|

| By Kelly Green |

The signs are there.

If you don’t have any exposure to gold in your portfolio, you might want to.

Although the U.S. officially abandoned the gold standard in 1971, gold is still treated as an important financial asset. Investors tend to flock to it in certain situations.

- Inflation

- Economic turmoil

- Political risk

Check … check … check.

We’re already seeing the highest gold prices from the past 10 years:

More importantly, gold prices have proven that they could not only touch their previous high of $1,800, but could also find some resistance at this level.

I wouldn’t be surprised if $1,600 is something we never see again.

Some of my colleagues think that $2,000 gold will soon be a distant memory!

I’m not saying to throw all your money into gold. But you might want to make sure that you at least have some exposure.

There are three main ways to expose your portfolio to gold:

- Physical gold like bars, ingots, coins

- Gold-based managed funds like mutual funds or exchange-traded funds (ETFs)

- Shares of gold miners, my personal favorite

I could spend the rest of this article talking about the pros and cons of each. But I don’t know your personalized investment situation. And even if I did, I can’t provide personalized recommendations.

If you want to hold physical gold, there are numerous ways to do that. We won’t go into that here.

But, if you want to find mutual funds, ETFs or stocks, you have the WeissRatings.com stock screener, which can help you find all three.

Let’s take a look.

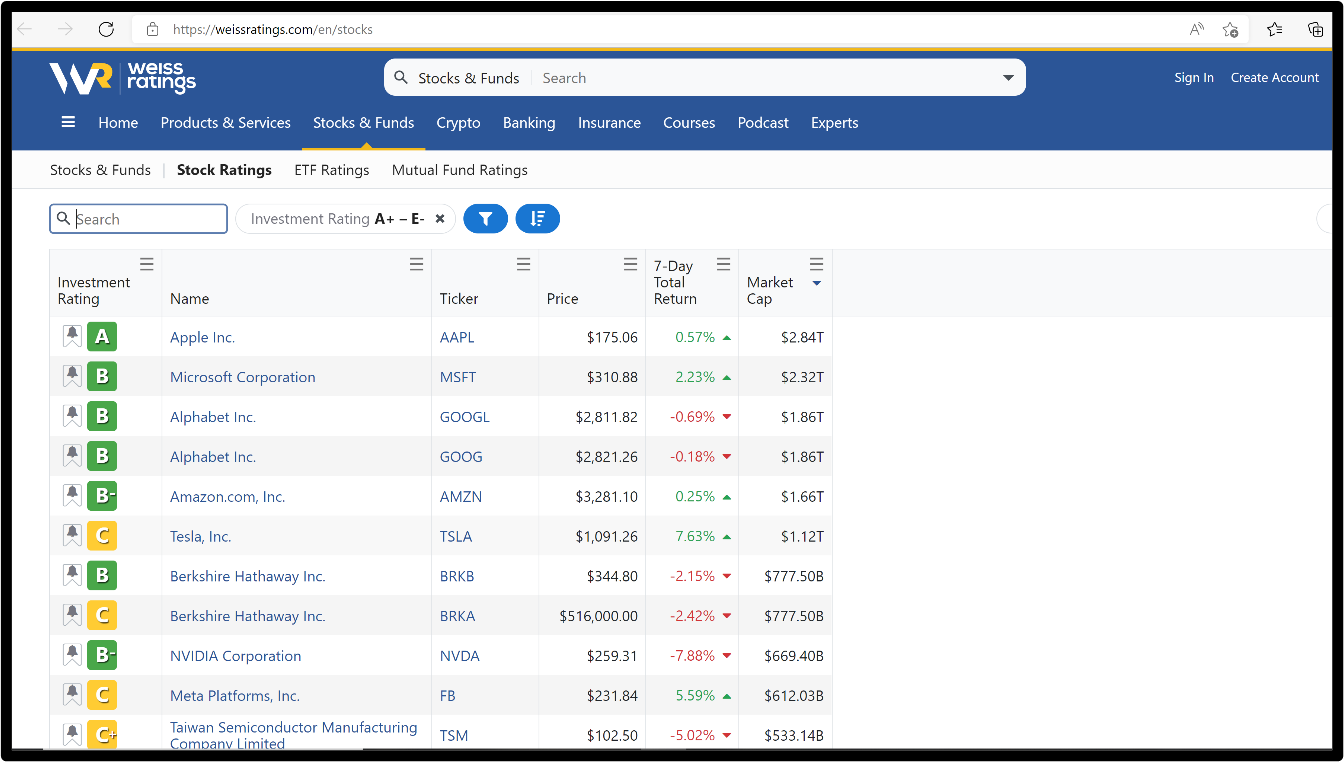

First, head over to the stock screener like you normally would.

