|

| By Gavin Magor |

Q2 earnings reports are starting to pour in like the raging Niagara Falls. The moment that data hits the tape, the Weiss ratings start to filter it.

When you visit our website, you might see more ratings upgrades and downgrades. And, if you subscribe to one of our premium services like the Weiss Intelligence Portfolio, where stocks with the best prospects rise to the top of our proprietary rankings, you could see that leadership change or become reaffirmed.

Think of the Weiss ratings as a water filter. A rush of water comes in and the filter removes contaminants.

A slew of financial data comes in, and we filter out the noise. No heavy lifting on your part required!

Because, in my opinion, sound financial data is vital. With the Weiss ratings, you get that and more. And it’s rung true throughout our 50-plus-year history.

Whilst uncertainty in the markets remains high, certainty within our ratings reigns supreme.

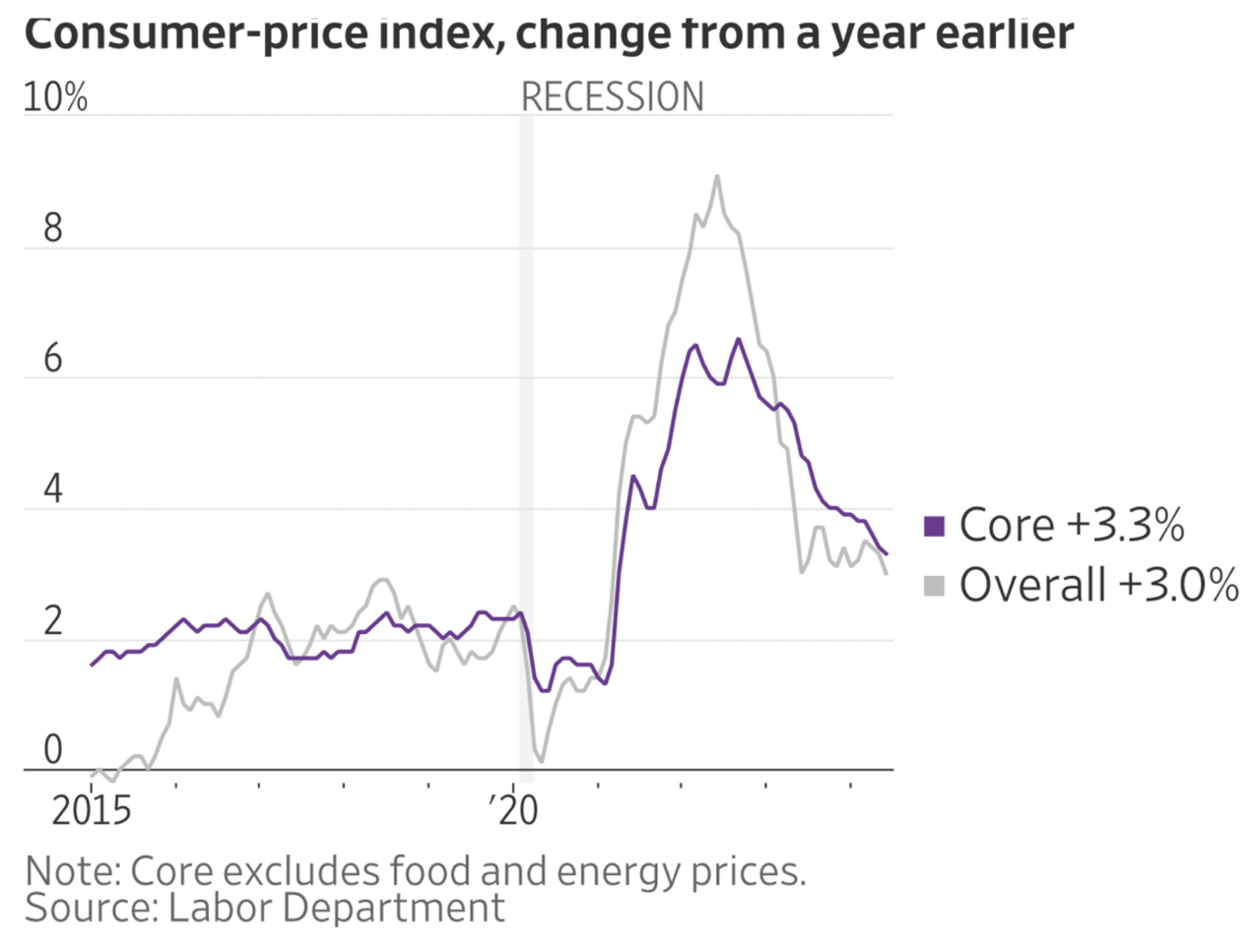

Last week, the market was bolstered by another cooler-than-expected Consumer Price Index report, showing that the rate of inflation further cooled to 3%.

That’s a good sign … and further increases the chances of the Fed to lower interest rates in September.

As of writing, the market is now pricing in an 89% chance of a rate cut in September. As I have said in recent issues, I do believe rates are still set to come down.

But right now, we’re laser-focused on earnings season, which unofficially started just a few days ago on Friday.

Helping You Earn This Season

New earnings data is very important for our stock ratings, which are updated daily. We, as analysts, probably get a little too excited to see the new numbers. But it’s one of the things we love.

So, as new data — and consequently new ratings — come in during the next few weeks, please be sure to check out the Weiss stock ratings page.

On Friday, big banks like Morgan Stanley (MS), Citigroup (C) and Wells Fargo (WFC) were among the first to report last quarter’s financial performance.

But in addition to the new data, always be sure to listen to the earnings calls for stocks you are heavily invested in. Certainly, you can’t listen to all. But I encourage all investors to listen to a few each quarter.

Why? Because company leadership is on full display, giving their breakdown of the overall economy and where their company fits into it.

You should also be on full alert for how they say it, as their tone usually drops some big clues.

On that note, let’s see some of the stocks in the Weiss stock ratings that were recently upgraded.

After a few easy filters and clicks, here’s what populated in the “A+” to “B+” gradings range:

Unsurprisingly, six out of the seven highly rated and upgraded names have moved higher over the past seven trading days.

Be sure to explore all our highly rated names, not just the ones that were recently upgraded, which are shown above.

