|

| By Tony Sagami |

That 11% headline increase in the Producer Price Index (PPI) in April doesn’t begin to tell the whole story about inflation.

Food prices have skyrocketed. In just the past 30 days:

- Fruit up 8.5%

- Fish up 5.1%

- Pork up 4%

- Grains up 3.8%

Those are increases just in the last month. On an annualized basis, we’re talking about 40%–70%! Overall, food prices climbed by a 28% annualized rate. Ouch!

And food inflation is going to get worse.

PPI is a measure of inflation on the wholesale level, so it takes a couple of months for these prices increases to work their way to retail inflation, aka the Consumer Price Index (CPI).

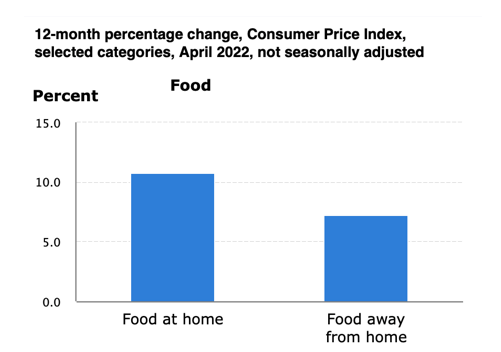

The CPI currently shows inflation for food at home at 10.8% and food away from home at 7.2%. Expect both to worsen.

That is bad news for the poor because food inflation hurts them the most. The bottom 20% of wage earners spend 18% of their income on food compared with 11% for the top 20%.

I’ve recently covered ways to profit from food inflation, and if you’ve been with me for a while, you know that I was raised on vegetables in western Washington State.

I know more about farming than anybody on Wall Street, and I’m telling you, those Harvard MBAs could learn a lot about investing from farmers like my father. Life on a farm teaches a surprising number of investment lessons.

Boring Work Is the Most Important Work

Farming is far from glamorous, and most of the work my parents had me do was dreadfully boring.

When I was in kindergarten, my father had me pick rocks out of the fringes of the farm; in the summer, I spent thousands of hours on my hands and knees pulling up weeds.

It was boring and seemed meaningless at the time, but every successful business needs a strong foundation, and the basic building blocks of preparing the soil is crucial.

The same is true of investing. Reading annual reports, financial statements and balance sheets can be boring, but it’s that fundamental, time-consuming research that sets you up for long-term success.

Summer Profits Come From Winter Efforts

My non-farmer friends assumed farmers took it easy during the winter. Wrong! Even when snow covered the ground, my father still worked a minimum of 12 hours a day.

There might not have been any crops to harvest in winter, but there was always plenty of off-season work to do on the farm, like repairing the farm machinery and mending fences.

My high-school basketball coach used to scream at us that December games are actually won in June, July and August during off-season workouts. The same is true of investing. You make your profits before you buy a stock, not after you sell it.

Core & Explore

The most important decision any farmer makes is what to plant. The price of vegetables could vary widely from year to year, and many farmers would play a “Green Acres” version of roulette by trying to anticipate what the hot vegetable of the year would be.

Not my father: He stuck to red radishes and green onions for roughly 80% of our farmland and gambled with the last 20% on what crops he thought could deliver big payoffs.

I do the same with my portfolio today. I keep the vast majority of my portfolio in stable, established blue-chip companies and use the last 20% or so for more speculative bets.

Profits, Not Revenue

What makes one farmer more successful than another?

Many of our neighboring farmers also grew radishes and onions, but what made my father more successful was that he knew it isn’t how much you harvest, but how much profit on what you do grow.

My father was a very frugal man, and he seldom bought anything if it wasn’t on sale, so his cost was lower than most of his competitors’.

I’m a cheapskate too, so I seldom buy stocks unless they go on sale. You’ve probably heard the warning, “Don’t try to catch falling knives.” Well, I love falling knives.

I’ve carried this philosophy over to my service, Disruptors & Dominators, where Members are currently sitting on open gains of 45%, 25% and 21%.

Plow Under Your Mistakes

Sometimes, things just went wrong on the farm. Insects would infest our crops; some months were so wet that it triggered mold outbreaks; and some years frost would come too early or arrive too late and damage the crops.

Instead of spending too much time and/or too much money on rescuing the damaged crops, my father would often plow them under and start over.

My father was a big believer in cutting your losses and moving on. I find that many investors are too stubborn to admit a mistake or want to wait until they break even before selling.

Expect Storms

Whether or not my father had a good year depended on three things: (1) no late frosts, (2) no early frosts and (3) no natural disasters like hail storms, droughts or massive insect infestations.

While you can’t avoid disasters, you can plan for them and run for cover when they arrive. The wise investor diversifies in anticipation of those things that are beyond control and buys insurance to protect against catastrophic losses.

That’s pretty wise advice for the current market.

If you’re so heavily invested in stocks that you’re losing sleep, you’re NOT diversified enough and should consider either increasing your allocation to cash or purchasing some portfolio insurance.

Best wishes,

Tony