In this segment, Financial News Anchor Jessica Borg interviews Research Analyst Sam Blumenfeld about stocks leveraged to food inflation, the next round of interest rate hikes and how Dividend Kings offer portfolio protection.

You can watch the video segment or continue reading for the full transcript.

Jessica Borg (narration): Many investors feel an atmosphere of uncertainty.

But some things are clear.

JB: We're seeing the anticipation of interest rate hikes being a factor.

Sam Blumenfeld: A lot of how the market is moving and the market direction is based on expectations of what the Federal Reserve is going to do.

Is it going to take a more dovish, accommodative approach, or is it going to rip the Band-Aid off with a 50-basis-point rate hike?

JB (narration): In March, the market planned for a 25-basis-point rate hike — a quarter-point rate hike — and that did happen.

It was the first rate hike in more than three years.

The rate increases are to offset inflation.

Research Analyst Sam Blumenfeld is tracking assets that are soaring right now.

He works closely with Senior Analyst Sean Brodrick, editor of Wealth Megatrends and SuperCycle Investor.

SB: During periods of inflation, commodities typically outperform general equities.

We've seen oil prices move significantly over the past year — partly due to the Russian invasion of Ukraine and partly due to other factors driving oil, such as the resurging demand.

JB (narration): The right stocks can bring generous gains.

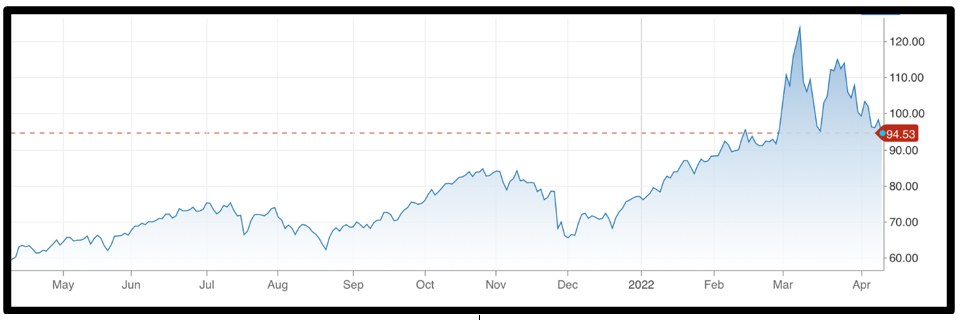

Crude oil — measured by the benchmark West Texas Intermediate (WTI) — is currently around $100 per barrel.

It recently peaked at $130 per barrel, a 13-year high.

If you go to the Weiss Ratings website, you can see top performers in the oil and energy space, and how similar stocks compare.

Other industries are also benefiting from inflation.

JB: Food inflation is certainly something no one can ignore right now.

SB: Absolutely. One thing we see in corporations — how they handle inflation in general — is that they're not going to take a dip in their profit margins.

They're just going to raise prices … or, creatively raise prices for consumers, just so they can pass those extra costs down.

JB (narration): So, a good move is to gain exposure to major food producers.

Archer-Daniels-Midland Company (ADM) is among them.

It makes food and beverage products and is a big player in agriculture.

SB: It's closing in on Dividend King status of raising its dividend of at least once a year for 50 consecutive years.

JB (narration): A so-called Dividend King is a publicly traded company that has consistently increased their dividend for 50 or more years.

Just 40 companies so far this year qualify as a Dividend King.

Not all Dividend Kings make a good investment at any given time. Some may be overvalued. It's about knowing which ones to select.

SB: In the Wealth Megatrends portfolio, we focus on companies with stable cash flows that are going to be around for the long haul. These companies are most likely dividend-raisers that consistently increase their payments to shareholders.

JB (narration): With ADM, for example, subscribers to Wealth Megatrends have seen their position go up about 36% since December.

The company is one of many in that sector flourishing with inflation.

The U.S. Department of Agriculture (USDA) says supermarket and grocery prices are already 8.6% higher now than a year ago.

While the agency says food inflation will likely ease up in the coming months, it may take longer.

And any pullbacks with these food companies can mean a great buying opportunity in the second fiscal quarter (Q2).

SB: Consumers, at the end of the day, are seeing higher prices — whether it's coming from the cost of the food itself or other fees that are added on.

JB (narration): So, while you're waiting for prices to become more "palatable," you can ride a megatrend in the meantime.

JB: Research Analyst Sam Blumenfeld, always a pleasure to speak with you. Thank you so much for your insights today.

SB: Thanks for having me on, Jessica.

Best wishes,

The Weiss Ratings Team