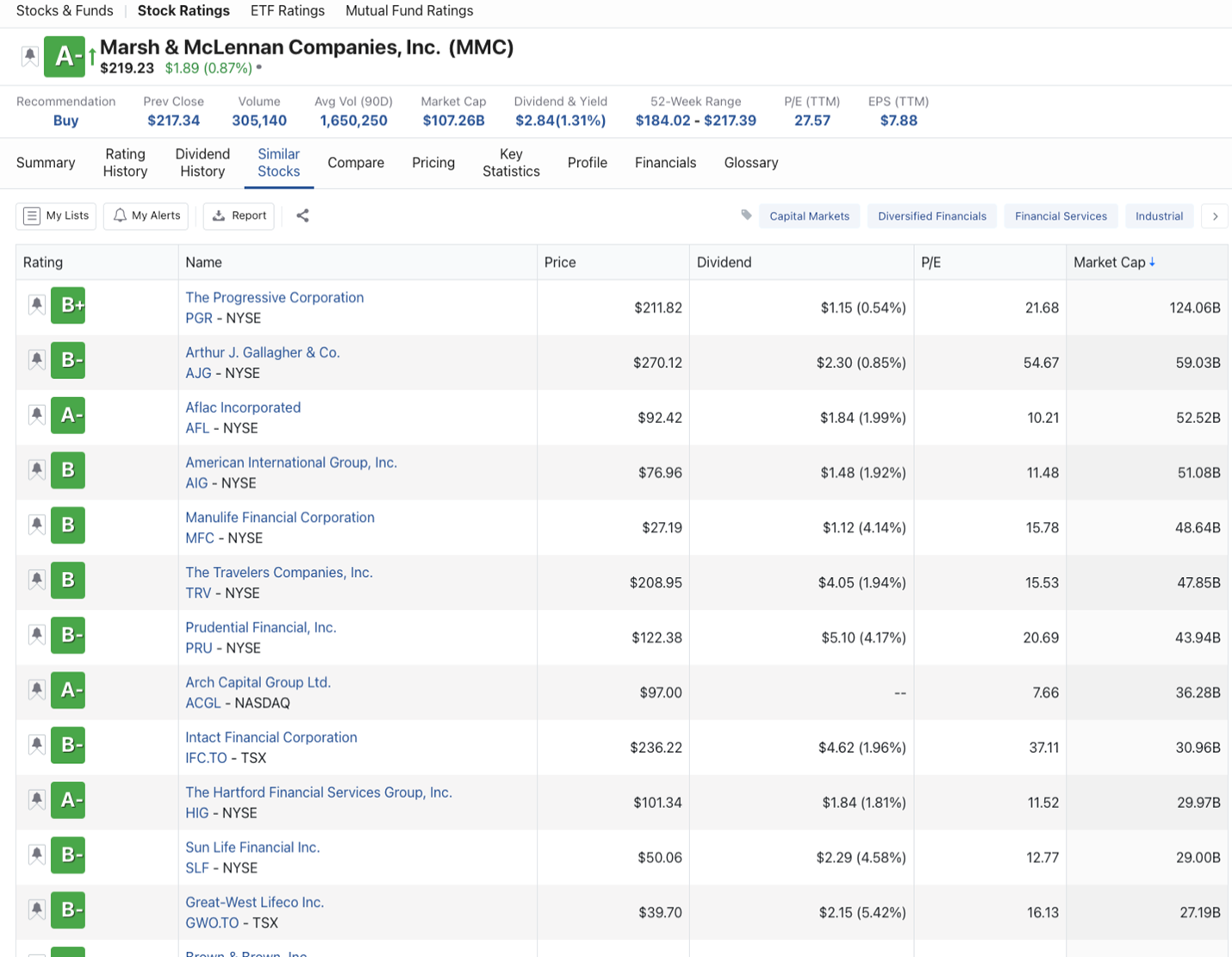

But if there is one name above that I would like to dig into a bit deeper, it’s Marsh & McLennan (MMC).

‘A’-Rated Name Making

a ‘Buy’ Rating Look Easy

For starters, it has never left our “Buy” range over the past 10 years. That is very rare in our ratings system, since we place such a strong emphasis on safety.

Marsh & McLennan is a Chicago-based financial services company. It helps its clients manage risk, develop business strategies and optimize their workforces.

MMC shares are up a very respectable 321% over the past 10 years. That’s before dividends!

Let’s say you already own MMC in your brokerage or retirement account ... but you might want more exposure to financials just like it.

A really great feature on our ratings site is “Similar Stocks.”

Or, perhaps, you think MMC’s dividend is too low for your liking. You could check other highly rated financials to find a better dividend for your needs.

Again, this is one easy click away in the “Similar Stocks” tab:

You’ll see that Prudential Financial’s (PRU) dividend is yielding 4.2%, and Sun Life Financial (SLF) is yielding 4.5%.

Now, these aren’t “Buy” recommendations. But they are certainly a jumping-off point for those of you who want to put the reams of data behind the Weiss ratings to work in your own portfolio.

However you tackle earnings season, I am quite confident that, with the Weiss ratings offering you a helping hand, you will be in a better place to succeed.

And if you’d like a little more of a tailored investing strategy that uses some of the most advanced AI technology known to man, we’ve got you covered.

Our company founder, Dr. Martin Weiss, recently released a special video that shows how investors could have beaten the market by 51-to-1 over 10 years. He’s even committed $1 million of his own money to the strategy.

I strongly recommend you take a moment to watch his presentation here.

Cheers!

Gavin Magor

with

P.J. Amirata