The screener is currently showing all 13,220 rated stocks.

We will come back to this stock universe. But for now, notice the line above the filters:

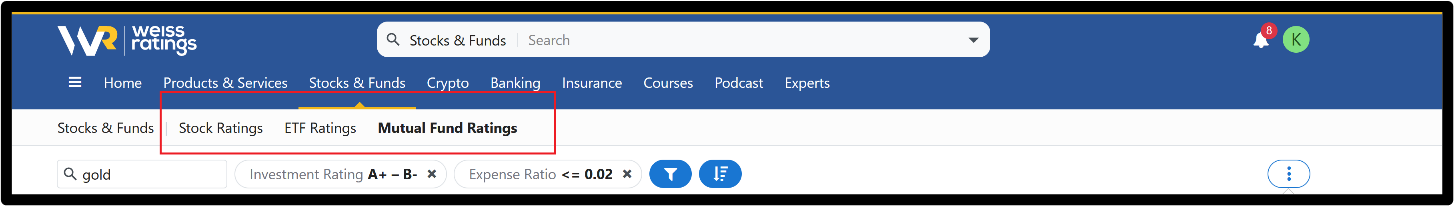

You can easily switch over to the ETF or mutual fund universe. Let’s start with mutual funds.

I decided I wanted to see mutual funds with an investment rating in the “Buy” range (A+ through B-). I also wanted to add a maximum expense ratio of 2%. And, of course, I wanted to include those with the keyword “gold” in the name.

Here’s what I found:

