|

| By Sean Brodrick |

In 1968, a scientist at Stanford wrote a book that rattled politicians and the public alike.

Titled “The Population Bomb,” Paul Ehrlich’s book sold millions of copies. Its premise was that the Earth was overcrowded. And soon, all of us would face “mass starvation” on “a dying planet.”

Like many doom forecasts, this one turned out not to be true. Ehrlich correctly identified the problem — too many people for existing food resources — but missed the solution.

The solution was that agricultural science was about to make leaps and bounds, with improved seeds and advanced fertilizers that raised harvests enormously.

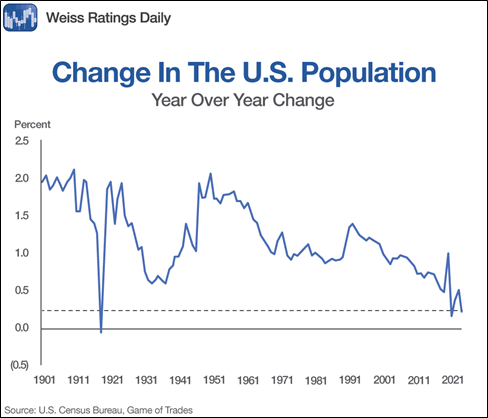

Today, America is facing a “Population Bomb” of its own. But ours is the reverse of the one Ehrlich identified. America’s replacement birth rate is rapidly approaching zero and about to go negative.

At the same time, we are having fewer births, and people are living longer thanks to advancements in medicine.

Result: The U.S. population is already older than it has ever been. America’s median age used to be 30. Now, it’s over 38 and rising fast.

There are many reasons for this. The effects and implications will strike some as dire. If things continue on current trends …

- A hundred years ago, one out of every 20 Americans were senior citizens. Now, it is one in seven. By 2030, one out of every five citizens will be of retirement age. It’s hard to fund Social Security when a fifth of your population isn’t working. According to Forbes, Social Security will run out of money to pay out promised benefits and expenditures by the mid-to-late 2030s.

- A larger percentage of old people means fewer young people. There is already evidence that America’s demographic decline is dampening start-up rates because new companies can’t find enough young workers they need.

- Healthcare costs are going to soar. Old people get sick more often. By 2030, about 70 million Americans will be on Medicare. That will send costs through the roof.

Now, I brought up Ehrlich’s book because he did not see a solution where there was one. There is plenty of reason to think that we just haven’t grasped the solution to this new “Population Bomb” yet.

There is a simple solution: Allow more young people to immigrate. But a whopping 78% say there is a crisis at our borders, and 22% of Americans think migrants place economic burdens on society. Increasing migration would not get many votes.

So, what are other workable solutions? I can see two, and both are high-tech.

First, more software focused on helping older adults cheaply and quickly. I’m talking about doctor visits via computer, health monitoring software and so on.

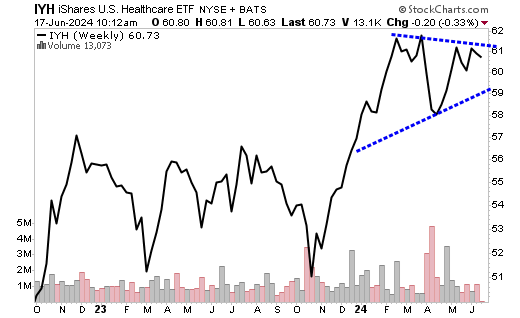

There are companies already doing this, and some of them are in the iShares U.S. Healthcare ETF (IYH).

That fund gets a “C+” from Weiss Ratings, has an expense ratio of 0.40% and a dividend yield of 1.14%. Here’s a weekly chart.

The IYH made a big move at the end of last year and is now coiling up while it digests those gains.

You can drill down into this fund for those stocks more leveraged to an aging population.

The other solution is robotics. Now, I’ve been talking about the robotics megatrend for years, and most recently wrote about it in January. In my January column, I wrote:

“Analysts at RationalStat expect the global industrial robotics market to grow at a compound annual growth rate of 12.8% between 2023 and 2030, and AI will accelerate that trend.”

That still holds true. And the aging of America is accelerating this trend.

Robots don’t ask for overtime, they don’t want vacations and most importantly, they don’t shuffle off to Florida to collect Social Security.

Robots are an excellent solution to the aging of America’s workforce.

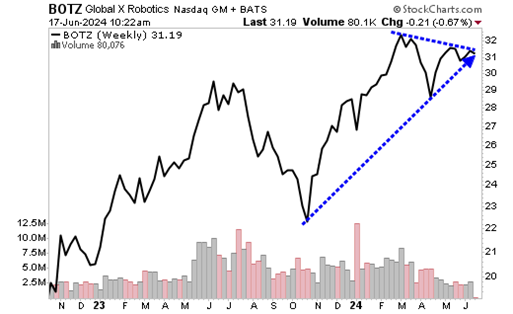

There are multiple funds to play this. My current favorite is the Global X Funds Global X Robotics & Artificial Intelligence ETF (BOTZ).

It gets a “C-” from Weiss Ratings, has an expense ratio of 0.68% and a dividend yield of just 0.19%.

But you aren’t buying it for its dividend yield. You’re buying it for the megatrend it’s riding.

If you’d bought BOTZ when I first mentioned it in 2022, you would have an open gain of more than 46%. That beats the 39% the S&P 500 racked up during the same time frame.

Here’s a weekly chart of BOTZ …

You can see BOTZ is coiling up for a breakout one way or another. I believe that breakout is going to be up.

To sum up, America is facing a new Population Bomb.

We shouldn’t kid ourselves that it is unsolvable. Solving it could make a lot of money.

Intelligent investors will get ahead of this trend with stocks and ETFs that make the most of it.

All the best,

Sean

P.S. Of course, if you are investing for income, you are actually in luck. We just held a “Superyield Conference” here at Weiss Ratings. You can still check it out here.