Metals Heat Up as the Shutdown Looks to Wind Down

|

| By Sean Brodrick |

The U.S. government enters Day 43 of the shutdown today.

But it could open back for business next week, for the first time since Sept. 30.

That’s according to the world’s leading prediction markets site.

Bettors on Polymarket now give a 95% probability that the shutdown ends on Friday, Nov. 14.

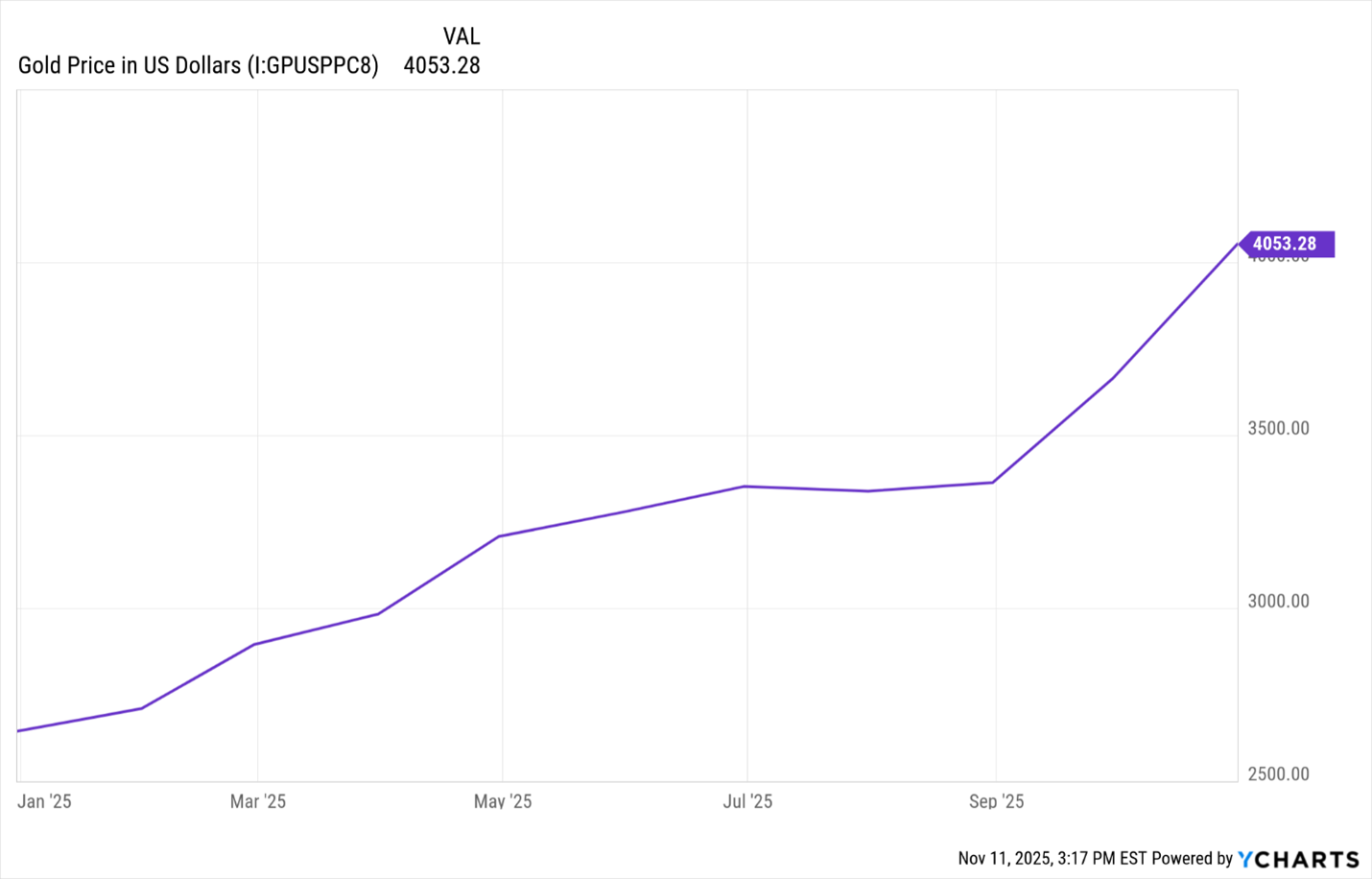

Stocks and precious metals have run higher this week in anticipation of all that sweet, sweet government spending that could soon hit the tape.

Related story: Cryptos like the Trump family's World Liberty Financial and Official Trump have also been on a tear.

Speaking of President Trump, his advisers have floated the idea of revaluing gold on the government’s balance sheet.

Right now, the U.S. values its gold at $42.22 per ounce, a number set in 1973.

At that price, America’s 260 million ounces in Fort Knox are booked at just $11 billion.

At current market prices, they’re worth closer to $874 billion.

So why would he want to revalue it?

Because President Trump wants both a strategic Bitcoin reserve and a sovereign U.S. investment fund.

And revaluing the gold in Fort Knox could do both.

To that end, there is a bill sponsored by Wyoming Sen. Cynthia Lummis to use gold revaluation to bankroll a U.S. strategic Bitcoin reserve.

It’s a fact that Trump wants 1 million Bitcoin, precisely what the Lummis bill proposes, to make America the world’s “crypto superpower.”

