|

Last summer, I told you about an even dozen “elite” stocks according to Weiss Ratings.

You see, these were the only 12 we rated at least an “A-.”

That’s not just a “Buy” rating … that’s the equivalent of a strong “Buy” rating.

For perspective, at that time, we had ratings for 12,645 different stocks.

That’s the top 0.095% of all our ratings!

Today, I want to share with you:

- How they have performed.

- What has changed since that early September article.

- And what the new list looks like.

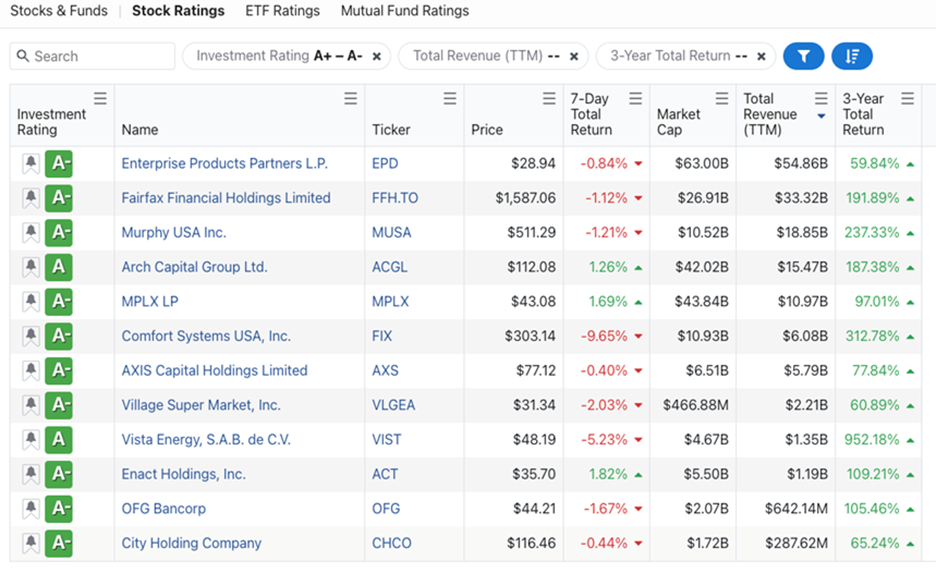

First, here’s the old list:

As you can see, they were scattered across many industries.

MPLX (MPLX) and Enterprise Products Partners (EPD) are both oil and gas pipeline plays.

You also have a few asset managers or portfolio companies like Fairfax Financial Holdings (FFH.TO) and Arch Capital (ACGL).

But you have one-off plays like Village Super Market (VLGEA) and Comfort Systems (FIX).

These can’t be any more different.

So, what puts them all on the same list? Or at least, what did put them on this list a year ago?

The same answer I give for almost everything: The data.

That’s what our ratings are all about.

We have 7 terabytes of data that we use to adjust our ratings for the several thousands of stocks, insurers, banks, ETFs, mutual funds and crypto assets.

And we update those numbers daily … ensuring members of Weiss Ratings Plus will only see the latest, most accurate data we can provide.

That’s probably why this particular list of elite-rated stocks did so well.

- The average performance was 15.1%. But there were some much bigger gains in there, too.

- Fairfax, for example, popped 55.9% in just under 11 months.

- Comfort Systems nearly doubled, currently up 95%!

While most of them are still in or near this top tier of rating, there have been a few changes since then.

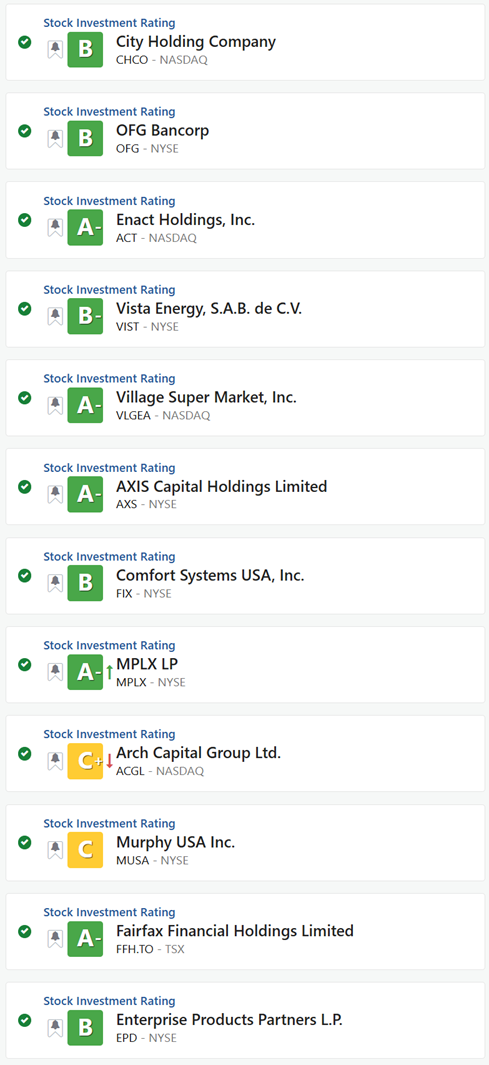

Here’s where all 12 are currently rated:

As you can see, only five have kept their “A-” rating.

Five others held onto their “Buy” rating but slid into “B” territory.

The other two became “Holds.” That’s Arch Capital and Murphy, in yellow.

Still, none have fallen so far as to earn the dreaded “Sell” rating.

So, if you own any of these, our system says they are still worth holding.

But our system is also saying something else …

Here at our one-year checkup on last year’s highest-rated stocks, there are now double the number of elite stocks.

And two of the new arrivals are rated even higher than these 12 were.

That’s 24 total stocks with a minimum rating of “A-.”

And two earned our most-elite “A” rating.

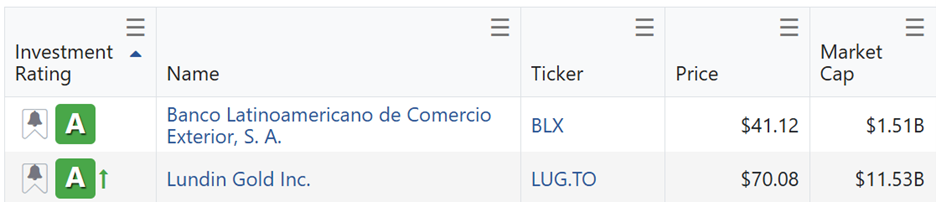

Here are those super elite ones:

Lundin Gold (LUG.TO) is a Canadian miner with one of the highest-grade gold mines in the world.

Considering gold’s enormous rally over the past year, it shouldn’t come as a surprise that gold miners like Lundin are doing great right now.

The other is Banco Latinoamericano de Comercio Exterior (BLX) — a Panama-based bank.

The other thing to note is that in Lundin’s case, you can see the green arrow next to the letter grade pointing up.

That means it was recently upgraded, which is usually a great indicator that it could do even better going forward.

These are all things members of Weiss Ratings Plus can search and filter for.

As I always say, trust the data.

But first, you have to see the data.

Cheers!

Gavin Magor