|

| By Sean Brodrick |

This year, we’ve seen the tech sector soar. Tech has rallied twice as much as any other sector. But nothing travels in a straight line, and tech is taking a pause.

Today, I’ll show you how to invest in a group that will profit from that rotation and other trends.

In fact, I’ll show you how to get a slice of $6.1 trillion that’s looking for a home.

As I said, tech has been hotter than hot this year. It’s the start of that new tech supercycle that I talked about in previous columns.

Now, though, we’ve seen tech gains start to cool quickly as investors realize that artificial intelligence riches won’t show up overnight.

As money flows out of tech, it’s flowing into a few new areas.

One is small caps, which have lagged since early last year. Finally, small caps — as tracked by the iShares Russell 2000 ETF (IWM), the most popular basket of small-cap stocks — are getting some love.

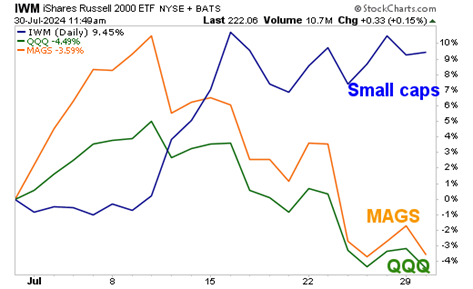

Small-cap performance has sizzled in the past month compared to the tech-heavy Invesco QQQ Trust (QQQ) and the Roundhill Magnificent Seven ETF (MAGS).

MAGS holds the “Magnificent Seven” tech stocks that have led the market higher all year — Nvidia (NVDA), Meta Platforms (META), Microsoft (MSFT), Amazon (AMZN), Alphabet (GOOGL), Apple (AAPL) and Tesla (TSLA). Those stocks were market leaders. But look what happened in the past month.

Wow, what a swing!

The initial move is short term, as investors rotate out of tech stocks — which they perceive as overvalued — and into beaten-down small-caps.

Now, let me show you two things that can potentially keep this small-cap rally running all year.

Fed Rate Cuts Will

Power Up Small Caps

The U.S. Federal Reserve will announce its latest decision on its benchmark interest rate at 2 p.m. today. The market expects the Fed to hold the course for now, putting the chance of a rate cut at 5% in July.

The market expects the Fed to start cutting in September (there is no August meeting). The odds of a 25 basis-point cut in September are priced at 100%.

The chances of two cuts this year are now priced at 98%. And the odds of a third cut this year are better than even.

Add that up, and that’s one 25-basis point rate cut in September, one in November and one in December.

And that’s just the start. Wall Street expects more rate cuts NEXT year.

This has the potential to power up small caps.

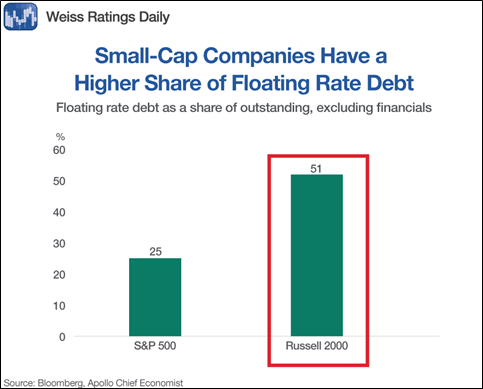

Small caps have a higher share of floating-rate debt compared to the S&P 500. Floating-rate debt responds to changes in interest rates.

Small caps are sensitive to higher rates. So, they suffered as the Fed hiked.

Now, though, the shoe is on the other foot. That should keep more Wall Street money rotating into small caps.

Speaking of Money Rotation …

American savers love higher rates. I know because I’m one of them. I opened an internet bank account to take advantage of the higher interest on the money I had sitting around.

I’m getting more than 5% on that money deposited with a banker I never met. It sure beats what TD Bankwas offering me, even after TD raised the interest it pays on deposits.

I know I’m not the only one. Money-market fund assets surged to $6.1 trillion by the end of the second quarter of 2024, up from $5.4 trillion in the same period in 2023. And that’s way up from the $3.2 trillion stored in money market funds in the second quarter of 2019, before the pandemic.

As interest rates come down, money market returns will start to shrink. Investors will look for higher returns. And beaten-down small caps — especially those that pay dividends — are going to shine. But not just the dividend payers …

Wall Street paints with a broad brush, and money flowing into the IWM is a rising tide that will lift most small-cap boats.

Now, I’m not saying all $6.1 trillion will rotate into small caps. Heck, a good amount will probably go into the tech stocks that are selling off now once they find new support. After all, the latest tech supercycle is still going strong.

But enough of that money should find its way into small caps to power a massive rally.

How You Can Play It

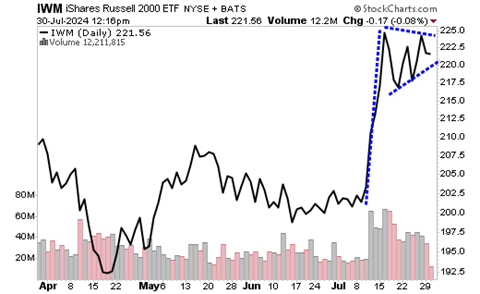

The iShares Russell 2000 ETF (IWM), which I mentioned earlier, is a great way to play this move. It has a dividend yield of 1.3% and an expense ratio of 0.19%. It’s very liquid, which makes it easy to trade in and out of. Here’s a daily chart of the IWM …

It sure looks like the IWM is forming what’s called a “bull flag” pattern. The old saying on Wall Street is “flags fly at half-mast.” That gives us a price target on a breakout of $249 a share. Nice!

For even bigger returns — balanced against higher risk — you can drill down into the IWM to find the best stocks in this ETF. In any case, the returns on select small-cap stocks and ETFs offer the potential for extraordinary profits.

Best,

Sean

P.S. The best part about this move into small caps is that many of these small companies are not household names. They are, however, often the very companies that can become household names.

In this special presentation, you’ll discover a handful of companies not named Nvidia that could soon become just as recognizable as the AI giant.