The U.S. government already has 200,000 Bitcoins from seized assets and needs 800,000 more. The cost would be roughly $92 billion.

To get those funds, Congress could pass a bill revaluing the gold in Fort Knox.

And suddenly the U.S. “discovers” hundreds of billions in new assets.

Now, you might be thinking: “The Constitution says only Congress can revalue gold.”

Yes, but we’ve also seen President Trump take on many powers for himself that were previously allotted to Congress — tariffs, for instance.

The accounting trick would make Washington look richer.

It’s financial sleight-of-hand with global consequences. And it would turbocharge the gold bull market.

If this happens, you’ll want to own gold!

Regular Weiss Ratings Daily readers know I’ve been bullish on gold for a while.

And on Oct. 4, 2024, I raised my long-term target on the precious metal to $6,902.82 for multiple reasons.

That would be a move of around 70% from current levels.

But it’s a reachable goal in the next few years because:

- Debt is exploding.

- The dollar, though gaining, is still wobbling.

- And trust in the integrity of economic data … which has been absent throughout the shutdown … is eroding.

In that kind of environment, gold remains the ultimate safe haven.

But don’t forget about gold’s little sister, silver.

Silver is the overlooked star of precious metals bull markets.

History shows silver outperforms gold once bull markets accelerate.

- In the 1970s, gold surged 2,300% while silver exploded 3,540%.

- In the 2000s, gold gained 648% while silver jumped 1,106%.

Could silver hit $100? Absolutely.

That would be a double from today’s price near $50.

Plus, silver is coiled tighter than a spring. When it breaks out, it will likely move fast and leave latecomers in the dust.

Even better, silver is missing one thing that gold has …

Central banks generally don’t stack silver, though I believe that could change down the road.

What silver has that gold generally doesn’t is industrial demand.

Around 59% of silver demand comes from industrial uses, such as solar photovoltaic panels, electric vehicles and consumer electronics.

Solar sector demand is especially significant.

Solar demand for silver grew nearly 140% from 2016 to 2025, as global renewable energy policies, dropping solar panel costs and industrial stimulus continue to expand installations.

That’s true even with manufacturers using less silver per unit.

As a result, solar demand amounts to between 17% and 19% of total global demand. And it’s only going to increase!

Capital Economics forecasts silver demand from the solar sector will increase by almost 170% by 2030, hitting around 273 million ounces.

EVs use two to three times more silver per vehicle than conventional cars, and growing adoption continues to boost consumption.

The rollout of 5G networks and ongoing electronics innovation are further industrial contributors.

At the same time, silver has a supply constraint that gold doesn’t.

First, it’s important to know that only 28% of silver comes from primary silver mines. This makes the overall supply dependent on base metal mining.

This also makes the supply of silver inelastic. Supply won’t increase much even if the price of silver takes off.

Second, we may be seeing peak gold — the maximum gold coming out of the world’s mines on an annual basis — right now.

That’s what industry experts are saying.

But we’ve already seen peak silver. It happened SEVEN years ago.

This shortfall in mined silver results in persistent market deficits and diminished inventories.

Declining ore grades, delayed new mine projects and geopolitical risks in major mining countries further tighten supply, supporting prices and fueling investment demand.

Frankly, I can’t make a case NOT to own silver!

I like owning the physical metals myself.

But I REALLY like owning precious metals miners.

Even just a 20% move in gold or silver can translate into 50% to 100% gains for miners.

For developers and juniors with strong deposits, the upside is even larger.

My silver pick from the 2025 Weiss Investment Summit, Discovery Silver (DSVSF), is a great example.

Back in May, I told attendees at this intimate gathering to consider picking up some Discovery shares while they were trading at $1.92.

Those who followed my lead would be up a massive 133.3% today!

That pick was too small at the time to share with you here.

But those small, coiled-spring types of stocks are exactly the kind my Weiss Ratings colleagues and I share at our annual Summits!

When you sign up to attend the 2026 Weiss Investment Summit, slated for May 3-5 at The Boca Raton resort here in Boca Raton, Florida …

You get premier access to picks like Discovery.

You also get to meet with like-minded investors at a Forbes 5-star resort with “luxury” written all over its oceanfront rooms, golf courses and world-class restaurants.

More important than that, you get to rub shoulders with Dr. Martin Weiss, our publisher and CEO Dallas Brown, my colleagues including Chris Graebe, Juan Villaverde and Nilus Mattive. And of course, me!

Our 2026 Weiss Investment Summit is already shaping up to be our best yet. I look forward to hearing how well attendees did with Discovery and all the other Summit-exclusive picks they received from our team.

I hope you’ll be able to join us this coming May!

Click here to save your spot now while our special Early Bird pricing is still in effect.

All the best,

Sean Brodrick

P.S. In addition to our featured 2026 Summit guests, we’ve just added an instantly recognizable name I’m sure you’ll be looking forward to meeting.

He’s an NFL Hall of Fame celebrity with an impressive track record as an investor and entrepreneur, who’ll come to share his experience.

I’ll go ahead and reveal who it is right now …

It’s 17-year NFL legend Dan Marino!

I’ve already outlined several reasons why you should join us at the 2026 Weiss Investment Summit.

But the opportunity to hear from one of Florida’s favorite sons could be a real game-changer for Summit attendees.

Don’t miss your chance to meet this MVP … along with all your favorite Weiss MVPs. Click here to reserve your Summit spot now.