s a chart of Circle from that day through now.

As you can see, CRCL has dropped more than 40% since then …

And my put position — which I just recently closed — produced a bigger GAIN than that.

So where do things go from here?

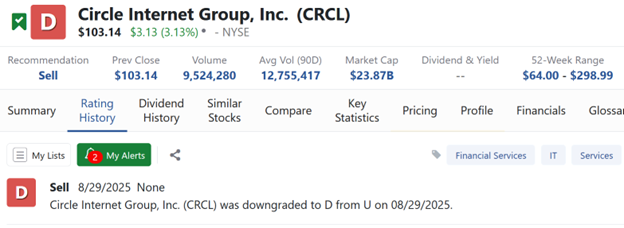

Well, I’ll start by saying the stock has now been assigned a Weiss Rating.

And, unsurprisingly, that rating is a “D.”

In the Weiss Ratings universe, any stock rated below a “C” is a “Sell.”

I agree that Circle remains a “Sell,” especially ahead of two major events …

#1. Its earnings release is this Thursday, Nov. 12.

No matter what the company reveals, I doubt it will be enough to justify the stock’s valuation … even AFTER this big collapse in its shares.

And as I pointed out in my original article, lower interest rates —which have now come to pass — only hurt the business more going forward.

#2. The end of the IPO lockup period on Dec. 5.

Insiders and early investors haven’t been able to sell any of their shares. But soon enough, they’ll be cleared to do so.

As I said in my original piece, they’d be crazy not to take some money off the table as soon as possible.

All of them — including many company personnel, institutions and venture capitalists — got in at a pre-launch price of $31 per share. Many got in at substantially less than that.

With the stock already losing so much air, will they really want to hold on for the long term now? Especially when they could still bank a double or triple from their IPO (or pre-IPO) price?

Doing so would be foolish.

Because I also see a lot of new competition lining up in the stablecoin space.

I also see someone in this WSJ article quoted about selling options on BitMine (BMNR) to make money right now.

Bottom line: Circle was a sell above $200. And it’s still a sell here around $100.

CRCL was already priced pretty darn aggressively at IPO time, when it was priced at $31.

I wouldn’t even consider looking at it until it’s back in that range or even lower.

In the meantime, I’ll use our new Weiss Ratings Plus tools that let me tap into our company’s 10-terabyte financial dataset, one of the largest on earth.

Within Weiss Ratings Plus, you can use our Stock Ratings Analyst to find stocks you want to buy (or sell).

We’ve even just added an Intraday Pricing Tool. Not only can you get alerted when a stock’s grade or price changes. (Say, if CRCL would ever merit a “Hold” or even a “Buy” rating. But you might be waiting a long time for that!)

But you can also tell our system to notify you when they move by a certain percentage or dollar amount.

You can even use our one-click screeners to find “Wall Street’s Hidden Buy Signals: Real-Time Stocks Just Flipped to ‘Buy’ (Before the Crowd Notices)” … “Wall Street’s Danger Zone: Real Time Stocks Just Downgraded to ‘Sell’ (Before You Get Burned)” … and much more.

As my colleague Gavin Magor recently told his Weiss Ultimate Portfolio subscribers, “There’s no sense staying down on any stock when we could instead be UP on something else.”

We designed Weiss Ratings Plus to help you do just that.

Click here to see how you can start putting it to work TODAY in your own portfolio.

Best wishes,

Nilus Mattive