|

| By Jon Markman |

Two days ago, I shared a story that illustrated what makes a failed “disruptor” in the tech industry. If you haven’t read that, I recommend you do so now, by clicking here.

Why is it so important to identify failed innovators? Because making money in tech investing is all about successfully gleaning the future, while avoiding mistakes of the past.

I want to share a second story with a different example of a failed innovation. Again, I did offer it to my Disruptor & Dominators Members first. But this side of tech investing is so important, I want you to have it too.

Let’s get right into it …

I showed you how legacy companies can falter in the innovation game with General Motors (GM). Now, let’s look at a new-age consumer products innovator that, too, has hit the skids.

The story of online furniture giant Wayfair (W) shows that disrupting is really tough. Only profitability ultimately creates wealth … not creativity alone.

Wayfair is loved by Wall Street investment analysts. Executives at the Boston-based company had the bright idea in 2002 to disrupt furniture retailing, a business segment that has not materially changed in a century.

The qualm most people have with furniture buying is it involves a lot of heavy lifting, so to speak. Consumers must shop for the furniture by visiting several stores. When they find the item they want to buy, the real friction begins. An order gets placed and a delivery date is typically set six to eight weeks into the future.

The innovation at Wayfair is removing this friction. However, this is easier said than done.

Traditional furniture sellers purposefully build in shipping delays because they either make furniture to order, or they drop ship finished goods manufactured in Asia. The delay between the point of sale and the delivery date allows the retailer to pool orders, thereby building economies of scale to increase profitability.

And just to be clear, profitability in the furniture industry can be illusive. Gross margins for the sector are in the 43%-45% range, according to The Retail Owners Institute.

Although this figure may seem high, profitability declines significantly with shipping costs and order returns, a growing problem in the age of Amazon.com (AMZN).

Wayfair has no shipping delays or associated costs, for that matter. The company offers a purely digital experience. Customers get a wide selection, reviews from previous purchasers and contactless payments. If this experience seems too good to be true, it is … sort of.

The company is an e-commerce company to its core. However, executives at Wayfair removed friction from furniture buying by building out a costly distribution network in the physical world. Furniture items, mostly flat-packed goods that are later assembled by the customer, are stored regionally in massive warehouses. The cost of storage and shipping is then transferred to third-party sellers, much like the Amazon 3P model, a marketplace for third-party sellers.

All this seems great, except furniture is costly to ship and customers like to try items first before committing. Also, Wayfair has made returning these items — or at least getting a discount in lieu of return — extremely easy. And this is a margin killer.

This business model is more dumb than disruptive.

It doesn’t work for the obvious reason. People want to see how furniture looks in their room before committing to the purchase. And because Wayfair is competing with the Amazon customer experience, removing friction from the return process is essential … even if it kills any chance of ever reaching profitability.

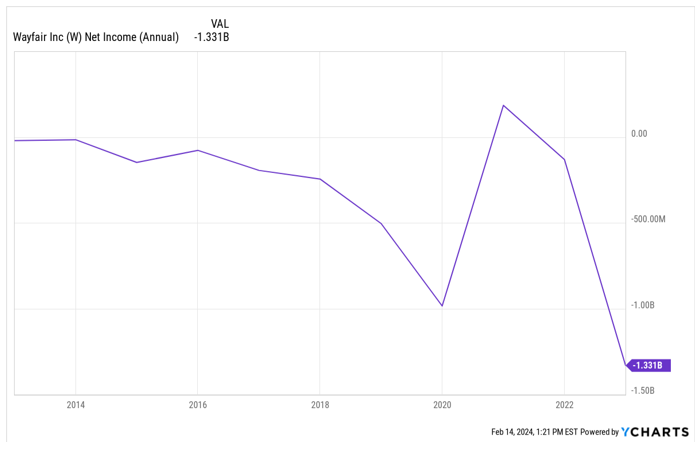

Wayfair has earned only one quarterly profit in the entire history of the enterprise.

During the pandemic in 2020, net income rose to $135 million, mostly because people didn’t return goods under the threat of ongoing supply chain shortages. In the three years prior, Wayfair posted losses of $985 million, $504 million and $244.6 million, respectively. During calendar year 2022, the company had a loss of $1.3 billion.

This reality of growing losses is not lost on Wayfair executives. They have been scrambling to cut costs. Execs announced job cuts in January of 13% of the global workforce, including 19% of the corporate team. The cost-cutting initiative will result in 1,650 lost jobs and $280 million in annual savings.

The innovation storylines at GM and Wayfair are not unique, sadly. The culture at most companies is a natural repellent to disruptive innovation. Change is the enemy of corporatism that creates layer after of layer of vice presidents and bureaucracy. Change is also illusive to new companies without a history of building profitable businesses.

Investors were foolish to believe that Mary Barra, the product of a culture of inefficiency, was going to disrupt GM. Bullish bets on Wayfair ignored the unlikely path to profitability.

More importantly, neither business was at the vanguard of a legitimate secular trend.

GM can’t compete with Tesla (TSLA). The supply chains are ultimately very different.

Wayfair is at a disadvantage to Amazon, IKEA and even Walmart (WMT). These larger retailers have greater economies of scale. They can use other parts of their businesses to offset e-commerce losses.

The key to finding disruptive winners begins with a transformational secular trend. And there’s one I am finding winner after winner in …

You guessed it … AI. In fact, we recently put together a special presentation on the biggest AI “Superproject” to date. Click here to check it out.

All the best,

Jon D. Markman