|

| By Gavin Magor |

Happy Memorial Day!

Whether you’re having a BBQ with family, enjoying time at the beach or just spending time at home watching a baseball game, enjoy.

But never forget the true meaning behind the holiday, and that is to honor and salute those who made the ultimate sacrifice.

Last week was an action-packed week in the markets, but I want to use today’s issue to talk about some shocking developments in the insurance industry.

You may recall that I wrote an article on the insurance industry last fall about some major concerns within insurance.

A lot of what you know about the insurance industry may be incorrect, at least for those of us living in disaster-prone states.

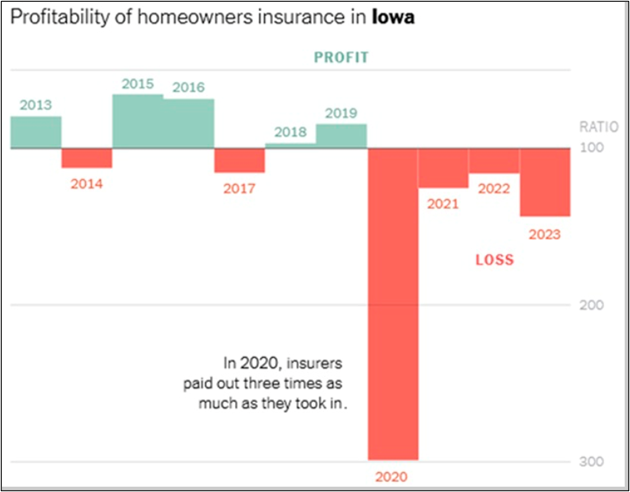

Because it’s not just us that are seeing our property and casualty premiums skyrocket ... I’m talking about most states, and even those that have never had a hurricane and only had one instance of an earthquake, like Iowa.

Check out the profitability of homeowners insurance in the Hawkeye State over recent years:

Sure, inflation is a big part of higher premiums, but lack of competition and greed are also a large part of the equation.

You see, property and casualty insurers make their money through investments. They take your money (premiums) upfront and then they invest that money.

Then, they delay any payouts they have to make for as long as possible. They do this because that time delay can make them big money. In other words, these companies are investment funds.

Don’t just take my word for it — consumers are bearing the brunt right now ... and I’m sure you’ve noticed an increase in your premiums.

But not to worry … one of the smartest things consumers can do is check out our Weiss Insurance Ratings for peace of mind and sanity.

Let me show you how …

Insurance Ratings for Rationality

Much of an insurance company’s safety can also be tied into its investment strategy. If they’re not making money overall, then they’ve got a problem and they’re not safe.

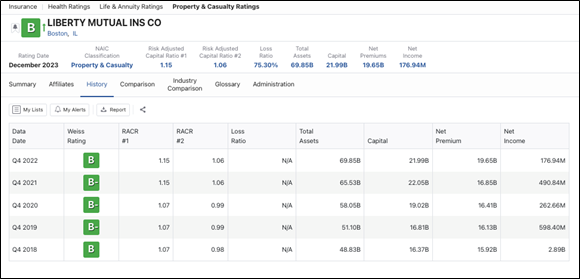

Let’s take a look on our P&C Ratings page at a very large provider, Liberty Mutual, who we currently rate as a “B.”

We have done the heavy lifting, but you can see that its risk and surplus are all healthy metrics above. Risk Adjusted Capital Risk, Loss Ratio and Net Premiums are all extremely important gauges when looking at an insurance company.

Typically, a P&C insurer will owe many, many multiples of their capital in potential exposure — that is just how the business works. They don’t expect to pay out on all the exposure ... and that’s why reinsurance comes in, so they can go even deeper.

Another great tool is our ‘History’ feature. It breaks down the rating for each insurer on a yearly basis. Check out Liberty Mutual’s:

Going back to my point about many insurers being greedy, insurance companies pay their executives very well, even if their float is down. Float is another insurance industry term, meaning the amount of money remaining from premiums that have not been paid out in claims.

At the moment, the issue may be controllable, but in coming years, if things get worse and we eventually see another housing crisis, the federal government may have to step in to create an emergency fund.

Ultimately, this would be a good solution to a very unfortunate problem, but the pockets of the Fed surely run deeper than many insurers.

However, this wouldn’t help resolve the problems like we've seen going on in Florida.

A vast majority of people can’t get a premium at a reasonable rate ... and the rates differ considerably, even among neighboring people.

You see, premium prices that insurers are charging don’t reflect actual risk, they charge theoretical risk.

From what I’ve seen, insurers don’t act in the best interest of the policyholders; very often, they’re acting in the best interest of their shareholders.

They don’t have interest in the woes of their policyholders, and we’ve seen that in multiple situations.

This year alone, Heritage Insurance — a Florida insurer — was fined $1 million for not paying policyholders fairly in the wake of the many claims submitted following Hurricane Ian.

Weiss Ratings is here to help consumers, and our insurance ratings should be your first destination when doing insurance research.

Cheers!

Gavin

P.S. Nvidia continues to be the face of artificial intelligence. But while everyone’s patting Nvidia on the back, it’s quietly moved on to the next phase of AI. Click here to find out about the three companies Nvidia needs to help conquer this new AI frontier.