|

| By Gavin Magor |

“A billion here, a billion there; pretty soon you’re talking real money.” — Sen. Everett McKinley Dirksen

Man, if you or I owed as much money as the U.S. government, we would have filed for bankruptcy a long time ago ...

Yet, thanks to the ability to print money and increase credit limits at will, it’s business as usual on Capitol Hill. And Dirksen’s 1950s-era quote remains timeless.

In fact, when you consider how much the U.S. owes, the rate that debt grows every year and all the interest paid, its fiscal health is on the verge of failing.

The national debt is now around $36.2 trillion, or 122% of the Gross Domestic Product.

When you add debt that includes states and cities, that figure balloons to over 135% of GDP.

In other words, the federal government’s debt is growing faster than the economy.

Today: ‘A Trillion Here, a Trillion There’

A big chunk of that government debt is interest.

The rate is so high that the government is now borrowing money simply to cover these interest payments.

Interest alone on the $36 trillion debt is now $1 trillion, up from $300 billion just a few years ago.

It doesn’t help the case that interest rates aren’t falling at the pace — even rebounding — as many folks expected.

How Did the Debt Grow So High?

Well, borrowing can be an effective tool for recovering from public health crises and natural disasters. Or for building infrastructure that will last a long time.

For example, bailing out U.S. banks to prevent a collapse during the 2007-’08 crisis and ensuing recession seemed like a good idea at the time.

However, government debt really exploded as a result, and COVID-19 compounded the problem.

The U.S. paid out roughly $5 trillion in the pandemic to households, mom-and-pop shops, restaurants, airlines, hospitals, local governments, schools and other institutions.

In the past, debt would spike during recessions or crises but then decline after those events.

More recently, though, it’s grown like a beanstalk … even when the economy is doing well.

The Math Isn’t Mathing

As a result of all this spending, the U.S. has the largest budget deficit of any of the 38 countries that comprise the Organization for Economic Cooperation and Development (OECD). Those nations include Europe, North America, the Pacific Rim and Latin America.

The deficit is expected to be roughly $2.3 trillion this year, with about $7.5 trillion in expenses vs. $5.2 trillion in revenue.

We already know that running a deficit nearly twice that of GDP growth is not viable over the long term.

And when you add another $2 trillion of non-discretionary spending into the equation, it makes matters even worse.

The debt crisis is so big, and mandatory spending so great, the government debt bubble can only keep growing for so long.

If (or when) it pops, we could be in for even higher borrowing costs, slower wage growth, more expensive goods and services, and a depreciating dollar.

Good Thing We Have Gold … and Silver!

Gold has long been the leading indicator in the precious metals market, often initiating long-term bull markets.

Our resident natural resource expert Sean Brodrick has been calling for gold to hit $3,000 before midyear.

With the yellow metal currently sitting at an all-time high near $2,900, his forecast could very well be realized much sooner.

Silver tends to follow gold’s lead but with a delayed reaction. One that can result in even more pronounced gains.

Especially if Sean’s full forecast bears out and we see gold surge to $6,000 longer term.

And because silver is only a sliver of gold’s price, it can behave like a call option — giving you exposure to gold’s next moves, but at a fraction of the cost.

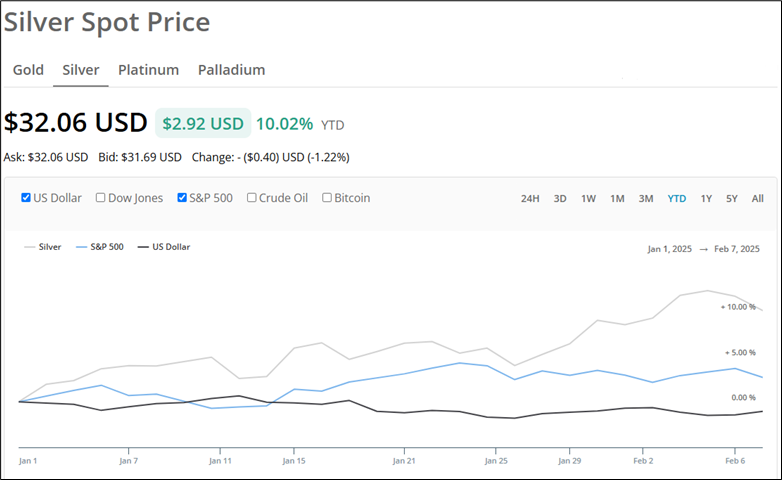

Trading at $32.06 an ounce, silver has already gained 10% in 2025 and 40% year-over-year.

Prices are expected to reach $38 before the year’s end.

Sean’s got a much more ambitious target for silver in mind.

He believes silver will hit at least $100 an ounce over the course of a multiyear bull rally.

That’s a potential 212.5% rally from today’s prices!

That sounds quite achievable. After all, silver is the most widely used commodity after oil.

Demand for silver has been so strong since 2021 that supply from mines can’t keep up.

On top of that, there’s a big new driver behind demand: artificial intelligence.

AI is expected to contribute $15.7 trillion by 2030 to the global economy, but that’s not possible without silver.

2 ETFs That Could Really Shine

Last week, I gave you “Our Highest-Rated Gold Plays” for 2025.

Today, I want to give you a pair of ETFs to prepare you for the next leg higher in silver.

Let’s start with the iShares Silver Trust (SLV).

SLV is the largest ETF focused on the precious and industrial metal. The ETF owns bars stored in JPMorgan Chase bank vaults in New York and London.

When it comes time for silver to shine, we may look back at today’s price around $29 a share as a bargain.

If you’d like exposure to the broader precious metals sector, just remember the word “glitter” because that is its ticker!

The abrdn Standard Physical Precious Metals Basket Shares ETF (GLTR) gives investors direct exposure to physical gold, silver, platinum and palladium.

Like SLV, GLTR holds physical bars of these precious metals in bank vaults.

It’s more expensive at around $120 per share. But with over a billion dollars in assets under management, and with gold and silver accounting for about 85% of it, GLTR offers a one-stop shop to invest in bars that you don’t have to hide in your financial bugout bag.

Cheers!

Gavin Magor

P.S. If gold and silver stocks are more your style, you’ll want to check out Sean Brodrick’s “7 NEW Gold Bull Run Plays.”

I’ve seen his research ... and these picks have enormous earnings growth and very bright potential. Some may even say it’s the start of a new gold rush. Click here now to see if you agree. Watch this video all the way to the end, and you’ll also see how to get a 2-gram gold bar of your own, sent right to your house!