A disinflationary wave has been slowly building. While you may not feel it or see it on a trip to the grocery market, for example, several key indicators show inflation may have peaked.

In this segment, I interview Senior Analyst Tony Sagami who discusses the data behind disinflation, the industries and investments benefiting, and if a so-called Santa Claus rally will ever arrive.

You can watch the video here or continue reading for the full transcript.

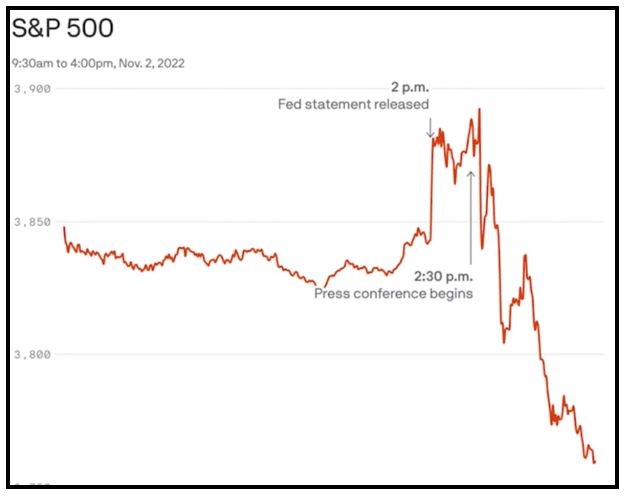

Jessica Borg (narration): It may seem like the market’s moves are direct reactions to statements made by the Fed.

Could be.

Tony Sagami: As a matter of fact, some Wall Street firms have hired linguistic Ph.D.’s to analyze the words that come out of their mouth.

I think that’s crazy, but that shows you how focused they are on what they have to say.

When the Fed first released the minutes that announced the 75-basis-point hike and said that they wouldn’t have to raise as much going forward, the reaction was extremely positive. Look at this chart … it shot up immediately!

Click here to view full-sized image.

JB (narration): But gains made were soon lost after the Fed’s remarks.

Overall, Senior Analyst Tony Sagami, editor of Disruptors & Dominators, sees a bullish streak on the horizon.

TS: The U.S. economy comes down to two basic things — the makers and the takers. There are companies that make products and there are companies that deliver them to our shelves.

And so, those are the two parts of the economy that are thriving.

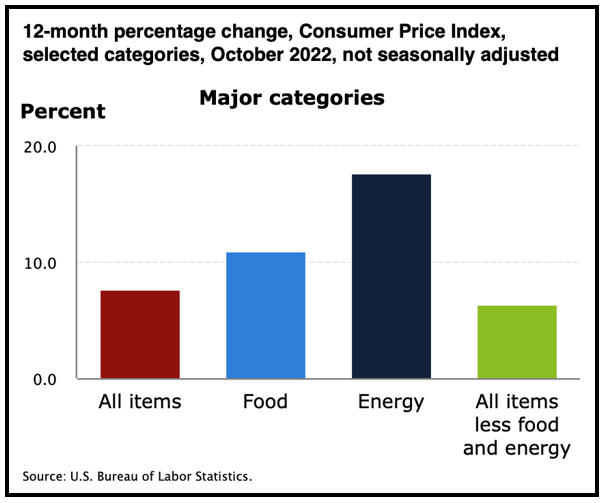

JB (narration): He says that stems from inflation getting lower.

Click here to view full-sized image.

TS: The Consumer Price Index looks in the past. It’s how things have gone up over the last 12 months. And that’s currently running at 7.7%.

It’s hotter than what people want, and it’s the reason for the Fed’s panic. But that’s on the retail level.

Let’s take a look at the wholesale level. This is the U.S. ISM Manufacturing Prices Paid Index.

Click here to view full-sized image.

The makers are paying less and less for their input. Whether it's copper, cardboard or paper, the price of things they buy is going down. It peaked in March, and they’ve been dropping ever since July.

So, this is evidence of declining inflation on the wholesale level and that’s a big deal.

Another big deflationary thing that we’re seeing is that the cost of shipping containers across the Pacific Ocean — the price to ship one of those giant containers we see on those ships — fell from $20,000 to $2,400. That’s almost a 90% drop in the price of shipping.

And so that’s also an important indicator of why inflation has peaked.

I don’t know if you can call it a pivot. Maybe it’s more of a pirouette, but the Fed is changing from being hyper-aggressive to slowing down.

And when the Fed stops its attack on interest rates, that’s when the stock market skyrockets.

JB (narration): In the meantime, certain types of stocks are shining.

JB: The Dow Jones has been a star recently.

TS: Let’s take a look at October. In the month of October, the Dow Jones Industrial Average was up 14%.

Click here to view full-sized image.

It’s the best October in the stock market since 1976.

That’s very impressive. What I think is very interesting is that the Nasdaq was up only by 2.5%, even the Dow Jones was up by 14%.

That shows you there’s been a very important shift between high tech to low tech.

The Dow Jones is filled with things like pharmaceuticals, energy, industrials, the kinds of things that were considered boring in the past. Now, they are leading the pack.

JB (narration): In the energy sector, take a look at the price path of Baker Hughes (BKR).

And in consumer staples, Disruptors & Dominators has a position in Costco (COST) that has seen gains upwards of 40%.

The stock is currently trading in the $490 range.

TS: They’re a couple of reasons why Costco does well in both an inflationary environment and even a recession. It’s been one of the more recession-resistant stocks out there.

Click here to view full-sized image.

Costco does very well, even when the economy is slow. It’s mainly because they have 148 million households that are paying between 60 and $125 a year just to be a member.

And 75% of Costco’s profits come from those membership fees and not from selling all those goods that people buy.

As a matter of fact, business is so good that Costco just raised its quarterly dividend from 78 to 90 cents.

Costco reports its quarterly results on Dec. 7. Wall Street is expecting earnings per share of $3.16, but that’s low. Costco is going to blow that out and it’s heading even higher.

JB: What are your thoughts on a year-end rally? How do you see it taking shape?

TS: Are we going to get a Santa Claus rally? I think so.

Click here to view full-sized image.

And it really doesn’t matter when the Fed actually changes and pivots. It’s what Wall Street’s perception is, and right now, they feel better about what the Fed is doing than they did a month ago.

When Wall Street gets it in their mind that the market is better, then the rallies can be explosive.

But I think we’re going to see that rally during some time in the first half of 2023.

So, instead of being pessimistic, this is the time to get optimistic. And like my father always told me, “Buy your straw hats in January.”

JB (narration): And prepare for dynamic weeks ahead.

JB: Senior Analyst Tony Sagami, it is always a great pleasure of mine to speak with you. Thank you so much for your time and insights today.

TS: Let’s do it again.

Best wishes,

Jessica Borg

Financial News Anchor

Weiss Ratings