How to Capitalize on the Rising Value of the Dollar

The stock market is a fluid situation and dynamics at play are drawing a deepening gulf between investment winners and losers.

In this segment, I speak with Senior Analyst Mike Larson who describes the game of catch-up the Fed is playing, stocks that are recession-resilient and how the rising value of the U.S. dollar is affecting investments across the board.

You can watch the video here or continue reading for the full transcript.

Jessica Borg (narration): How does a house in the midst of olive groves sound?

How about a cliffside getaway on the Mediterranean?

You may want to consider making that purchase if it's always been your dream.

JB: It's a good time to buy that beautiful villa overseas!

Mike Larson: I'm only half joking … if you're looking for foreign real estate or things like that — a second home or vacation home or you're nearing retirement and you've always wanted somewhere to relocate, but you've never had the time or money to do it — those are the kinds of things that as the dollar gets stronger, you, with dollars in your bank account, can go and buy on the cheap.

JB (narration): Yes, the value of the U.S. dollar is gaining strength and has parity with the euro.

Mike Larson, editor of Safe Money Report, says that means global capital will be pouring into the dollar.

ML: The easiest thing to keep in mind about currency values is when you have higher interest rates in one country versus lower interest rates in another, money is going to gravitate toward the higher-rate countries. That's just how it works because people want yield. They want more yield earned on their cash.

When you have a U.S. Fed that's out there doing 50-, 70-basis-point hikes and they're doing it every several weeks, and you have the European Central Bank — which is only on the cusp of doing its first hike and it's only going to be 25 basis points — and you have the Bank of Japan saying it never wants to raise interest rates again and going to keep rates at zero, you can see why money is coming out of the yen, money is coming out of the euro, and money is flowing into dollars.

JB (narration): So, if you're a U.S.-based investor, you want to focus on U.S.-based companies that earn most of their money in the U.S.

You want to stay clear of funds that track foreign stocks or foreign bonds because of headwinds that you'll be facing.

ML: When the dollar is going up, it lessens the dollar value of the foreign bond you own or the foreign stocks that your mutual fund owns, for example.

JB (narration): But consider the overall economic conditions. A recession in the U.S. might not be far off.

ML: I think it's going to have by the tail end of this year or early next year.

But a recession more broadly isn't just two quarters of negative gross domestic product. It's joblessness going up, office vacancies rising. There are a lot of other things that tend to go into it.

There are some people out there that are saying that we might hit the technical definition of a recession right now.

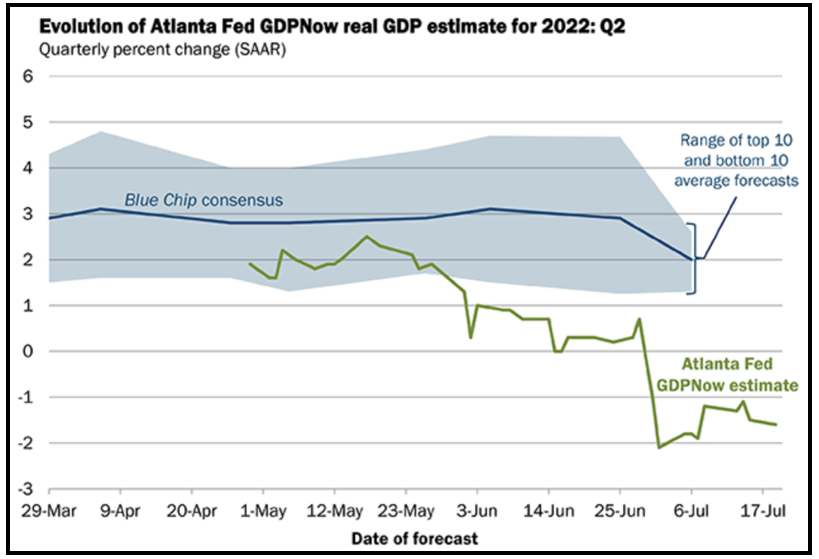

In this first quarter of this year, we already had negative GDP growth. Some of the models out there that look at the data coming in and try to estimate what the second quarter is going to be are, in fact, spitting out negative numbers.

JB: There are areas of the market that remain promising for investors.

ML: Yes, if you focus on domestic companies, you tend to tilt your investments toward more defensive sectors, and I think that's the best strategy for an investor right now.

These are defense kinds of names that don't need a hugely powerful and strong economy to do very well, and to generate revenue and earnings.

JB (narration): Defensive sectors like consumer staples and utilities.

One food-and-beverage giant Mike recommends is General Mills (GIS), which has a juicy dividend yield of 2.93%.

ML: We all think of General Mills as cereal, but they're involved in a ton of other food and beverage products.

JB (narration): It also meets certain safety criteria to get a Weiss rating of "A," a signal to buy.

Another name in the Safe Money Report model portfolio is major food, snack, and beverage company, Mondelez International (MDLZ).

Mike says these types of stocks may not get all the attention, but they're the ones generating profits.

ML: They may not knock your socks off. They may not be the greatest, most exciting type company — everyone wants to talk about EVs and things like that — but they're what's making you money as an investor now, and they're the kinds of companies that are going to attract money in the rising dollar, weakened economy environment that we have.

JB (narration): If you're a fan of exchange-traded funds, the biggest and most popular ETF in the consumer staples sector is Consumer Staples Select Sector SPDR Fund (XLP).

And in the utilities sector, there's Utilities Selector Sector SPDR Fund (XLU).

ML: And then you can use the Weiss Ratings to drill down within some of those ETFs and see which companies have the highest ratings, which have a little more yield.

JB (narration): Mike says to keep in mind …

ML: In an environment where Fed-hiking is generally bad for stocks and some other assets, it's good for a few others out there — like the dollar.

As an investor, you have to make sure that you're positioned in more of what's working and less of what isn't.

When you have a rising dollar, it tends to hurt commodities, precious metals, miners and things like that.

There's a real huge split between winners and losers in this environment.

JB (narration): Fortunately, it's clear what some of the emerging winners are.

JB: Senior Analyst Mike Larson, it's always terrific to get your insights. Thank you so much for your time today.

ML: Great, thank you.

Best wishes,

Jessica Borg

Financial News Anchor