|

| By Nilus Mattive |

In Colonial America, there were no income taxes, payroll taxes or corporate taxes.

There was one major type of tax: excise taxes and tariffs.

Essentially, items were assessed fees upon importation and, in some cases, upon sale.

As the Tax Foundation explains:

“What sort of items were these tariffs imposed on? Primarily, they were levied on ships on a per-tonnage basis, slaves, tobacco and alcoholic beverages. In all, the average tariff worked out to about 10% of the value of imports, with lower rates being imposed on goods from Britain than from elsewhere …

“Midway through the 18th century, the British Parliament began imposing excise taxes that are notorious to this day. In 1764, Parliament passed the Sugar Act, imposing a tax of one pence per gallon on molasses imports, equivalent to more than $2 a gallon today. Just a few years later, the Townshend Acts started making their way through the British government, one of which imposed a tax on tea of four pence per pound ($8 today). Opposition to these taxes culminated in the famous Boston Tea Party.”

There were also battles over these types of taxes before the tea situation boiled over.

For example, back in 1765, colonists got irate over a newly imposed “stamp tax” that required them to pay money for official paper used in newspapers and other printed materials.

Many people refused to comply, including some of the people employed to collect the taxes. Britain repealed the tax the following year.

The situation enraged the Crown, emboldened the colonists and set a precedent for the larger battle coming less than a decade later.

As I reflect upon these events now, I can only laugh.

In modern America, we still have excise taxes and tariffs on many types of goods. But they make up a relatively small part of the government’s revenue.

That’s because we have a litany of other taxes and fees that would make a colonist’s head spin.

What’s more, in many cases, citizens actually vote FOR these taxes rather than against them.

And I don’t just mean that in terms of the specific political candidates they support. I have seen plenty of referendums associated with tax hikes pass with large swaths of voter support.

Whatever happened to the spirit of Colonial America? What can you do about it?

Well, this:

3 Steps to Legally Cut

Your Personal Tax Burden

I could write an entire book on ways to cut your personal tax burden. But for now, let’s at least talk about three broad strokes to consider.