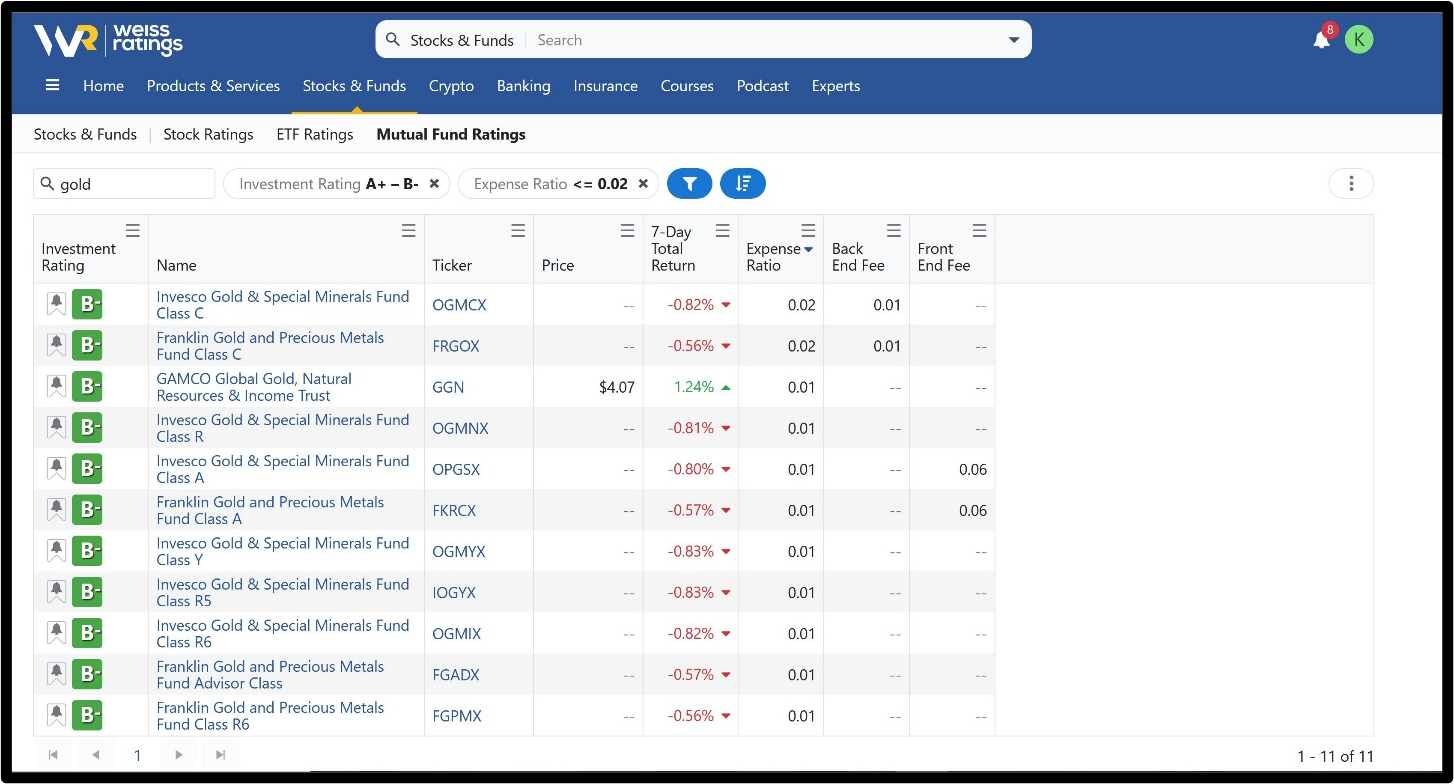

There were 11 mutual funds that met my criteria.

