|

| By Tony Sagami |

The transition from elementary school to junior high was a big one for me.

I started looking at girls differently, but the one thing that I really missed was recess.

Recess was my version of childhood heaven. While the girls played hopscotch and jumped rope, my pals and I lived to play kickball, flag football, dodgeball and baseball. Those were the days!

Like a lot of hyperactive boys, I had more energy than commonsense, so I had a good deal of scrapes, cuts and bruises. But after a quick visit to the nurse's office, I was good to go.

More often than not, the school nurse would swab some Mercurochrome on my wound and send me on my way.

Monkey Blood

You remember Mercurochrome, right? The bright, red/orange liquid in a small, brown bottle that was topped with a cap that contained an applicator. My friends and I called it "monkey blood."

Mercurochrome was discovered in 1919 and was developed as a topical antiseptic to treat small cuts/scrapes during the Depression, World War II and into the 1950s and '60s.

But you won't find Mercurochrome at pharmacies anymore: it contained mercury, which is now understood to be toxic.

The Food & Drug Administration (FDA) started requiring any product that contained mercury to go through rigorous (and costly) FDA approval, which effectively killed off Mercurochrome.

- Today, Americans are spending more money on over-the-counter (OTC) drugs than ever.;

The average household spends around $338 a year, which in 2021, equated to a whopping $160 billion!

A big chunk of that $160 billion was spent on OTC treatments like Tylenol, Advil, Robitussin, Sudafed, Dramamine, Nicorette, Pepto Bismol, Pedialyte and Benadryl. (I bet there are a few of those bottles in your medicine cabinet right now.)

As long as kids continue to scrape their knees, catch colds, run fevers, cough and get upset stomachs, trips to local pharmacy to buy OTC medicines will continue to grow.

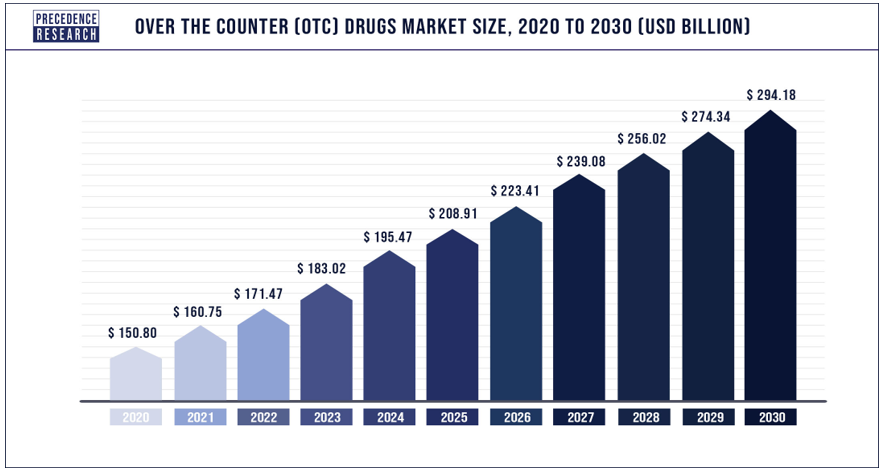

- That's why OTC sales are expected to hit $294 billion by 2030.

That is a mountain of money … and investing in the OTC food chain will be a very profitable experience.

Drugmakers & the Retail Drug Market

The retail drug market for prescriptions is dominated by three large, national pharmacy chains: Walgreens Boots Alliance (WBA), CVS Health (CVS) and Rite Aid (RAD).

And don't forget about the makers of those OTC drugs:

- Johnson & Johnson (JNJ)

- GSK aka GlaxoSmithKline (GSK)

- Pfizer (PFE)

- Novartis (NVS)

- Bayer Aktiengesellschaft (BAYRY)

- Merck (MRK)

Big Time Dividends

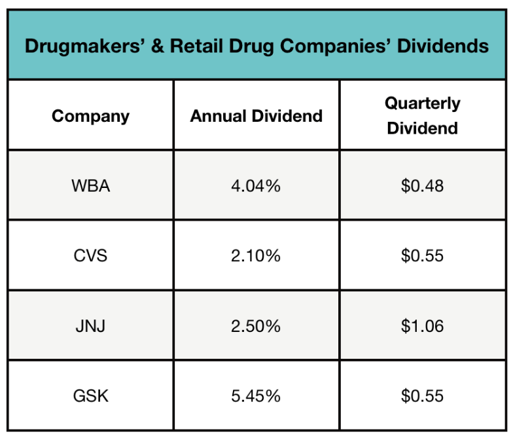

And given today's abysmally low yields, some of those companies make a lot of sense when considering their dividends:

In fact, both Johnson & Johnson and Walgreens are members of the S&P 500 Dividend Aristocrats — companies that have increased their dividends in each of the last 25 consecutive years.

- J&J is also a Dividend King, having raised its dividend for 59 consecutive years.

That doesn't mean you should rush out and buy any of the above stocks.

As always, timing is everything, and it's crucial to do your own due diligence … but you can always dive into the Weiss stock ratings to research which ones might be a good fit for your portfolio.

Keep in mind that during market corrections or bear markets, these are the kinds of value stocks that traditionally outperform growth stocks.

You can find a similar approach with some of the companies in my colleague Jon Markman's service, The Power Elite.

His subscribers are currently sitting on open gains of 116.28%, 129.47% and 143.35% in what I would consider fundamentally sound companies. Click here to learn more.

Bottom line: There are big profits to be made from treating scrapes, cuts and bruises.

After all, the only medicine better than Monkey Blood was my mother's gentle kiss on my forehead. Everything felt better after that.

Best wishes,

Tony