|

| By Sean Brodrick |

Man is the market obsessed with a potential recession now.

JP Morgan (JPM) CEO Jamie Dimon captures the mood of the Street when he says a U.S. recession is very likely to happen in six to nine months.

Some think the odds are even higher.

This kind of thinking is combined with the Federal Reserve hiking interest rates — which takes away the free money the market became addicted to over a decade — and I can’t blame anybody for wanting to hide under a rock.

But you know what? You’d be missing out on the opportunity of the decade! I’m talking about …

Battery Metals

Electric vehicle sales are soaring, driving demand forecasts higher and higher for the metals in the batteries and wiring.

Supply will be hard-pressed to keep up. If you act now, you could set yourself up for a potential mountain of profits.

Let’s look at some facts:

• The International Energy Agency says global EV sales doubled in 2021 to 6.6 million vehicles.

• That figure accounts for nearly 9% of the car market.

• Looking forward, the EIA says 2022 will show “another all-time high for electric vehicle sales, lifting them to 13% of total light duty vehicle sales globally.”

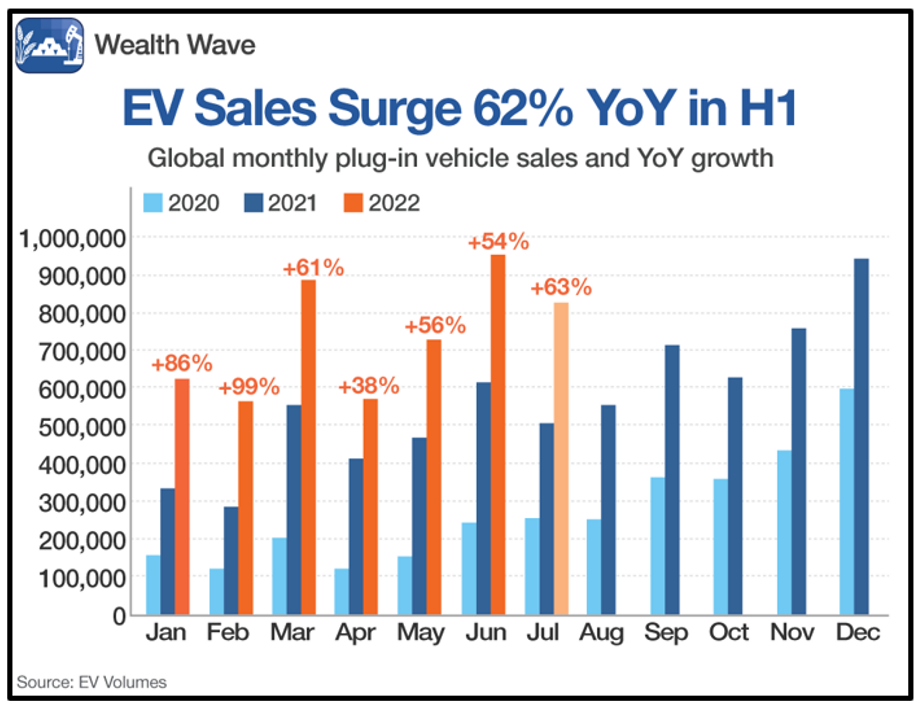

Sales figures through July show the IEA is probably right:

According to data from EV Volumes, a total of 4.3 million new battery EVs and plug-in hybrid EVs were delivered during the first half of 2022. That’s an increase of 62% compared to the first half of last year.

Sales continued to be strong in July, up 63% year over year. For the full year, sales are forecast to rise 57%. The way things are going, that might be a low-ball estimate.

It’s something members of my trading service, Wealth Megatrends, are dialed into. They’re enjoying double-digit gains while being paid generous dividends in almost all positions. Click here to find out more.

And everyone is worried about China’s economy, right?

The reason for that is because the country keeps locking down cities due to COVID-19 outbreaks. Well, despite the ongoing pandemic, China’s EV sales in the first half of the year soared a whopping 113%!

EV demand is the main driver of battery metals. The other is electricity storage, which is necessary for alternative fuels. Let’s see what this will do to demand for battery metals:

As you can see, overall demand for metals used in lithium-ion batteries is forecast to eclipse 17 million tons by 2030. That’s according to Bloomberg New Energy Finance.

Here’s the wild part: As recently as a year ago that forecast was for a rise of just 10 million tons over the same time frame.

So, in the past year, the forecast for battery metals demand has soared by 70%!

What’s that mean? It means …

Battery Metals Are a Bargain

Throw in stricter and stricter sanctions on Russian exports of aluminum, nickel, copper and other metals, and prices could become quite volatile.

In Saturday’s column, I told you how bullish the supply and demand picture is for lithium. Now, you can see it’s bullish for all sorts of metals.

And just last month, Benchmark Minerals reported:

“More than 300 new mines need to be built over the next decade to meet the demand for electric vehicle and energy storage batteries. At least 384 new mines for graphite, lithium, nickel and cobalt are required to meet demand by 2035, based on average mine sizes in each industry. Taking into account recycling of raw materials, the number is around 336 mines ... Yet another 72 mining projects with an average size of 42,500 tonnes will be required to meet battery demand for refined nickel.”

Are those mines going to be built? Maybe. We’ll have to find the deposits first.

There is now less hard-rock lithium being produced by mines than in 2019 because the economic crisis that came with the pandemic tipped some miners into bankruptcy.

So, what if America — and the world — tips into recession? That would weigh on demand for some of these metals, but not all, or at least not a lot.

Lithium and nickel in particular look to have very strong fundamentals. And global inventories of copper at exchange warehouses are near the lowest level in more than a decade.

How Investors Can Play It

There are exchange-traded notes that let you track and trade the metals.

But my choice would be miners that are leveraged to the underlying metal and that also pay fat and growing dividends. This is because even if the blast-off in metals prices is delayed, you’re paid to wait.

And since these miners have been dragged down with the broad market, you can buy them at HUGE discounts.

You could roll up your sleeves and do the hard work to find individual miners or you can just buy the Amplify Lithium & Battery Technology ETF (BATT).

It’s loaded with great metals miners including BHP Group (BHP), Glencore (GLNCY), Albemarle (ALB) and more. And it sports a forward dividend yield of 2.8%. That compares nicely to the S&P 500’s forward dividend yield of just 1.8%.

One more thing — and you may not like this — BATT is trading near a 52-week low:

I don’t see this as a problem. For one thing, many of the stocks in BATT are way oversold and looking dirt-cheap at recent prices.

Also, I know there’s a massive megatrend in place that is going to push demand for these metals higher — and the stocks of companies that mine them will go along for the ride.

You might not be buying at rock-bottom, but that fat dividend pays you to be wrong for a bit until the hit that point.

The long-term forecast is much higher. So, you’re buying BATT out of the bargain bin.

You can play the battery metals megatrend however you like. But don’t ignore this opportunity. As always, remember to conduct your own due diligence beforehand.

All the best,

Sean