|

| By Gavin Magor |

Not only has silly season come early this year, but it’s also gotten extra silly … and fast.

On Friday, the major indices tanked after last week’s job report came in significantly higher than expected with unemployment hitting its highest mark since October 2021.

Like I mentioned in last week’s column, expect strong volatility in the coming months. This past week could not have provided a better example of that … and what’s possible to come.

Make no mistake, there is a lot going on in the markets right now. It is earnings season, we expect an interest rate cut in September and it’s an election year, among other things.

Sure, these stories are fueling volatility just as warm ocean waters fuel a strong hurricane. But these market movements are not justified.

These types of hard swings are not normal. And I don’t see the market heading in one direction or another … just vigorous volatility.

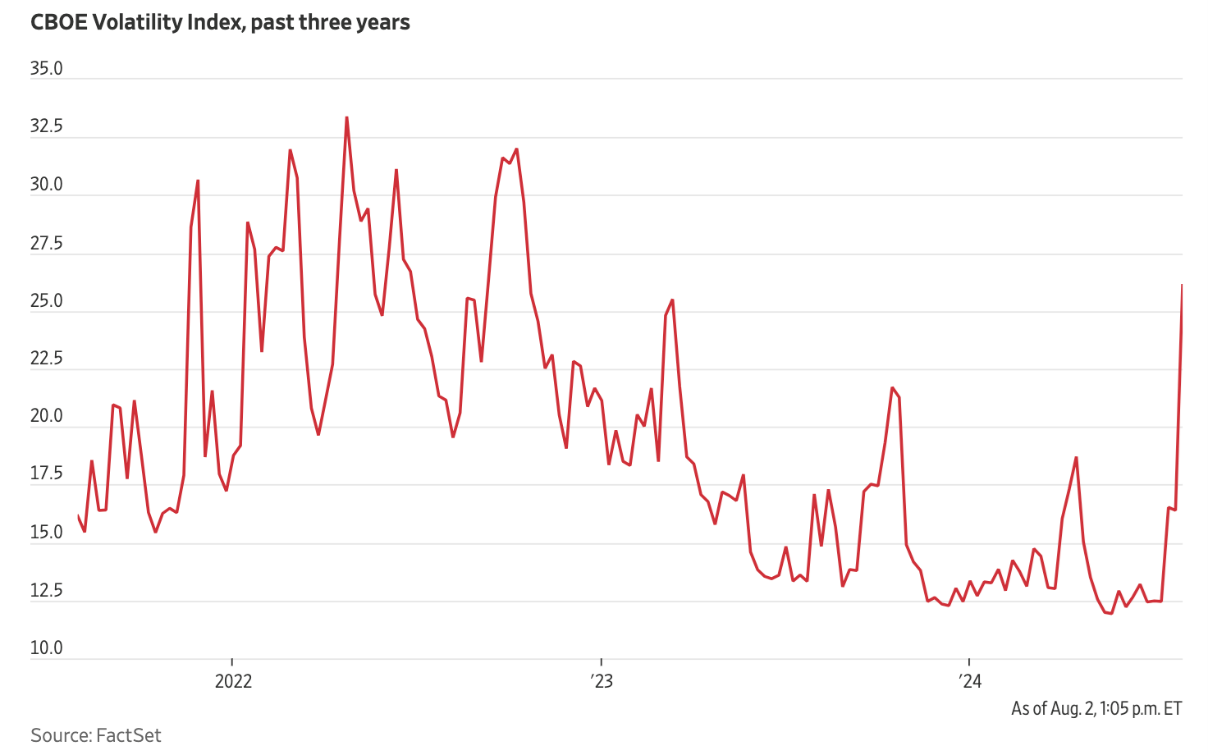

Don’t just take my word for it … let’s take a look at last Friday’s CBOE Volatility Index, or VIX, which hit its highest level since 2022.

The VIX rose above 29 on Friday, up a rocketing 60% from Thursday. As of writing, the Nasdaq was down 279 basis points, and the S&P 500 was down 232 basis points.

So as the market twists and churns like the ocean’s swell increases in foul weather, I reckon you head to an oasis of sanity. That’s the Weiss Stock Ratings.

Superior Stock Sorting Solution

A stock with an “A” Weiss Rating is defined as:

“The company’s stock has an excellent track record for providing strong performance with minimal risk, and it is trading at a price that represents good value relative to the company’s earnings prospects. While past performance is just an indication — not a guarantee — we believe this stock is among the most likely to deliver superior performance relative to risk in the future.”

So, when you see that beautiful green “A” next to a stock, you can be assured that it has undergone a rigorous test … with a very strong bias towards safety.