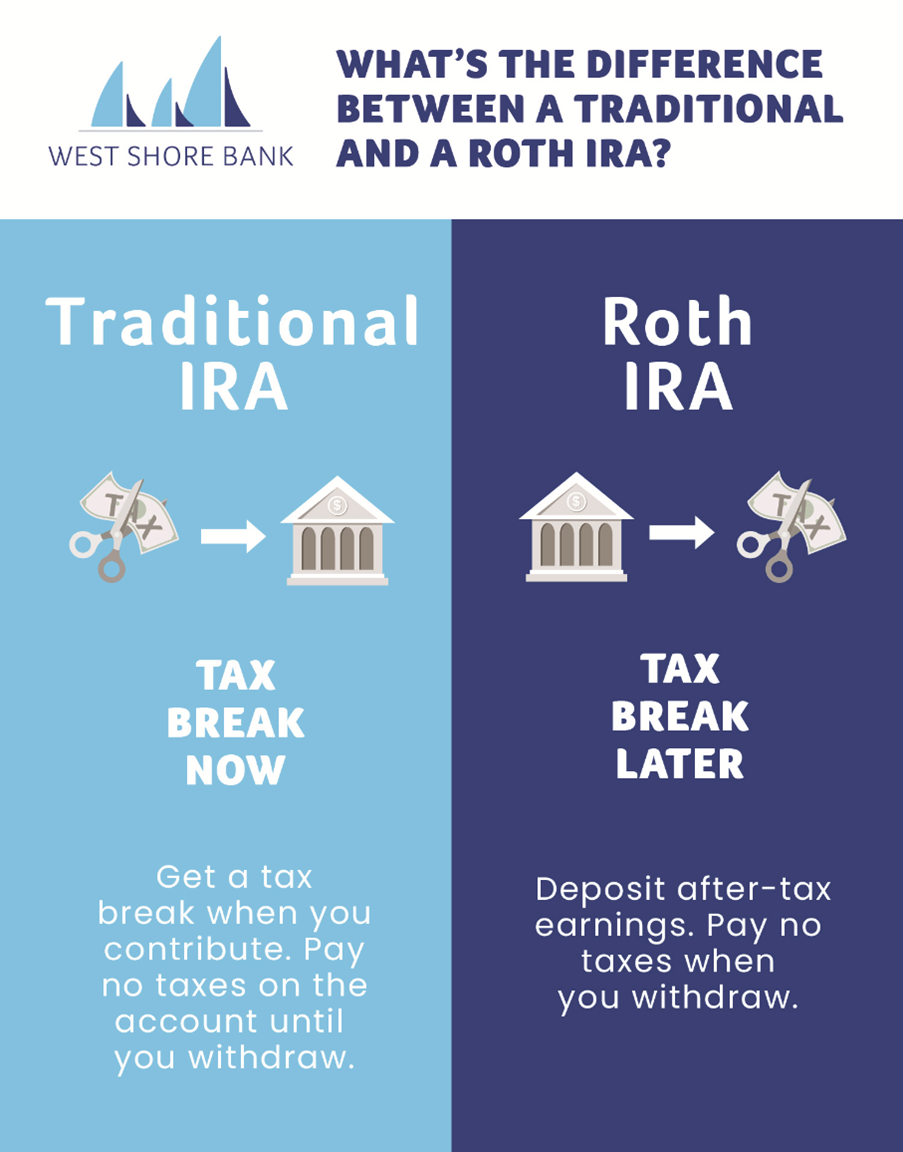

No. 1: Use readily available tax shelters like IRAs.

While I can’t guarantee that lawmakers won’t keep changing the rules around IRAs, 401(k)s and other tax-sheltered accounts, I still recommend using them as some of the most accessible ways to get powerful tax advantages when it comes to your investment portfolio.

The majority of my own family’s investing is done inside these types of accounts. And we use a whole range of these accounts to accomplish different purposes.

For example, my Solo 401(k) plan lets me reduce my current tax bill, while my Roth IRA lets more aggressive investments grow tax-free forever.

I covered this subject in a bit more depth last year. You can read that here.

No. 2: Use the rest of the tax code to your full advantage.

Maybe I’m just a glutton for punishment, but I like to know exactly what’s happening with my finances. So, I do my own taxes every year.

However, that’s no easy feat. The current U.S. tax code is notoriously complex, with almost 10,000 different sections covering everything from estate and gift taxes to coal industry health benefits.

Buried inside all of that are many things you might be able to use given your own personal circumstances.

So, if you don’t want to do a lot of reading, it often pays to talk to an accountant or tax attorney about what steps you can take to keep more of your hard-earned money.

No. 3: Consider where you live now and in the future.

Where you live can have a huge impact on how much money you give to the government.

In some cases, simply moving out of an incorporated city can slash your tax bill quite nicely. Moving from one state to another can often do even more.

Indeed, I saw this personally when I moved from New York City to Jupiter, Florida. And I am seriously reconsidering my current residency in California as well.

Also, keep in mind that different places might have tax policies that are advantageous during different times of your life.

One area might offer low property taxes that are great when you have a larger house. Another might exempt retirement income from taxation, which is perfect for your golden years.

Some states have inheritance taxes, while others don’t. Heck, for some high earners, buying a small house in a no-income-tax state might literally pay for itself!

Want to go one step further? Consider moving out of the country entirely, even if it’s just for a year or two …

While the U.S. is only one of two countries that taxes its citizens on their worldwide income, the Foreign Earned Income Exclusion (FEIE) makes it possible to exempt up to $126,500 from federal income taxes if you establish residency in a foreign country or simply stay outside the U.S. for 330 days in a single year.

In some cases, you can even get additional credit for your housing costs.

Given the potential savings and living costs in other parts of the world, it might be possible for many remote workers or business owners to get overseas vacations for free!

There are plenty of others. In fact, I recently shared one — including a specific investment — with my Safe Money Report readers.

It wouldn’t be fair to give it away here. But you can join them. The best way to do that is to check out my other recent government overstep presentation here.

Best wishes,

Nilus Mattive