Even with Sticky Inflation, You Can Rely on This

|

| By Mahdis Marzooghian |

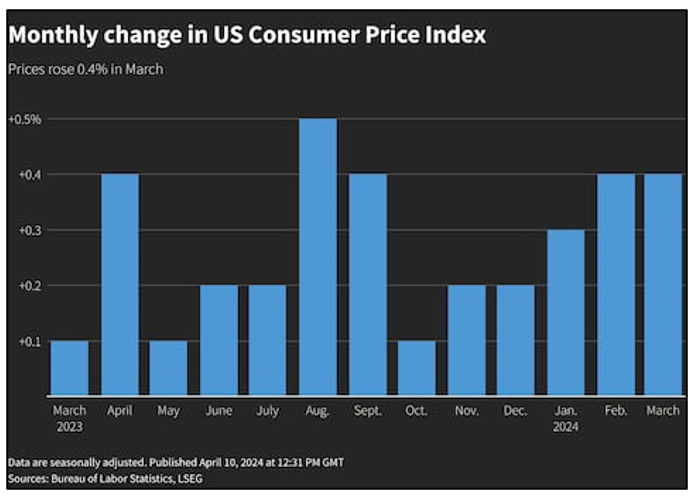

The current inflation we have on our hands is stickier than everyone thought — and no amount of promises from the Fed about future rate cuts is going to wash it away.

In fact, there may be no June rate cuts at the rate we’re going. Bottom line, this inflation is sticking.

Not only that, stocks fell yesterday as major U.S. banks kicked off the corporate earnings season with — you guessed it — inflation concerns weighing heavily on investors.

The Dow Jones Industrial Average shed 306 points, or 0.8%. The S&P 500 slipped 0.8%, while the Nasdaq Composite pulled back by 1%.

According to the University of Michigan’s Surveys of Consumers, April’s consumer sentiment index came in at 77.9, below the Dow Jones consensus estimate of 79.9. Year-ahead and long-run inflation expectations also ticked up, reflecting frustrations over sticky inflation.

Investors now have to come to terms with fewer rate cuts by the Fed this year.

But even if inflation sticks for longer than we anticipated, our experts here at Weiss Ratings have the reliable research and data to help you safely navigate the bumpy road ahead with confidence. In fact, here’s their latest batch of research to help you chase the inflation blues away …

Final 4 of the Weiss Stock Ratings

As March Madness neared its close, our Director of Research & Ratings Gavin Magor reviewed the top-four performing Weiss-rated “Buys” over the past year to help you keep your portfolio stocked with winners.

How to Invest in ‘Crises Unicorns’

It’s a well-known fact that chaos in markets and economies bring opportunities. And right now, in the startup world, it’s the right time to profit from those. Our startup investing expert, Chris Graebe, has the scoop.

Profit from Wall Street’s Big Mistake

Megatrends & Supercycles Analyst Sean Brodrick shows you how Wall Street is currently making a big mistake — and it’s one you can use to your advantage.

Position Yourself for ‘Robotaxi’ Gains

Tech guru Jon Markman shrewdly points out that the way we do transportation is not smart. Indeed, we buy an expensive vehicle and pay thousands for its maintenance, insurance and fuel — only to have it sit parked 95% of the time. Here’s why you need to get in on the answer to this problem.

These ‘Real World’ Cryptos Produced 770% Returns

Imagine disrupting Google Maps from your phone … and getting paid to do it. Safe Investing Analyst Nilus Mattive is going to show you how crypto is used in these lucrative, real-world scenarios.

Have a great weekend,

Mahdis Marzooghian

Managing Editor, Weiss Ratings Daily