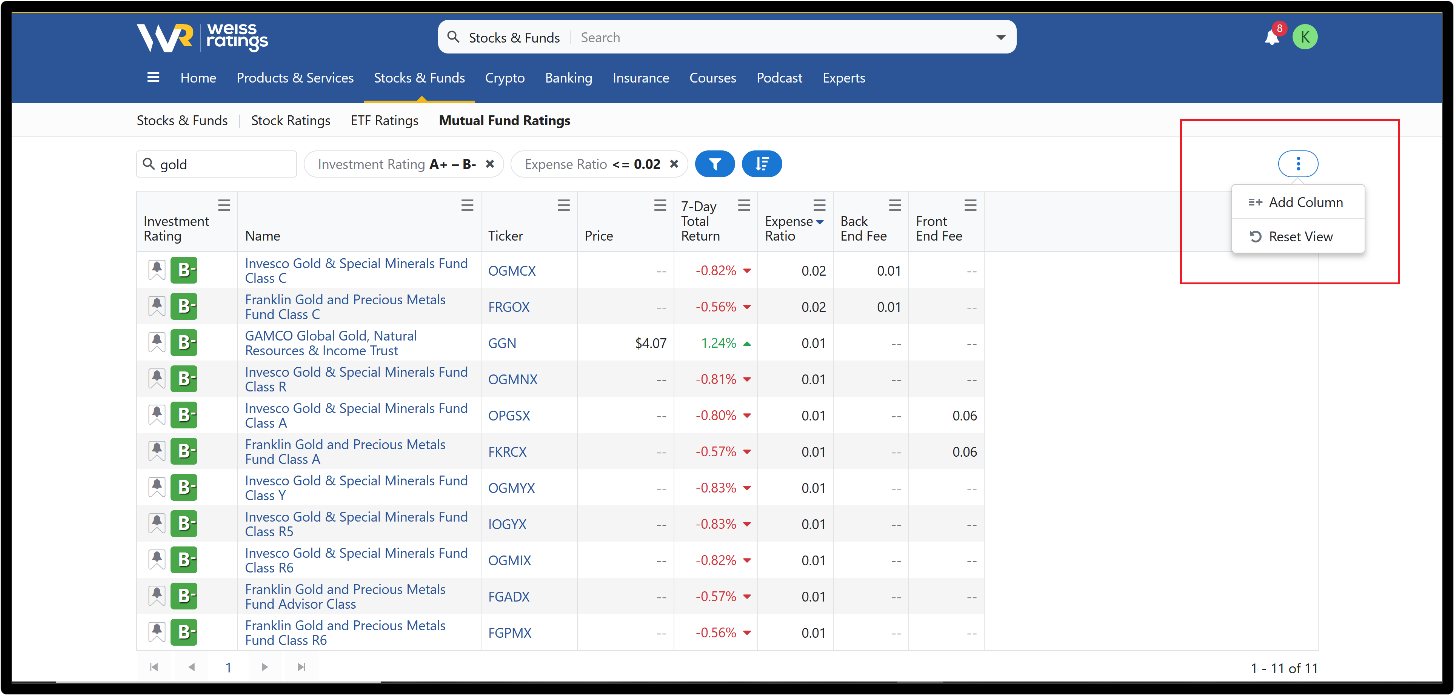

You’ll also notice that I added a few extra columns to my results. I did that by using the three dots in the upper right-hand corner of the screener.

I personally like to avoid anything with high extra fees if I can. Two of these funds have a 1% back-end fee, and two have a 6% front-end fee. But of course, you could add all the factors that are important to you.

Nine or 11 funds (depending on if you exclude those with the 6% fee) is way more manageable to take a closer look.

From here, you can right-click on the fund name and open each in a new tab for quick comparison.

The same goes for ETFs.

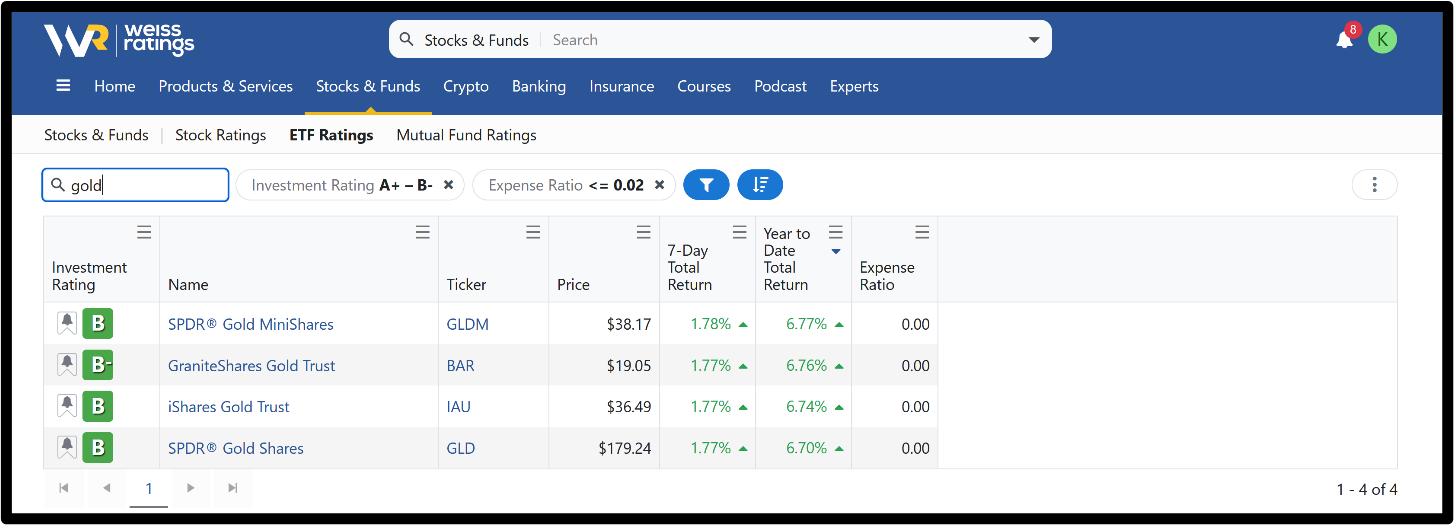

Go back to the top and click ETFs to open the options for ETFs. I entered the same filters in the ETF universe and got four results.

Next, we move back to stocks to find our miners.

