Profit from the Next Sneaky Move of the Oil Sheiks

|

| By Sean Brodrick |

Oil prices look poised to make their next big moves higher.

If you acted on a suggestion I made in a previous Weiss Ratings Daily issue, then you’re already racking up open gains.

If you didn’t, there’s still time — but you need to act fast! In fact, I have a brand-new idea for you, with even more potential.

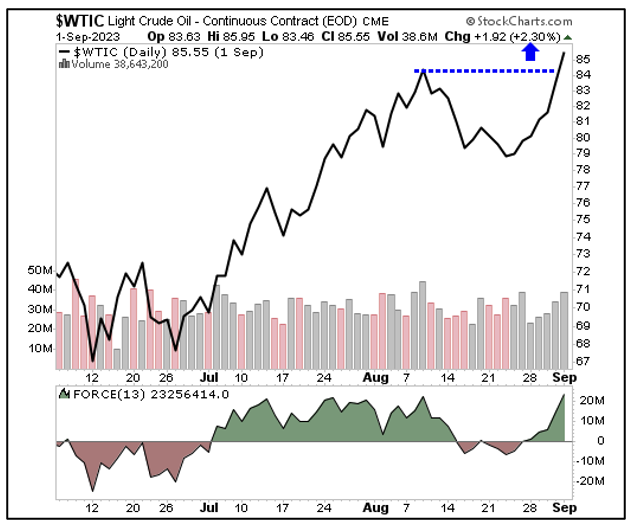

What’s going on can be seen in this chart. The price of West Texas Intermediate crude is breaking out to the upside.

Click here to see full-sized image.

There could be a retest of the breakout, but I expect an oil price of $99 a barrel sooner than later. What happens there depends a lot on how global oil suppliers react.

Will they open up the taps and sell more oil, or sell fewer barrels at higher prices? I’ll show you why the Saudis, in particular, want higher-for-longer oil.

Mind you, this is against a backdrop of bad economic news coming out of China. That country’s economy is sputtering, and leaders in Beijing are dragging their feet in response. That was part of the pressure on oil prices in August. But now, it seems like oil has priced in China’s woes as it hits the accelerator.

When oil ignores China, that strikes me as pretty bullish.

Meanwhile, the U.S. economy is charging ahead. The Federal Reserve is forecasting real GDP growth of 5.6% in Q3. More people are working full time than before the pandemic. You know what people with jobs do? They drive, which in turn pushes up gasoline demand.

The Saudi Oil Squeeze

Now we get to the “squeeze” part. I’m talking about OPEC+, particularly Saudi Arabia. Last week, the “Central Bank of Oil,” as we like to call the Saudis, extended its 1-million-barrels-per-day production cut until the end of the year.

Riyadh first applied the 1 million-barrels-per-day reduction in July and has since extended it on a monthly basis. Now, it’s going to the end of the year … at least.

In all, OPEC+ — which includes a group of non-aligned countries led by Russia — supplies about 40% of the world’s oil. The cartel has chipped away at production all year. Recently, the cuts amounted to 5.16 million barrels per day, or about 6% of global supply.

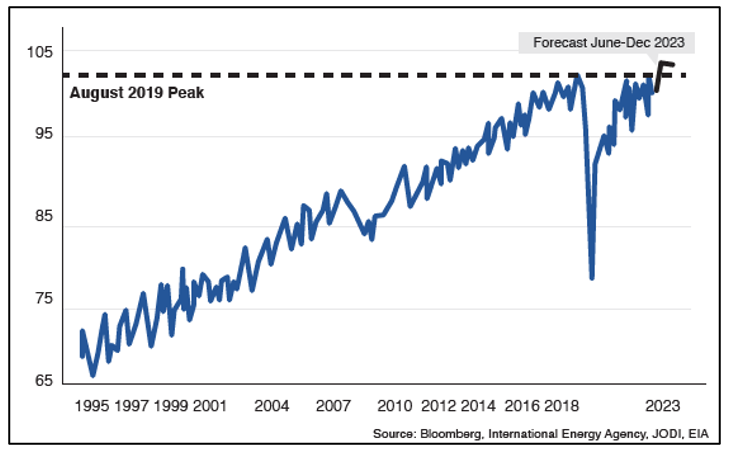

And this is against a backdrop of rising demand. Forecasts vary, but estimates range between 1 million to 2.1 million barrels of additional global demand added this year. In fact, global oil demand has already climbed above its pre-pandemic high.

Click here to see full-sized image.

Just two weeks ago, we got the news that global oil consumption hit a new record of about 102.5 million barrels per day in July, above the 102.3 million bpd record set in August 2019. And global oil demand will likely increase a further 3% to 4% in the next five years.

Now, in normal times, as oil prices go higher, OPEC+ members start cheating like mad on production quotas, and oil prices come back down again. The difference this time around may be the November 2024 election.

Why the Saudis Could Cut Deeper for Longer

I believe the Saudis could go longer and cut deeper, for the simple reason that oil sheiks do not get along with Joe Biden at all. They would love to see a friendlier president in the White House.

It’s been shown that prices at the pump affect voters’ perception of economic health. So, it would not surprise me to see the Saudis squeeze the oil market leading into the November 2024 election.

In fact, Saudi oil exports swooned in August to 5.6 million bpd, down from 6.3 million bpd in July.

So, I’m quite bullish on oil. In fact, my intermediate-term target on crude is $99 a barrel.

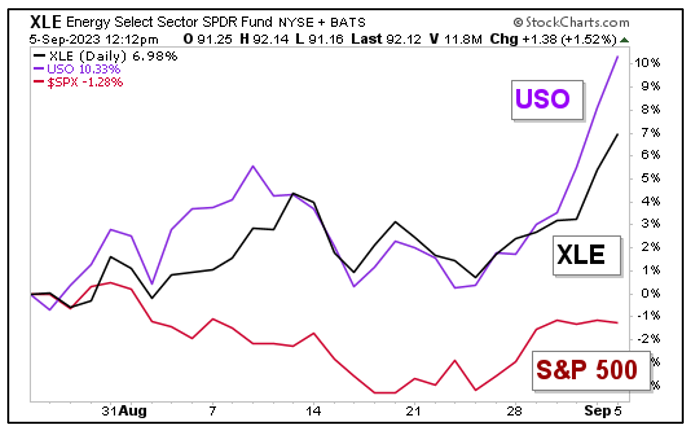

On July 26, I suggested you consider using the Energy Select Sector SPDR Fund (XLE) to ride this next leg up in energy. And the XLE, which has an expense ratio of just 0.10%, is up nearly 7% since I mentioned it. That’s pretty good, considering the S&P 500 has fallen about 1.3% during the same time.

The XLE is breaking out and pays a 3.48% dividend yield to boot. It’s a perfectly fine way to keep playing this rally.

Another Way to Play This

But I want to give you one more idea: the United States Oil Fund (USO). This fund — which has an expense ratio of 0.81% — tracks the price of crude oil in Cushing, Oklahoma. And it is outperforming the XLE.

Click here to see full-sized image.

You can see the USO is up more than 10% during this same timeframe. If oil continues to zigzag higher, USO should go along for the ride. But you won’t get the nice dividend yield you do with XLE, and the USO’s expense ratio is higher.

So, consider using whichever one suits your investing style — XLE, USO … or both!

The Saudis are handing you a profit opportunity. You can sit on the sidelines or play it for all it’s worth.

That’s all for today. I’ll have more for you soon.

All the best,

Sean