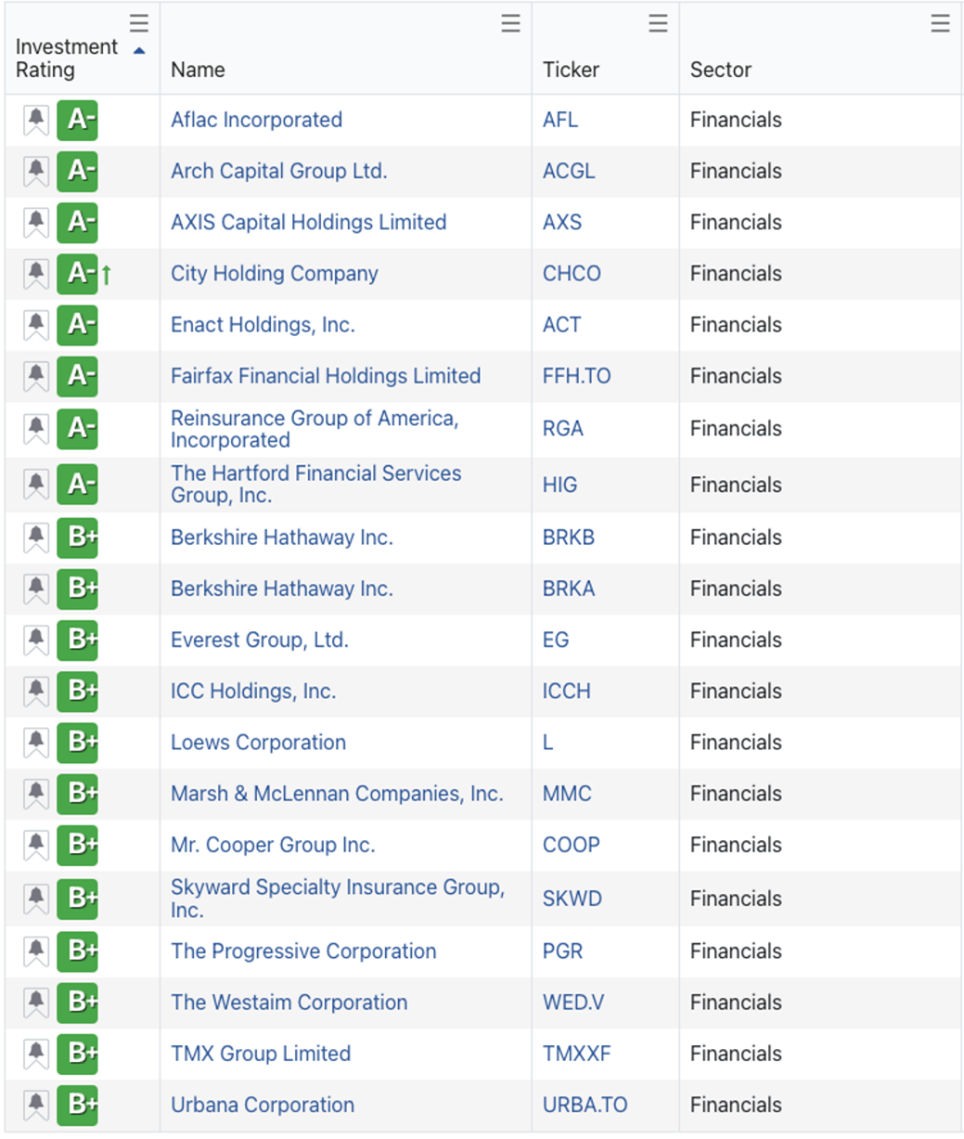

Let’s take a look at some recently upgraded names into our “A” territory:

One name above that really strikes my eye is City Holding (CHCO).

CHCO is a regional bank that primarily operates in underserved markets. It appears to be benefitting from higher interest rates and economic growth.

Another strong testament to its safety is that it has been in our “Buy” range since November of 2021.

Turning to the technical side of things, shares are up 84% over the past four years, not including their very respectable 2.35% dividend yield.

Be sure to explore this company.

And also, financials stocks in general are benefitting from the higher interest rate environment that I mentioned.

So, if you’d like to broaden your financials exposure, be sure to consider some ETFs as well.

One big financials ETF is the Financial Select Sector SPDR Fund (XLF), which is up 11% year-to-date.

You could also go back to the Weiss Stock Screener and explore all of our highly rated financials names.

Wherever you go to do your investment research … be sure to make the Weiss Ratings one of the highest priority spots on your list.

Just as some of the best sailors rely on their radars and compasses during rough seas, be sure to let the Weiss Ratings guide you through strong market volatility.

Cheers!

Gavin

P.S. Another great guiding light during times of volatility and wild market swings is Safe Money Report. As its name suggests, it is made for times like these. Click here to see the latest presentation on a coming threat.