In this segment, Financial News Anchor Jessica Borg interviews Senior Analyst and world traveler Tony Sagami about his trip to Sri Lanka and investments tailored to the global demands of the day.

You can watch the video here or continue reading for the full transcript.

Jessica Borg (narration): These photos are courtesy of world traveler and Senior Analyst Tony Sagami.

He's taking in all the natural splendors of Sri Lanka.

Tony Sagami: It wasn't on my radar, but this truly is one of the most beautiful, magical countries I've been to.

JB (narration): At this moment in time, there's also this — long lines for gas. At times, they are hours-long, and sometimes, there's none left to get.

There's also protesting in the streets.

JB: Tony, this is a really interesting time to be in Sri Lanka. What's your experience been like so far?

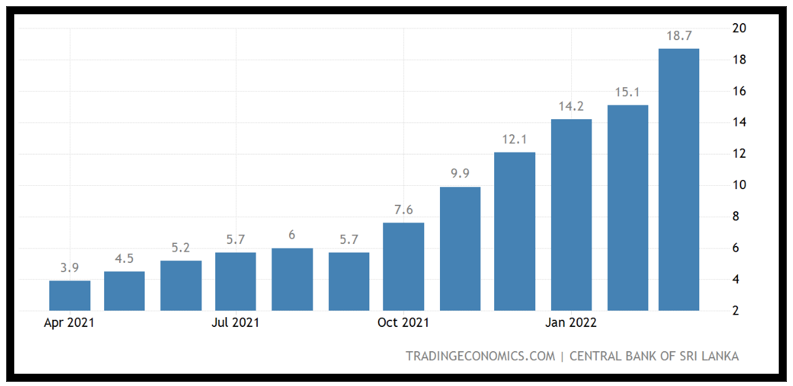

TS: It's not just the gasoline shortage, but inflation, in general. Gas prices are way up, almost double.

And it's symptomatic of a government that's spent too much money and gave away too many benefits.

As a result, they have no foreign currencies. They can't pay Saudi Arabia or other places they're buying oil from, and so that's why they have the shortages. And it's so bad that there are brownouts once or twice a day for one to two hours.

And that's really a problem when it's 90 degrees.

The cost of everything is going up, including their food.

Here, the price of dal — which is a staple of Sri Lankan and Indian diets — has almost tripled in the last two months.

JB (narration): Prices have gone up, while the value of the Sri Lankan rupee has fallen. Tony's hotel won't even accept it.

TS: They said, "We will not accept Sri Lankan dollars. We only want U.S. dollars, euros or British pounds." And I thought that it was very unusual for a country not to accept its own currency.

JB: And you think there's a correlation between the situation there and here in the U.S.?

TS: It's not a coincidence that Sri Lanka has inflation and so does the U.S., because of the government spending too much money and borrowing money that it doesn't have.

It's not just Sri Lanka and the U.S. It's also Germany, Japan, England.

JB (narration): Tony is editor of Disruptors & Dominators. The portfolio holds stocks tailored to this unique economic environment.

TS: The Federal Reserve has two main instruments. Number one is interest rate policy, which they have tightened once and are going to tighten again very soon. But there's also the supply of money … and that's quantitative easing.

They say they're going to reduce the balance sheet, but they haven't yet, despite promising to do so back in December.

JB: You write a lot about how a lot of hard assets are having a great run right now.

TS: Make sure you have a healthy allocation to hard assets, and there's all kinds of hard assets like gold and industrial metals.

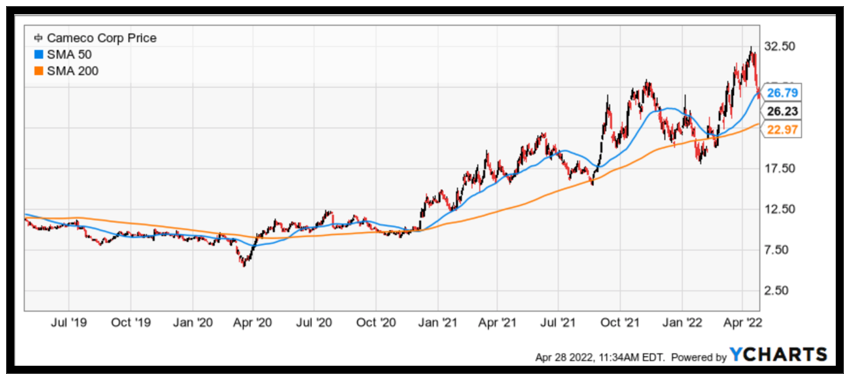

Uranium has skyrocketed because it's turning out — surprise, surprise — to be a popular green energy alternative after decades of hatred.

JB (narration): Investors with Disruptors & Dominators are sitting on large open gains right now with Cameco Corporation (CCJ), the world's largest publicly traded uranium company.

TS: This movement toward green energy is not going to stop. It doesn't matter which political party you're with.

And wind and solar are very useful, but they're not going to roll out at the capacity that we need, to completely replace fossil fuels.

The biggest bridge between green energy and fossil fuels is nuclear power.

Countries all over the world are starting plans to build and expand nuclear plants, and that just means more demand for uranium.

JB (narration): The D&D portfolio also holds U.S. Global GO GOLD and Precious Metals Miners ETF (GOAU) and Pan American Silver (PAAS).

TS: It's the largest silver producer in the world.

And silver has a unique characteristic in that it's a hard asset but has a store of value, just like gold.

But it's also heavily used for industrial materials.

And it's especially needed in the green energy way, when you look at solar panels and electric cars.

And so silver, I think, has a very bright future.

JB (narration): Even with volatility likely a mainstay for months to come, Tony is confident the market will thrive.

TS: The market is going higher because we're not in a recession — not even close.

Take a look at unemployment, gross domestic product (GDP) growth, retails sales — the economy is still very healthy.

Because remember, a recession is two consecutive quarters of negative GDP growth, and you can't have negative GDP if Americans are spending money.

JB (narration): He says market corrections are simply to be expected.

TS: Corrections are very common. As a matter of fact, those 5-10% corrections? On average, we get four of those a year.

That's on average. And we also average one +10% correction a year.

Don't let them dissuade you from your long-term goals.

JB (narration): And aim for good returns on investments suited to these times.

JB: Senior Analyst Tony Sagami, always a pleasure speaking with you. Thank you so much for making time for me today.

TS: Thank you.

Best wishes,

The Weiss Ratings Team