|

| By Dawn Pennington |

Last month, more happened besides crashing stocks, Fed shenanigans and a meager kick-the-can “continuing resolution.” It was also the first month we’ve seen big IPOs in quite some time.

September brought two much-talked-about IPOs, Instacart (CART) and Arm Holdings (ARM).

Fun fact: If you click on CART, you’ll see that Maplebear is the company’s official name. Maple is a nod to Canada, and bear is a nod to California’s state flag. The founder dreamed up Instacart during one Canadian winter and launched it from the Golden State.

In case you missed it back then, your analysts and editors did give their opinions on how to play these new stocks:

- Chris Graebe gave us his thoughts on whether it’s worth it to pick up some Instacart shares here at the ground level. (Hint: He prefers getting in even sooner!)

- Jon Markman said that there’s no AI without ARM. That’s because this British chip designer has been around since 1990. And one of its biggest customers is the biggest name in AI right now, Nvidia (NVDA). In fact, if you can pick up ARM around $42.50, as Jon suggests, that’s like buying Nvidia at a 90% discount!

Another fun fact: This is Arm’s second tour as a public company. SoftBank took it private in 2016 at a $32 billion valuation. Upon its latest IPO, the company was valued near $60 billion.

So, while both IPOs had eyes on them from inside our building, neither were a “Buy.” There’s a very good reason for this.

But first …

Click here to see full-sized image.

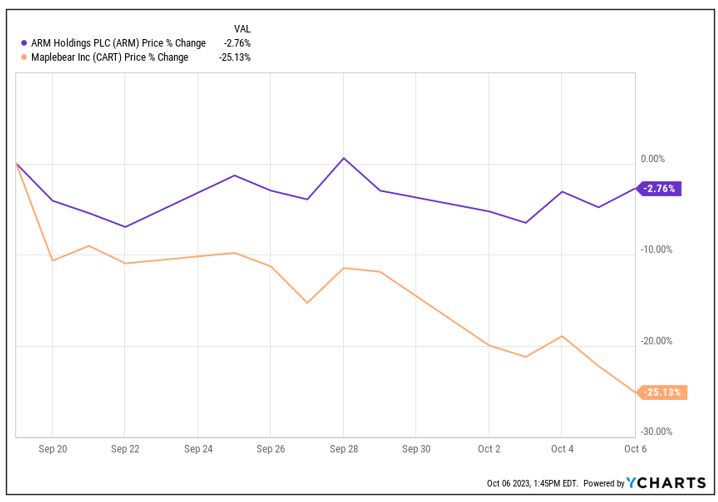

While there was plenty of excitement to start, even pushing pre-launch prices up, the market’s very bad, no-good month took its toll here, too.

Both IPOs have been fairing pretty poorly so far. That’s not to say they won’t both make something of themselves someday. We just know it ain’t today. In fact, we built that very idea into our Weiss Ratings system.

We don’t give superficial ratings to any stock, ETF, bank, insurance company or crypto. There’s just no point to rate something before it has a history.

These two companies will need to get some public exchange trading action under their belts before they can graduate from their current “Unrated” statuses.

As you can see, we take our Weiss Ratings very seriously. Of course, if you are a long-time Friday Weiss Ratings Daily reader, you know this all too well.

Gavin Magor — who is actually our Director of Research & Ratings — lays out a new case every week for why you should trust our system, and how to use it to find new investment ideas.

I bring all of this up because just recently he let me in on a little secret … he’s all set to release, for the very first time, a brand-new technology designed to boost even further the performance of our already-valuable Weiss Stock Ratings.

Gavin, Dr. Martin Weiss and the Research & Ratings Team have been working on this technological upgrade for eight years, long before most people even believed this technology was possible.

Here’s what Gavin had to say about it just the other day …

“You know all about the tremendous wealth that’s been created by Apple (AAPL), Alphabet (GOOGL) and Microsoft (MSFT).

And let’s not forget Nvidia (NVDA) or Berkshire Hathaway (BRKA).

But how do you find stocks that are even better?

How do you create a short list of companies that offer BOTH better growth potential AND better relative safety?

On Tuesday, I will give you a live demonstration of exactly how I personally do it using the Weiss stock ratings — the same ratings that you have access to online right now.”

He’s also going to divulge how the technological upgrade can actually boost profits even more.

Oh, and that “Tuesday” he mentioned … that’s tomorrow.

I asked if I could share this live demonstration with you. Martin and he agreed. They just need to know you’re coming. Just click here, and we’ll take care of the rest.

To your wealth,

Dawn Pennington

Editorial Director