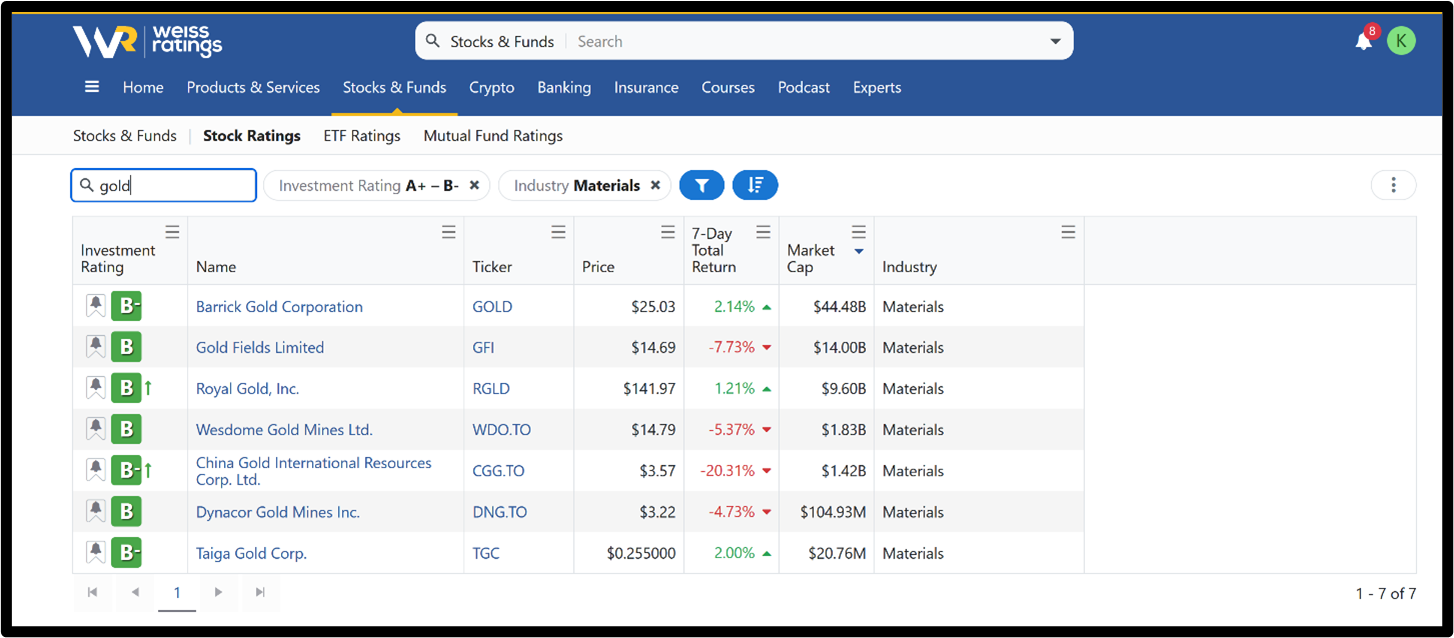

Please note: The search feature I used in mutual funds and ETFs only searches the name. If you use it with stocks, it will do the same thing. This means that you will only get miners that have “gold” in their name.

In this case, you’ll still get seven results:

This is not all gold-rated miners. If you want to make sure you see all your options, I recommend searching the materials industry and leaving out the “gold” search term. You will get all 119 “Buy”-rated companies in the material sector.

Sure, it creates a little more work for you to look at more companies. But it will give you more options. There’s always a trade-off.

Hopefully, you can see it’s not difficult to customize the stock screener for whatever you’re looking to add to your portfolio — stock, mutual funds or ETFs.

And, you can do this for so much more than just gold (even though you really should make sure that gold is on your radar right now).

My colleague and cycles expert Sean Brodrick thinks that we could possibly see $7,000 per ounce gold in the next two years!

He recently told me that the combination of inflation, out-of-control money printing, soaring debt and war is all linked to powerful, unstoppable cycles that are converging at this very moment.

Sean recently had an emergency Zoom call with founder, Dr. Martin Weiss, to discuss those cycles, and I suggest you watch it now if you’re looking for ways to both protect and grow your wealth.

There’s no doubt that the next few years are going to be a roller-coaster ride. I highly recommend you continue to use the Weiss Ratings stock screener. And that you check out Sean’s video so you know what to expect from the market over the next two years.

Best,

Kelly Green