|

| By Sean Brodrick |

After a tough couple of years, the real estate market is licking its chops. It is eyeing potential interest rate cuts at the upcoming Fed meeting on Sept. 17-18.

As I write this, the Street has already priced in a 25-basis point rate cut for September, with a 33% chance of a 50 bp cut. Many think this will provide the needed relief for homebuyers.

My view: Probably not. But it WILL be a boost for investors.

I should add that Donald Trump and Kamala Harris are pushing very different plans to address the housing crisis. Will those help homeowners, investors or both?

That’s a bit tricky. Let me explain …

The Housing Dilemma

Let’s start with the question: “Does America have a housing crisis?” Simply, yes.

The problem started back in the Great Financial Crisis of 2008. After that, America moved from having a surplus of housing to a deficit.

Before 2008, there were about two million new home starts per year. After 2008, home starts plunged.

And they remain low, averaging about 1.1 million new homes a year. That’s far below the 1.6 million needed to keep up with population growth.

Estimates vary, but America’s housing shortfall is now between 1.5 million and 5.5 million units.

The Trump Plan

Trump has given few details on how he will address the housing crisis. He did say he might offer down payment assistance to prospective home buyers.

Along with other Republicans, Trump also called for the opening of limited amounts of federal land for development and for cutting regulations that raise housing costs.

Basically, Republicans will cut regulations and let the states take the lead. But they aren’t giving many details on how.

The Harris Plan

Harris would tackle the problem of corporations driving up home prices by denying tax benefits to investors who buy large numbers of single-family homes and turn them into rental properties.

She also has ideas on rent control for those types of properties.

Among her proposals is one to build 3 million homes over the next four years, partly powered by a tax incentive for builders of starter homes and a new $40 billion innovation fund.

She also wants to give $25,000 to first-time home buyers.

Some critics say that giving new home buyers $25,000 would just increase the price of starter homes by $25,000.

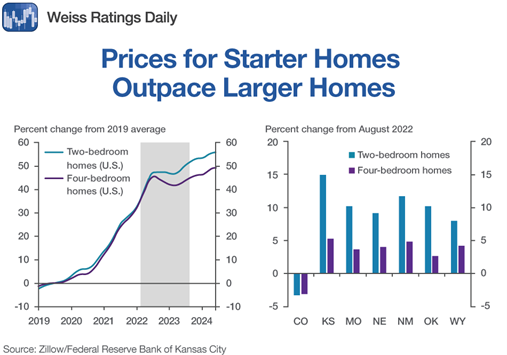

Those critics might have a point. Prices for starter homes have outpaced larger homes since 2022, according to data compiled by the Kansas City Fed …

One reason is there are fewer starter homes. And critics say giving new home buyers $25,000 would squeeze supply and drive prices up.

On the other hand, Harris does have a plan for that — tax incentives for builders of starter homes.

Lower Interest Rates — Higher Prices

Another thing that would help everyone is lower interest rates. And that brings me back to where I started this article.

Interest rates and home prices usually have an inverse relationship. When mortgage rates go lower, home prices typically go up.

So, lower interest rates won’t be the panacea many home buyers hope for. On the other hand, it’s potentially good news for real estate investors.

That’s because rising home prices will boost real estate stocks and ETFs. Here’s a good one …

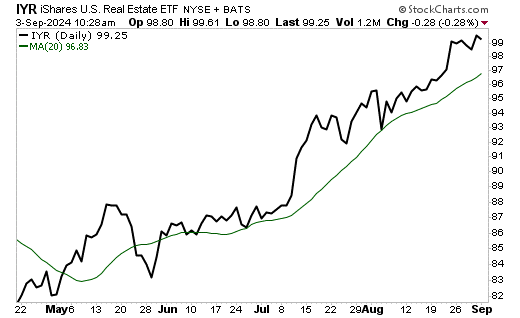

The iShares U.S. Real Estate ETF (IYR) has a Weiss Rating of “C” and an expense ratio of 0.39%. It also has a dividend yield of 2.7%, much better than the S&P 500 yield of 1.3%.

You can see that the IYR has stepped higher along its 20-day moving average since June.

I don’t like to chase anything, but I could see buying this fund on a pullback to the 20-day.

My price target is $122 a share in the next six months.

In the IYR, you get a basket of leading real estate stocks: Prologis (PLD), American Tower (AMT), Equinix (EQIX) and more.

It’s one way to play an industry that — thanks to more rate cuts — could be set up for a great 2025.

All the best,

Sean

P.S. Of course, another industry that could get a shot in the arm with falling interest rates is tech.

My colleague and tech guru Michael Robinson recent found a target tech opportunity he’s calling “The Next Nvidia.”

You will want to see what he has to say by grabbing your spot here.